Citigroup: SWOT Analysis

Citigroup Inc. (NYSE: C)

Introduction:

Citigroup, the American multinational banking and financial services giant, recently reported solid second quarter results on July 14th. Over the past few weeks, the company’s stock price has gained 6.45%. However, this recent surge is far from the norm. Citigroup has struggled to keep up with its competition since the start of the year, as seen in the figure 1.

Below, I have conducted a SWOT analysis, noting the strengths and weaknesses of Citigroup, as well as the opportunities and challenges that lie ahead.

Strengths:

One of Citigroup’s greatest strengths is its low Price/Book ratio of 0.74, meaning that the bank’s stock is currently valued at 74% of the total value of the company’s assets. Citigroup is the only big bank to trade below its tangible book value. This demonstrates that the market is bearish on Citigroup, which could lead to some massive growth with the right catalyst.

The bank’s second quarter earnings were a step in the right direction, with adjusted earnings up 1% to 3.93 billion, or $1.24 per share. Analysts had expected adjusted earnings of $1.05 per share, making for a big beat for the bank on that metric.

Weaknesses:

As the US housing market recovers, the demand for mortgage refinancing weakness. Additionally, the banking sector still remains sluggish, with global consumer banking revenues down 3% to 9.4 billion for Citi. Despite the US economy’s recovery from the financial crisis, the company is still suffering from the stock dilution experienced in 2009. Few companies had been as badly damaged by the financial crisis as Citigroup, and the company still feels the effects of the $58 billion stock exchange.

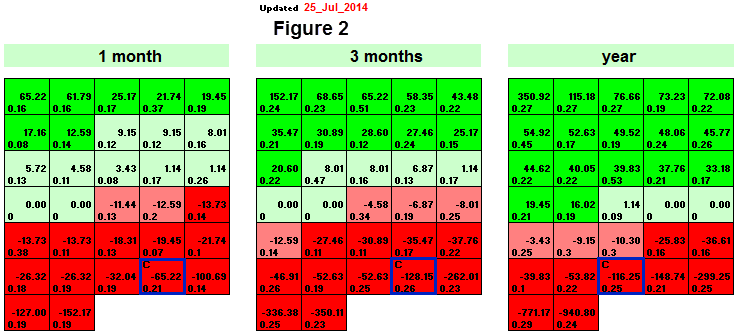

According to our algorithmic forecast, Citigroup is a strong sell in the 1-month, 3-month, and 1-year timeframes.

Opportunities:

With Citigroup trading at such a discount, there is the potential for a huge return. The stock price can go up 50% just by realizing the company’s book value. However, the probability of this happening is extremely slim.

Looking into the future, the US economy and banking sector looks like it’s on the right track. As the housing market and economy continue to improve, there is a good chance that Citigroup will have excess reserves. This may help bring back the investor confidence that the company has been struggling to find as of late.

The mortgage-backed security market is also beginning to heat up again, and Citigroup will no doubt have a hand in that.

Threats:

After failing the Federal Reserve’s annual “Stress test”, Citigroup is now forbidden from raising its dividend or increasing its stock buybacks. The bank fell short in its assessment of the risks it faced during a scenario of sustained economic stress. If the restrictions on the bank’s dividends and buybacks were not enough to deter investors, it certainly is not comforting to know that Citigroup’s business model would not be able to sustain another financial crisis.

Conclusion

At first glance, Citigroup may appear to be an undervalued gem. With a nice second quarter earnings report and stellar recent gains, many may see the company as having a bright future. However, there is a reason the stock remains a bargain. The Federal Reserve has its thumb on the bank’s future, restricting any further increases in dividends or stock buybacks. With no major catalysts on the bank’s horizon, I see no reason to take the risk of holding this underperforming bank. In this instance, I would agree with the algorithmic forecast and stay clear of Citi for the time being.