CRON Stock Forecast: Recovery Ahead As New Products Launched

This CRON stock forecast article was written by Maria Grishaev, Analyst at I Know First.

This CRON stock forecast article was written by Maria Grishaev, Analyst at I Know First.

Executive Summary

- Cronos Group Inc. had a mixed year in 2020 with their stock losing 2.66%, mostly due to the COVID-19 pandemic.

- With the new Biden administration and the legalization of cannabis in five new states in the US, the new product launches worldwide, the company’s future is looking better.

- Based on the Multiples Valuation model, my price target for CRON is 18$, indicating a cautious buy recommendation.

Overview

Cronos Group Inc is a cannabinoid company. The Company is focused on cannabis research, technology, and product development. The Company’s portfolio includes Peace Naturals, Cove, Spinach, Lord Jones, and Peace+. In late 2020, the company launched several new brands, Happy Dance™, a CBD skincare brand, co-founded with actress Kristen Bell in the United States and the medical brand Peace Naturals™ in Israel. Overall, the stock lost 2.66% in 2020, while it rose 64.41% YTD versus a 3.34 rise of the S&P 500. In the trailing twelve months, the stock outperformed the S&P 500 index by 263%.

Growth Opportunities Ahead

The full effect of the new brand launches is yet to be seen on the financial reports of the company as they were launched late in the fourth quarter of 2020.

The ongoing restrictions and closures experienced by retail stores in the U.S. as a result of the COVID-19 pandemic have negatively impacted sales and demand which has resulted in slower than expected revenue growth in the U.S. while in the rest of the world segment there wasn’t affected.

The Biden presidency is a positive sign to the industry as five new states legalized some form of cannabis use following the 2020 election results. Some believe that president Biden would be more willing to legalize marijuana on a federal level. These states represent a potential for growth in sales. Investors see this potential as well as the stock rose by 89.85% since elections day. As the world continues to emerge from the COVID-19 crisis with the rollout of the vaccinations worldwide, we can be optimistic about the outlook for the company with growing demand.

Indicators Show a BUY Signal

As we can see in the chart, the most recent time that the stock price crossed above the moving average for 200 days (the purple line) was in November and it signaled a potential change in trend. That was indeed the case as the stock rose from there. We can also see that the moving average for 50 days (the red line) crosses above the moving average for 200 days in the last week of November and it also indicates that the trend is shifting up. This is the known “golden cross” that gives us a buy signal.

Another indicator for a potential opportunity is the Bollinger Bands® squeeze. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. This can be seen happening here from September to October.

Competition Analysis

Most of the companies have a market cap under 500M, with a few companies that have a market cap over 1B$. The cannabis industry is a very volatile one. We can see in the chart below the stock price movements for the past 12 months:

We can see that some of the stocks performed better than CRON, but there are also companies that performed worse and are yet to recover from the March 2020 market falls.

In terms of production capacity, there are companies with a higher scale of Cannabis production than the Cronos Group. Aurora (Nasdaq: ACB) and Canopy Growth (Nasdaq: CGC) can produce over 500,000 kilograms while Aphria (Nasdaq: APHA) can produce only about half of that. Even they are having a hard time breaking even and become profitable and report net losses each quarter. Cronos is more focused on the research and development of a variety of products rather than on scaling its production capabilities.

Multiples Valuation Analysis Results in Higher Target Price

I estimated the CRON target stock price using the multiples valuation model. I looked for Cronos Group’s peer companies’ P/B ratios (the P/E ratios and EV/EBITDA are irrelevant as some companies’ ratios are negative or zero) and calculated the average P/B ratio for the cannabis industry. I got that the P/B average ratio is 3.64.

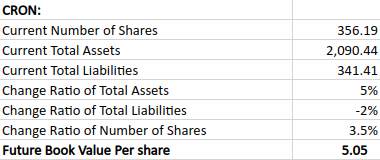

Next, I checked in the latest financial report the total assets and liabilities of the company. I made a few assumptions about the future of the company based on what I wrote above. I assumed that the total assets will grow at a rate of 5%, while the liabilities will go down by 2% in the next year. I also assumed that the number of shares will rise by 3.5%. That in total brings us to a future book value per share of 5.05.

Overall, I received a price target of $18.36. This target price is higher than the current stock price of $11.41, making a 60% difference.

Conclusion

I take the buy-side on CRON stock. It is reasonable to expect further growth in the stock price in the long term as the company improves its performance and the impact of the COVID-19 vaccinations on the demand and retail reopening.

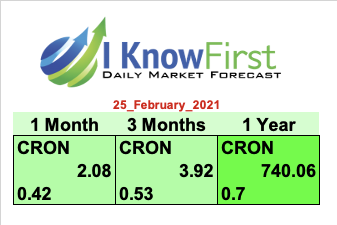

Please note that the stock-picking AI of I Know First has a high signal and predictability on the one-year market CRON stock forecast. The light green for the short-term forecasts is mildly bullish while the darker green is a strong bullish signal for the one-year forecast.

Past Success with CRON Stock Forecast

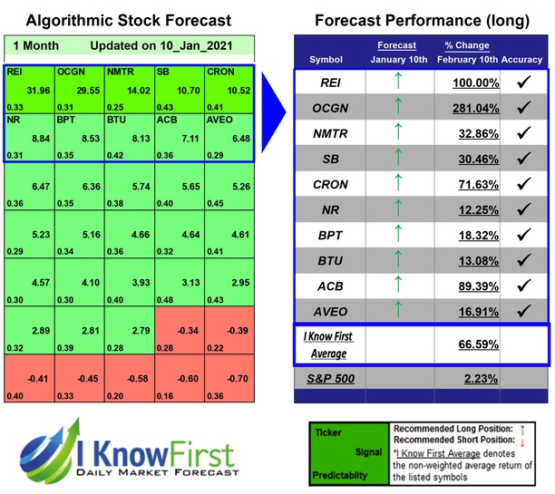

On November 10th, 2020 the I Know First algorithm recommended CRON as one of the Stocks Under $10 package. The AI-driven stock forecast was successful on the 3 months’ time horizon resulting in a 115.08% gain since the forecast date.

Moreover, on January 10th, 2021 the I Know First algorithm recommended CRON as one of the Stocks Under $10 package. The AI-driven stock forecast was successful on the 1-month horizon resulting in a 71.63% gain since the forecast date.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.