DDD Stock Analysis: 3D Systems 2016 Stock Forecast

DDD Stock Analysis

Executive Summary

Decreasing demand for 3D Printers

Decreasing demand for 3D Printers- Market Overview for 3D Printers

- Quarterly results expected to be negative

- I Know First Algorithm Is Bearish on AMD

Market Overview

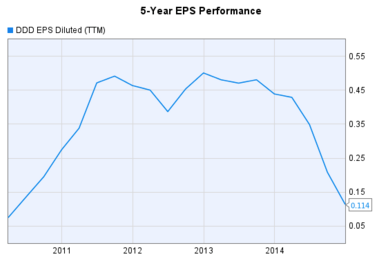

2015 was definitely not a good year for 3D printing companies; 3D systems shares suffered a 75% decline to 52-week lows. The stock is currently trading at around $7.00. A broad market weakness has taken its toll on all companies working in the sector; Stratasys and ExOne share have plummeted close to 10% and 25% respectively since the beginning of the year.

(Source: http://www.bidnessetc.com/61029-3d-systems-corporation-tanks-to-new-52week-low/)

Major producers in the 3D market have witnessed severe challenges, mainly due to very low market demand for the product. In light of this, 3D systems took provisions to discontinue its entry-level 3D printer, the Cube after disappointing sales and general results.

Analyst’s View

“DDD is down 10% at a five-year low of $6.69, after Canaccord Genuity, last night trimmed its price target by $1 to $9, following the lead of most of Wall Street. Specifically, 14 of 17 brokerage firms with coverage on the stock say it’s a “hold” or worse. What’s more, short interest is also elevated, representing almost 32% of the stock’s float. This bearish sentiment makes sense since 3D Systems Corporation has dropped nearly 77% of its value on a year-over-year basis.”[1]

Many on Wall Street believe the stock could plunge to as low as $3 due to increasing concerns regarding their fundamentals, and their main products. Also, the bearish sentiment among analysts is not aiding. As if this was not enough, 3D is now actively searching a replacement for former CEO Abraham Reichental.

Quarterly earnings reports are scheduled for 02-25-16, and the general view of sell-side analysts is that they will be negative. The view of many brokerage firms polled by Zacks is that EPS will come in at roughly -$0.03, indicating analyst’s general bearish view for the stock in the upcoming year.

(Source: http://3dprint.com/64251/stratasys-3d-systems-sales/ )

Our View

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database and utilizes it to predict the flow of money across 3,000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

I Know First released a bearish forecast on 3D Systems. The one-year forecast for DDD is shown above. On the 1 Year period, Netflix has a signal of -1305.74 and a high predictability of 0.59.

I Know First previously predicted DDD stock movement in this forecast from the 5th of January 2016. DDD showed a signal of -69.40 and a predictability of 0.3 and only 14 days later brought returns of 32.55%. The overall Tech Stock Package brought very nice returns of 21.10% to all investors that invested equally in the package, over performing the S&P500 which managed a -6.53% return during the same period.

Conclusion

The algorithm leads to believe that the stock is a long term short. The analysis provided above underlines fears about the stock and soaring sales, which support our view that the stock is not going to do well this year. We believe that soaring sales combined with decreasing market demand for the product will negatively affect 3D systems on the long term.

Decreasing demand for 3D Printers

Decreasing demand for 3D Printers