Disney Stock Forecast: Raise Your Bets On Disney

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

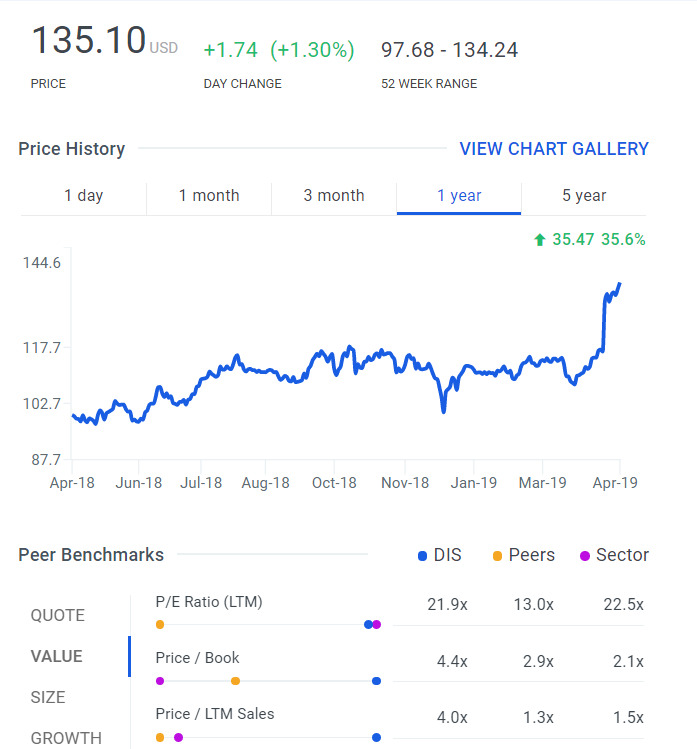

- My last buy recommendation for Disney’s stock was in April 2018. The stock now has a 1-year price return of +35.47%.

- I reiterate DIS as a buy. Going forward, the Marvel and Star Wars assets remain infinite gold mines. Disney is the no.1 player in the $200 billion global IP licensing business.

- The latest Avengers movie will break global theater gross sales. Further, this Marvel franchise movie will generate more sales from IP licensing.

- Disney’s stock has a P/E valuation higher than the average ratio of its peers. Going forward, Disney’s library of movies, brands, TV shows, makes it the King of Entertainment.

- The upcoming launch of Disney Plus paid streaming service is another inspiring tailwind for Disney. Maybe two years from now, investors will value DIS like NFLX.

I endorsed The Walt Disney Company (DIS) as a buy last April 2018. The stock now touts a one-year price return of +35.47%. I argued that its Marvel assets gave DIS an infinite gold mine. This view still stands true. The new Marvel movie, Avengers: Endgame, will again make Disney the world’s biggest-grossing movie production outfits. Content is king and Disney may have declared Avengers: Endgame as the final sequel, it still can make infinite number of movies/TV shows/video games based on those dozens of Avengers-affiliated superheroes.

(Source: www.Finbox.io)

I reiterating DIS as a buy. Do not worry too much if DIS has higher P/E (21.9x) and Price/Book (4.4x) ratios that the average ratios of its peers/sector. Disney’s massive library of intellectual properties (inclusive of Marvel and Star Wars) justifies the higher valuation. Let us also remember that Disney completed its $71 billion takeover of Fox entertainment assets. The synergy between these two firms can lead to more savings and better delivery of news and entertainment content. Fox Entertainment also fortified the content offering for the upcoming Disney Plus rival to Netflix (NFLX).

Ownership of 21st Century Fox can add $11 billion to $14 billion in Disney’s annual revenue. Disney now also effectively owns a controlling 60% stake in Hulu. Video streaming service Hulu is now valued at $15 billion. Hulu’s 25 million subscribers makes it a potent weapon against Netflix. Marvel, Disney, Star Wars, and Fox entertainment content will help Disney Plus and Hulu disrupt Netflix’s dominant position in paid streaming.

Why Marvel Is So Important

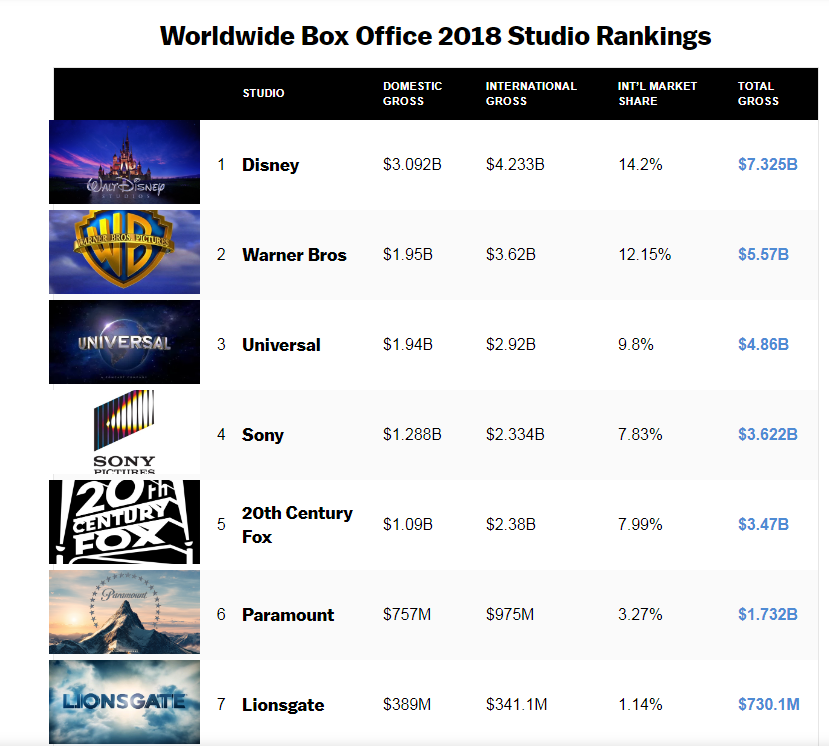

Hit movies are important because they boost the intellectual property licensing business of Disney. Disney is the top licensor in the world, with $56.6 billion worth of licensed retail goods. Marvel or Disney movies is not just about ticket sales. The bigger profits are from licensing Marvel and other Disney-owned characters and assets. IP licensing was worth $180 billion five years ago. Today, Disney still remains the no.1 player in the $200 billion/year global IP licensing business.

Trademark or intellectual property licensing revenue can help Disney reduce the new debt it acquired from buying Fox.

(Source: Marvel)

Disney assumed Fox’s heavy $19.2 billion debt. It obviously also had to borrow more money to complete the $71.3 billion buyout. Going forward, the strong revenue stream from Marvel superheroes movies and licensing is partly financing the $71.3 billion buyout of 21st Century Fox. Taking on debt is easy for Disney since it can meet debt principal/ interest payments through the help of product licensing fees.

My fearless forecast is that Avengers: Endgame can beat the $1.34 billion global sales of Black Panther, the $2.04 billion of Avengers: Infinity War, and the $2.06 billion gross of Star Wars: The Force Awakens. I calculate that Disney will likely earn another $1.5 billion from licensing/DVD/streaming rights from Avengers: Endgame.

Disney’s Marvel and Star Wars movies helps it maintain its no.1 status in global movies ticket sales. This trend will continue for many years to come.

(Source: Deadline.com)

Conclusion

Raise your bets on DIS. It is now a much larger/stronger entertainment company than it was last year. Disney’s stock has much lower valuation ratios than NFLX. NFLX’s stratospheric TTM P/E valuation of 131.63x (and 10.02x Price/Sales) will eventually drop after Disney Plus starts pirating subscribers away from Netflix. Hulu and Disney Plus can gradually catch up with Netflix’s global domination.

Marvel Studiosand its huge catalog of intellectual property is a strong long-term revenue/net income generator. Licensing Marvel and Star Wars assets will help Disney pare down the debt it incurred from its $71.3 billion buyout of 21st Century Fox. Going forward, culling of redundant employees, TV shows, and subsidiaries that emerged from the merger of Disney and 21st Century Fox will also improve the bottom line performance. Going forward, I see DIS delivering $10.5, $11.3, and $12.6 annual EPS for the next three years.

Disney’s EPS history is excellent. The additional net income from 21st Century and the savings from consolidation will help deliver my 2019 EPS estimate of $10.5.

(Source: MacroTrends.net)

If my $10.5 EPS prediction comes true, DIS will like trade around $190 to $200 by early 2020. My buy recommendation for Disney’s stock is in line with the bullish one-year algorithmic forecast from I Know First. DIS has a +106.37 1-year trend score from I Know First.

How to interpret this diagram.

Past I Know First Success with Disney Stock Forecast

I Know First has been bullish on DIS’s shares in past forecasts. On August 14, 2018, the I Know First algorithm issued a bullish forecast for Disney. The algorithm successfully forecasted the movement of the DIS’s shares. Until today, DIS’s shares have risen by 20.50% in line with the I Know First algorithm’s forecast. See chart below.

This bullish Disney stock forecast was sent to the current I Know First subscribers on August 14, 2018.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.