Stock Market Forecast: Does the Stock Market Feature Memory?

Sergey Okun – Financial Analyst at I Know First, Ph.D. in Economics.

Alisa Iartseva – Data analyst at I Know First.

Highlights

- The stock market has a long-term memory that allows us to make reliable predictions of the future based on previous behaviors and tendencies.

- The S&P 500 has the highest Hurst exponent compared with the DAX 30, the CAC 40, and the FTSE 100.

- The Hurst exponent rises with the extension of the step period length which decreases noise in a time series and increases predictability.

Memory is essential for humans, which allows us to connect the past with the future to be able to know patterns from experience, and much more. Memory can be inherent to the market indicators, as it is for humans. It is safe to assume that there are patterns in markets that occurred in the past and will recur in the future. Economic data often display cycles and patterns in many periods. But can we really rely on the market’s long-term memory?

Existing Approaches to Stock Market Memory

The classic financial theory, based on Efficient Market Hypothesis (EMH), states that share prices reflect all available information which is immediately reflected in stock prices. It means that a stock return has a normal distribution, or Gaussian distribution (the distribution curve is in the form of a bell). Therefore, this hypothesis denies the ability of the market to have a memory, and moreover, to construct sustained profitable investment strategies based on analyzing the past tendencies.

One of the first people who suggested that the EMH is not right was Benoit B. Mandelbrot, who put forward the idea of price persistence (The price persistence is the ability of a specific tendency to exist longer than the process that caused it) and the existence of long-term memory in financial markets. He offered to use Fractal Market Hypothesis (FMH), according to which financial markets tend to follow cyclic patterns. (We discuss FMH is here)

But still, the existence of long-term memory among stock markets is debatable. One of the most common usages of AI in recent years has become the stock price forecasting in which I Know First plays a significant role in the market. But how can we be sure that the use of such progressive tools as artificial intelligence is justified and we can trust the results? To find this out, we need to answer the question in the article title.

The Hurst Exponent

The Hurst exponent allows measuring the long-term memory. It was named after Harold Hurst and may be derived from rescaled range analysis (R/S analysis). This parameter provides us with the ability to determine whether a time series has a predictable tendency (persistent) or its behavior throughout the years is random (according to EMH).

The Hurst exponent value (H) lies within the interval 0 < H < 1. Depending on which part of the interval the estimated value appears, we can judge the memory of the market index. There are three possible cases to consider:

- If 0 < H < 0.5, then a time series is characterized as mean-reverting.

- if H = 0.5, then there is a completely uncorrelated time series with normal distribution. Stock returns are random, which is an example of Brownian motion.

- if 0.5 < H < 1, then a time series has positive autocorrelation and clusters in one direction (there is a persistent component). The closer the H value is to 1, the more predictable a time series is.

Stock Market Forecast: Experiment

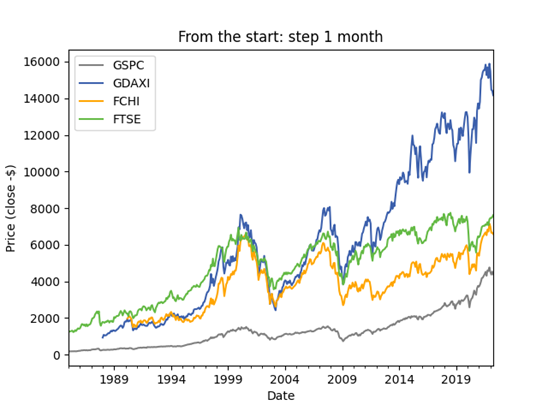

To make a practical assessment we ought to analyze the dynamics of the next four stock market indices: S&P 500, DAX 30, CAC 40, and FTSE 100. The monthly dynamics of all indexes are displayed in figure 1. We analyze the following available periods until April 9th, 2022:

- S&P 500 (GSPC) – starting on January 2nd, 1970;

- DAX 30 (GDAXI) – starting on December 30th, 1987;

- CAC 40 (FCHI) – starting on March 1st, 1990;

- FTSE 100 (FTSE) – starting on January 3rd,1984.

To make calculations using R/S analysis we use a python program for our convenience. The assumptions that we need to state: we consider stock return time series as a random walk, with random multipliers. The results of the experiment are presented in the table below.

As we see in the table, H is higher than 0.5 for all indices, which means that our hypothesis of the stock market having a memory is proven, and stock indices are predictable. We can also make a couple of other conclusions based on the results we have received. Firstly, with the extension of the step period length, from daily to monthly data, the Hurst exponent rises. The reason for this is that when we use the 1-month step, we analyze smoothed data with less noise, which makes it more predictable (we can see the same tendency in IKF algorithmic performance reports where the hit ratio increases as a forecasting horizon expands from a short-term to a long-term one). Secondly, values differ between indices, and we can see that the S&P 500 is more predictable than the DAX 30, the CAC 40, and the FTSE 100.

Stock Market Forecast: I Know First’s Machine Learning Algorithm

I Know First is one leading company that has been effectively using machine learning and AI-based algorithms to provide daily forecasts and facilitate trading for over 10,500 financial instruments. More importantly, I Know First’s algorithm does not depend on any human-derived assumptions except for the mathematical framework initially presented, meaning that it is more reliable and accurate than using technical indicators which involve a lot of human judgments. The algorithms can present patterns based on the data inputs, testing the performance on years of market data, and validating them on the most recent data, which prevents overfitting. If an input does not improve the model, it is “rejected”, and another input can be submitted. I Know First uses algorithmic outputs from the S&P500 Stocks package to provide an investment strategy for institutional investors.

The investment strategy that was recommended to institutional investors by I Know First accumulated a return of 162.42% which exceeded the S&P 500 return by 143.18%.

Stock Market Forecast: Conclusion

The question of the market memory can be a turning point in the more widespread usage of Machine learning and Artificial intelligence for stock market analysis and prediction building. The practical experiment that is conducted in this article, with an estimation of the Hurst exponent, has proven the presence of memory, and therefore the formation of tendency behaviors in the past which can be used to make reliable predictions of the future. This is what I Know First AI algorithm provides based on Chaos theory. The stock market is a Chaotic system that involves a lot of randomnesses, but a chaotic system has a memory, and patterns tend to repeat, so it can be predicted. It is time to start to rely on progressive models because the amount of historical data is getting bigger, and humans cannot proceed with it anymore with full accuracy. The I Know First World Indices package has proved its efficiency by providing a return of 162.42% and exceeding the S&P 500 return by 143.18% for the period of January 5th, 2021 – April 12th, 2022.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.