CVS Stock Forecast: CVS Health Is Worth A Buy-in Right Now

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

CVS Stock Forecast: Summary

- Retail sales of pharmaceuticals is still more popular than mail-order or online methods.

CVS Health is an industry leader in traditional brick & mortar marketing of OTC and prescription drugs.

CVS Health is an industry leader in traditional brick & mortar marketing of OTC and prescription drugs.- CVS has exemplary 12-month algorithmic forecast score. It might be worth betting on right now.

Defensive investors who are looking for safe long-term investments might consider adding CVS Health (CVS) to their portfolios now. Aside from its solid balance sheet, CVS Health’s future as a traditional retailer appears to be secured. According to the latest 2015 Global Shopper Study of Zebra Technologies, brick & mortar shopping is still the preferred choice of most shoppers.

Looking at the chart below, CVS Health’s robust retail drug sales ($88.4 billion in 2014) and general merchandise sales ($67 billion in FY 2014) are going to be stay healthy for many years to come.

Zebra’s global study revealed that more shoppers are still satisfied buying their supermarket and drug store products from traditional brick & mortar retailers. This study result is in line with the findings of PwC’s Total Retail 2015 report that got published last February.

As per PwC, more people shop more often on traditional brick & mortar stores. The people who shop every week still prefer to buy products from the nearest store rather than buy them online, 28% vs. only 17% for online shopping. Eight percent of daily shoppers also still prefer buying from traditional retailers. This is much higher than the 3% of daily shoppers who buy things from online stores.

Privacy/Security Is A Major Concern Over Online Shopping

The sensitive/private nature of pharmaceutical product purchases also compels me to believe that it is unlikely online drug stores will gain the complete trust of people. The possibility of online medicine purchase details getting hacked is one reason why I believe traditional CVS Health pharmacies will continue to thrive.

A privacy-minded customer could directly buy the medicine at the nearest pharmacy and be assured that nobody else is going to know what medicine he bought except him and the pharmacy’s employees. I myself do not want and never bought any medicine online simply because I do not want to risk getting my private medicine intake getting on the hands of third-party hackers.

Security concerns might be why U.S. shoppers are spending less on online purchases this year. As you can see from the chart below, the average American online shopper was spending more money in 2012 than this year.

My point now is that online stores are not the existential threat to CVS Health’s traditional approach to retail sales.

CVS Is Growing Its Retail Store Network

The lingering distrust of shopper against the vulnerability of private data stored on online stores is a tailwind for CVS. As long as there are nefarious hackers exploiting online stores, the retail pharmacy business is still not going to fade away. As a matter of fact, CVS has been steadily growing its number of pharmacies in spite of the advent of online drug stores since 2011.

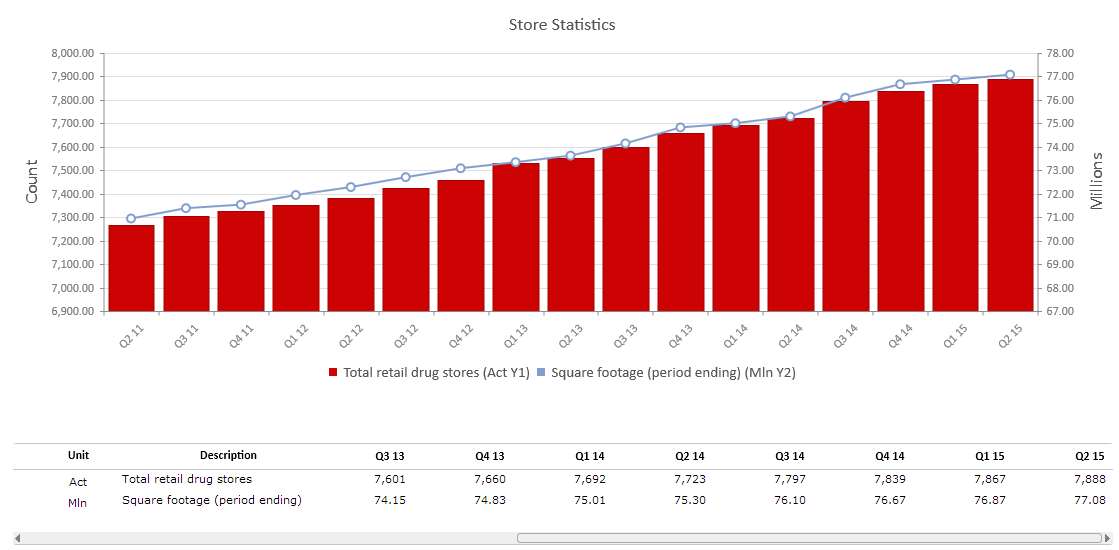

The chart below reveals CVS now has 7,888 retail drug stores as of Q2 2015. This is higher than Q2 2011’s 7,266 drug stores.

(Source: CVS)

Investors should therefore appreciate that CVS’s continuing program to build more retail pharmacies is only because there’s growing foot traffic going inside them. Instead of merely surviving the threat of online drug stores, the old brick & mortar retail pharmacy business of CVS is actually thriving in this age of smartphones and tablets.

Online stores never caused any real threat to the continued growth in revenue of CVS Health over the last few years. As per the chart below from SimplyWall.st, CVS’ revenue is still on an uptrend. For the past five years, CVS has consistently improved its earnings growth.

(Source: SimplyWall.st)

My Takeaway and I Know First Algorithmic Forecast

CVS is a safe long-term investment with a retail business model that will remain relevant for many years to come. The stock is still trading below from its 52-week high of $113.65. A long-term bet on CVS might prove very profitable after a one year period.

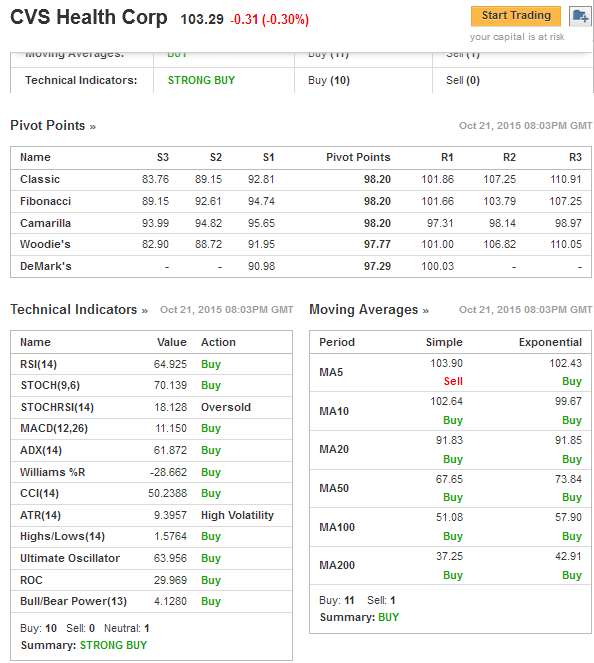

As per the latest October 21 report of I Know First, CVS is the leading mega-cap company with the best algorithmic forecast score for the 12-month prediction. The +164 score of CVS on the one-year forecast of I Know First is a loud Buy recommendation.

I expect CVS to trade above $110 again next year. This blue-chip company has a solid balance sheet and a massive network of stores to keep it growing. The bullish algorithmic forecast of I Know First for CVS is also supported by the traditional technical indicators.

CVS is a Strong Buy according to moving averages and other technical indicators.

(Source: Investing.com)

CVS Health is an industry leader in traditional brick & mortar marketing of OTC and prescription drugs.

CVS Health is an industry leader in traditional brick & mortar marketing of OTC and prescription drugs.