CRNT Stock Forecast: Ceragon Continues Pushing Communications Ahead

This article was written by Julia Masch, a Financial Analyst at I Know First

“5G will have an impact similar to the introduction of electricity or the car, affecting entire economies and benefiting entire societies.”

– Steve Mollenkopf, CEO of Qualcomm

(Source: Flickr)

(Source: Flickr)

Highlights:

- Ceragon starts the fiscal year strong

- Looking Ahead in India and Outdoor Systems

- Current I Know First Bullish Forecast for CRNT

Ceragon Networks Ltd (NASDAQ: CRNT) has had a strong year so far with increases of 64.65% YTD and 18.55% over the past 60 days. Ceragon is an Israeli company that provides wireless backhaul solutions to mobile operators and private networks globally. As mobile providers race towards 5G, Gigabit LTE, and other faster networks for their customers, they will use more and more of Ceragon’s technology.

Q1 2018 Results and Company Financial Analysis

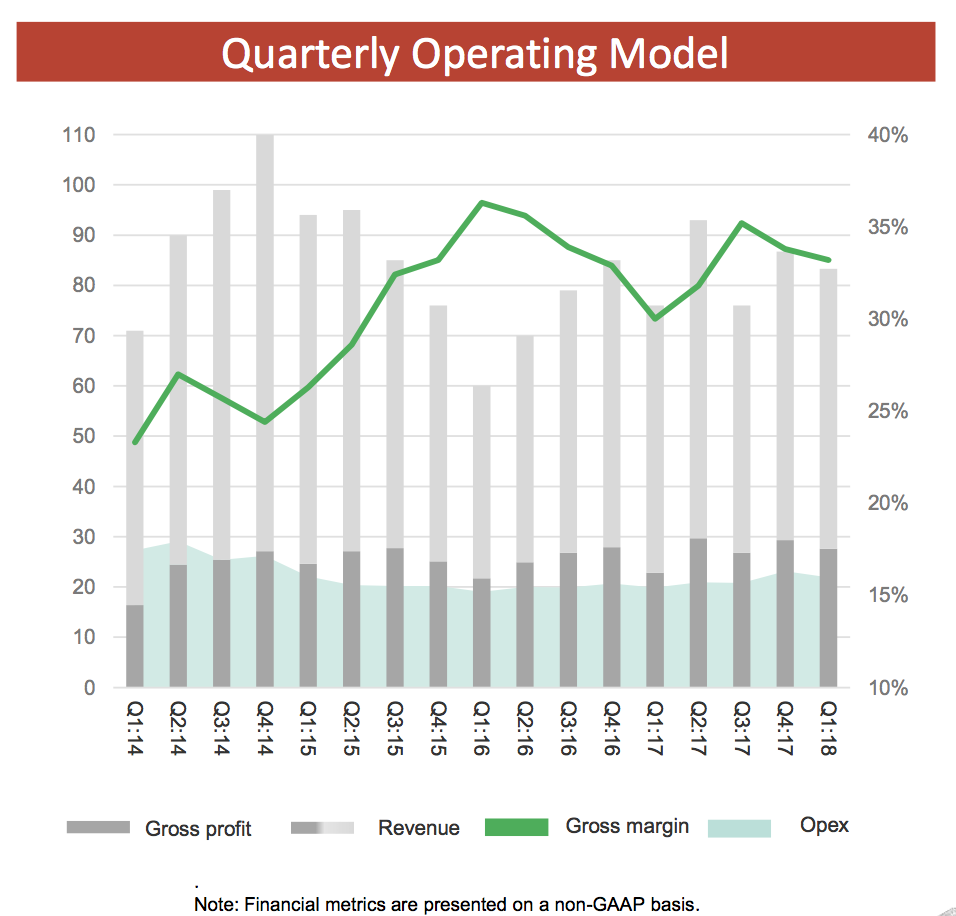

Ceragon posted a solid Q1 2018 earnings report on May 7, 2018 which detailed increased revenue and earnings per share (EPS) above expectations. First quarter revenue was $83.3 million, up 9.5% year over year. Additionally, the company has raised its quarterly run rate expectation for 2018 from $75-80 million to $80-85 million. These robust numbers are a good sign given record bookings in Q4 2017 as well as a tendency for Q1 2018 to be negatively affected by seasonal changes. Historically, Q4 is good for telecommunication companies since they must utilize their budgets. These fluctuations between quarters are also a result of changes in geographic mix and revenue currency, timing of various projects, changes in currency value, and more. Over the past year, business in Latin America made up 18% of Ceragon’s revenue with a large portion of this from Venezuela. Due to a large depreciation of Venezuelan currency that cost Ceragon Networks foreign exchange expenses of ~$600,000, financial expenses were much higher than in past quarters. Despite this Q1 2018 revenue only decreased 3.9% from a record high Q4 2017. Operating expenses also decreased from Q4 2017 to Q1 2018. Although gross margin slipped slightly, gross margin is still above 30% which is still very good for the company.

(Source: Ceragon Investor Relations)

(Source: Ceragon Investor Relations)

Additionally, EPS was $.04, which exceeded analysts expectations of $.03. Although post-tax adjusted EPS was $.03, these are still strong earnings considering the quarterly fluctuations typical for Ceragon. The high revenue and high earnings per share reflect a good start to the year for Ceragon given the seasonal fluctuations. The company’s Price-to-Sales (P/S) Ratio and Market Cap have also both been on the upswing since late 2017 and will continue to as demand for faster mobile technologies increase.

(Source: Ycharts)

The Future for CRNT – India and Outdoor Units

Ceragon Networks has already recognized the potential of the Indian market for wireless backhaul solutions. Recently, there has been a very aggressive move towards network densification as competition heats up between network providers in India. Since wireless backhaul is a primary solution for network densification, this is extremely good for CRNT. Ceragon has 2 clients that made up over 10% of revenue in Q1 and they were both from India. India has made up 41% and 46% of revenue over the past 12 months and past quarter respectively. The company expects revenue to continue increasing as the geographical mix of revenue becomes even more dependent on India.

Revenue by geography over past year (Source: Ceragon Investor Relations)

Revenue by geography over past year (Source: Ceragon Investor Relations)

Additionally, Ceragon has become a leader in providing outdoor units for wireless backhaul solutions. These systems are effective because they are easily installed, have less requirements, and can be more efficient. There has been a trend towards increasing quantity of all-outdoor units recently and these units have accounted for 18% of the total market in 2015 to 48% of the total market in 2017. Based on quantity of units shipped, these all-outdoor platforms have become over 60% of Ceragon Networks’ business. As the competition for 5G and Gigabit LTE speed up, demand for these superior solutions will continue to increase.

Technical Analysis

CRNT stock price has increased by 18.55% over the past 60 days. Throughout this time period, the price of CRNT has consistently been above the 200 day simple moving average. In addition, after being slightly below the 50 day simple moving averages for about a month between the beginnings of April and May, the stock price has risen above the 50 day SMA. This increase of price in comparison to the moving averages indicates a bullish trend for Ceragon Networks.

(Source: Ycharts)

(Source: Ycharts)

Additionally, Ceragon has an RSI of ~62 which is within the normal range, but closer to 70, the lower bound to being an overbought stock.

Analyst Recommendations

The current consensus by analysts polled by Yahoo Finance is to hold the stock.

Current Bullish I Know First Algorithm Prediction for CRNT

In line with the bullish trends shown in my analysis, the I Know First algorithm also currently has a bullish forecast for Ceragon Networks, especially for the 1 year investment horizon with a signal level of 381.42 and predictability indicator of 0.62.

Conclusion

5G is the mobile technology of the future and the demand for related products such as those Ceragon produces will only go up. Ceragon has the capability to help mobile networks develop this 5G technology with its wireless backend solutions. Ceragon’s industry leading technology and their focus on efficient outdoor systems will make Ceragon one of the big providers of wireless backend solutions in the future. Additionally, Ceragon’s global presence will allow it to expand in many different markets, in particular India. India’s growing demand for network densification will give Ceragon large amounts of business that will greatly impact its revenue in the near future. Moreover, the technical analysis of CRNT indicates a bullish momentum based on stock price and moving averages. For these reasons, I predict that Ceragon and its stock will continue to grow and CRNT is a stock worth investing in, especially in the long run. My prediction is in good agreement with the current I Know First bullish forecast for CRNT.

Past I Know First Algorithm Success with CRNT

In this forecast posted on February 11, 2018, the I Know First Algorithm predicted a signal of 20.72 for CRNT with a predictability of .34 for the upcoming 2 weeks. Over this time period, the stock price increased 40.67% in accordance with the I Know First Forecast Algorithm.

Current I Know First subscribers received this bullish CRNT forecast on February 11th, 2018.

I Know First Algorithm Heatmap Explanation:

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day and can be simplified explained as the correlation-based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to feel confident about/trust the signal.