DDD Stock: Stagnant Business and Competition From HP, Xerox and Chinese Firms Are Major Headwinds For 3D Systems

The DDD Stock Price Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The DDD Stock Price Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- After quitting its takeover attempt of HP, Inc, Xerox Corporation will likely accelerate is metal-based 3D printer plans. This can 3D Systems’ sales stagnate more.

- Like HP, Xerox is also a much bigger company than 3D Systems. Those two printing giants can afford to outspend 3D Systems in advertising and contra revenue-based marketing.

- 3D Systems will also have a hard time competing with the industrial 3D printers made by Chinese companies. There’s almost-zero chance that 3D Systems can penetrate the Chinese market.

- The competition from Xerox, HP, and Chinese companies makes 3D Systems a sell. We all love this 3D printing pioneer but it’s time to throw in the towel on DDD.

- You can hold on to your money-losing DDD shares but do not average down anymore. There are other better stocks than DDD.

The AI algorithm of WalletInvestor is still bullish on 3D Systems (DDD). It gave DDD stock a one-year forecast price of $8.714. The more detailed forecasts of WalletInvestor even expects DDD’s price to hit over $10.9 within the next 12 months. My takeaway is we should thrown in the towel on 3D Systems. I am giving DDD a sell rating. If you don’t want or cannot afford to swallow your losses on DDD now, you may still hold on to them.

I say the prediction chart of WalletInvestor below is not believable. 3D Systems is facing major headwinds ahead.

Pandemic Will Aggravate 3D Systems Already Bad Finances

We have to give up on 3D Systems because of its -1.70% 5-year revenue CAGR. DDD is essentially a stagnant company. The COVID-19 pandemic is only going to make it worse. The chart below illustrates that DDD is NM (Seeking Alpha’s abbreviation for Non Meaningful). We have to avoid investing on a non-meaningful company like 3D Systems.

The Pandemic was already mentioned as a reason why 3D Systems’ missed Q1 2020 revenue estimates. The pandemic will again push 3D Systems to report another year-over-year decline in Q2 and Q3. Sad but true, not many companies will buy a new 3D printer during these pandemic months. I therefore believe that 3D Systems will finish 2020 with just $500 million in annual revenue. It will also wrap up this year with a net loss.

DDD deserves a sell rating because it’s been in the red since 2015. Three more quarters with declining revenue and net losses will likely push down to $6. Sad but true, 3D Systems does not have a balance sheet that’s healthy enough to let it weather this pandemic headwind.

As of March 30, 2020, 3D Systems’ cash reserve is only $112.7 million. This is bad because the company’s total current liabilities is more than $165 million. Consecutive quarters in the red will quickly deplete the cash reserve of 3D Systems. Except for tge December 2019 quarter, DDD has been encumbered by its negative quarterly free cash flow.

A company with many quarters of negative free cash flow is certainly ill. Management is also inept when it cannot improve the free cash flow performance of its company. The easiest way to gauge a company’s long-term investment quality is through its free cash flow. 3D Systems has failed this important metric so I must give a sell rating.

New Competition From Xerox

The stagnant sales of 3D Systems is obviously due to the increased competition. The 3D printing industry is already crowded and worse, it is not growing fast enough. Xerox’s decision to make its own commercial liquid metal 3D printer makes it even more crowded. Metal additive manufacturing is where 3D Systems excels. Xerox, a much bigger company, now wants to disrupt this comfort zone of DDD. Metal 3D printers are and will remain the biggest opportunity for firms like 3D printers and Xerox.

Aside from its Western rivals like Stratasys (SSYS) and HP, Inc. (HPQ), DDD has is contending against much more affordable consumer/3D printers made by Chinese companies. Since China hosts some of the biggest factories today, it is expected that manufacturers there will likely buy high-volume, production 3D printers from Chinese companies. They are not going to purchase printers and materials from 3D Systems.

In other words, 3D Systems has zero chance of getting a foothold in China’s rising additive manufacturing industry.

Conclusion

The current pandemic exposed 3D Systems as an undesirable investment. 3D Systems is greatly handicapped by its stagnant sales, imperfect balance sheet, and stiff competition. 3D Systems’ future is very uncertain. The only viable path for it is to get bought by a bigger company like HP or Xerox.

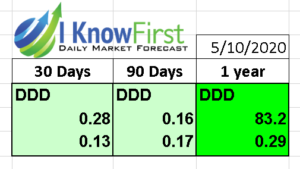

DDD is a sell. The predictive algorithm of I Know First gives a slightly bullish one year forecast for this stock. However, the chart below states that I Know First’s AI has a very low predictability score, 0.29, over its one-year forecasts for 3D Systems’ stock.

Technical indicators and moving averages also emphasize that DDD is a Strong Sell.

Past I Know First Success with DDD Stock

I Know First has been bullish on 3D Systems shares in past forecasts. On February 23, 2018, I wrote about DDD stock another article where I stated that mainstream adoption of home/office 3D printers hadn’t happened yet. At that same time, I analyzed 3D Systems’ brightest hope for reinvigorating its fortune – medical-related applications for restorative and cosmetic dentistry. My guesstimate was that restorative/cosmetic dentistry could contribute as much as $300 million to 3D Systems’ topline starting 2019. Since then, DDD shares have risen 23.82% in line with the I Know First algorithm’s 3 months forecast. See chart below.

Here at I Know First, our AI-based algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock market forecast, as well as Euro to Dollar predictions, gold price forecast, and, in particular, Apple stock price predictions. Today, we are producing daily forecasts for over 10,500 assets. These artificial intelligence stock predictions generated by our algo trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.