Coca Cola Stock Analysis for 2016: Is Coca-Cola Worth Adding to Your Portfolio

![]() Zack Tobin is a Financial Analyst at I Know First.

Zack Tobin is a Financial Analyst at I Know First.

Coca-Cola Stock Analysis

- Low Oil Prices Will Help Stock

- The Global Middle-Class Growth Will Add Consumers

- Margin Cost Cutting is Saving $3 billion a year

- I Know First is bullish on KO stock for the mid and long term

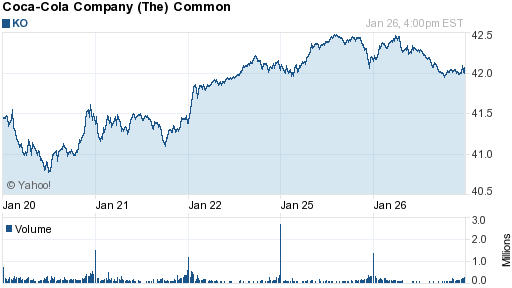

Like a lot of blue chip stocks Coca-Cola had a difficult first 10 days to 2016. However, since January 11th the soft drink company has had a nice rebound and is currently at $42.45 EPS. Wall Street analysts are somewhat split on the outlook for Coca-Cola. 2015 was a middling year; with around half believe the company is worth buying while the other half sees it as a hold. The forecast for Wall Street analysts over the next year ranges from $41 to $54.

(Source: Yahoo Finance)

The benefit of investing in a stock like Coca-Cola is that it has a low risk. For decades, Coke has been the best-selling soft drink in the world and is one of the more recognizable name brands in any industry. While it does have some fierce rivals in Pepsi and Dr. Pepper it’s unlikely that either one of these companies could do anything to topple Coke.

Concerns Over Oil Prices May Help.

In an interview with Bloomberg Television, Coca-Cola CEO Muhtar Kent explained why the decline in oil prices could possibly benefit his company.

“Mobility in the United States is up compared to 12 months ago, compared to eight months ago. More people are driving — more people are stopping at retail outlets and are buying goods at small retail outlets, gas stations and convenience stores” Kent said.

The drop in oil prices to their lowest level in more than a decade translated into $115 billion of savings for consumers last year — or $550 per driver — according to the American Automobile Association. Gas savings were often used to buy products such as cigarettes, snacks and drinks.

Many have analysts are expecting that the stock market is expected to fall in the upcoming months, due to the poor oil prices. The beverage industry is one of the few sectors that wouldn’t be affected by a worse economy. During the great recession from 2007 to 2009, Coca-Cola saw This is because that even in a recession people will be able to afford beverages such as Coke. This makes Coca-Cola an intriguing safe-haven investment.

(Source: Google Images)

Opportunities for growth

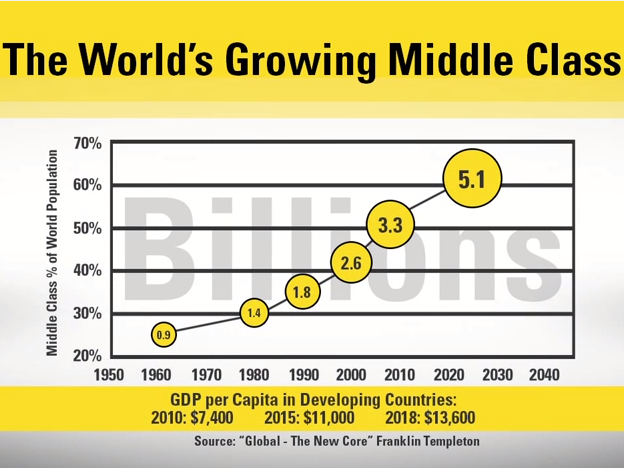

While there may be concerns over how the stock market will fare in the near future, the global middle class is expected to grow over the course of the next few years. Over the course of the next 5 years, 700 million people are expected to enter to the global middle class, and personal consumption growth is expected to increase to by $20 trillion. This will make Coca-Cola accessible to more people around the world, which will help increase revenue.

(Source: “Global – The New Core” Franklin Templeton)

One misconception many people have about is that they just sell soda. However, they actually own 20 billion dollar non-alcoholic beverage brands, 14 of which are non-carbonated. Examples include Minute made, Fuze Tea, PowerAde, and Dasani. It’s main competitor Pepsi- has begun to shift away from beverages and more towards foods. In fact, 63% of Pepsi’s revenue now comes from food. Pepsi’s shift toward the food industry reduces the rivalry will help make further make Coca-Cola the leader of the beverage industry.

Return Analysis

Over the last decade, Coca-Cola has compounded its earnings-per-share at 5.9% a year. The company is h growing its earnings to 7-9% over a year. In order for this to happen Coca-Cola will need to improve its margins. In order to improve, they have already closed four plants, reduced four non-bottling head count by 10%, and closed or converted 7 distribution facilities. In total improving the margins is expected to save $ 3 billion a year, which should be enough to keep increasing the EPS to 7-9%.

Conclusion

Coca-Cola may not have as high of a ceiling as other stocks, but it is a smart bet for investors looking for something that is low risk. For over a century now, Coca-Cola has proven to be a powerful company in a slow-moving industry. It’s difficult to see any thing that could prevent the company from lasting another century. With low oil prices and growth in the global middle class, now would be a good time to invest in Coca-cola.

My Buy recommendation for KO is also in line with the bullish algorithmic forecasts of I Know First Research for Coca-Cola. Both the 3 months and one year forecast have Coca-Cola’s stock increasing.

I Know First Research, A FinTech Company that created a state of the art algorithm that predicts over 3,000 markets on a daily basis.

We do offer unique data points through a 100% empirical predictive model for the capital market.

The algorithm produces forecasts with a signal, indicating the direction and strength of the predicted asset’s price movement, and a predictability indicator, which serves as a prediction quality measure. Our heat map forecast tables provide instant views on best market opportunities. They serve as a decision support system or an idea generator in the form of investment signals. We also provide customers with the foundations needed to form their own quantitative trading

strategies, such as our swing-trading model. To detail a bit more on the algorithm, recognizing a positive signal strength with the algorithm does not mean investors should automatically buy the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as Apple. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is positive and if the last closing price is above the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.

Previously I Know First predicted Coca-Cola’s stock movement in the Mega Cap Forecast from the 2nd of November 2014. It had a signal of 19.02 and predictability of 0.31 bringing after just one month returns of 7.09%.