CHWY Stock Forecast: What’s the Pawtential?

This CHWY Stock Forecast article was written by Yu Yao – Financial Analyst at I Know First.

Summary

- Chewy Turned Profitable in Q1 FY2022

- CHWY May Provide Some Protection from Recession

- DCF Valuation Model Indicates 15% Upside Potential in 1 Year

Company Overview

Founded in 2011, Chewy (CHWY) is the leading online pet food and supplies retailer. CHWY partners with more than 3,000 brands in the pet industry, offers more than 100,000 products, and provide a high-bar, customer-centric experience to our customers. Through its retail website and mobile applications, CHWY offers pet services for dogs, cats, fish, birds, small pets, horses, and reptiles as well as food, treats, supplies, and prescriptions for pets. CHWY was acquired by PetSmart, the largest specialty pet retailer in North America, for $3.35 billion in 2017. CHWY completed the initial public offering (IPO) on June 18, 2019.

Its mission is to be “the most trusted and convenient destination for pet parents and partners everywhere”.

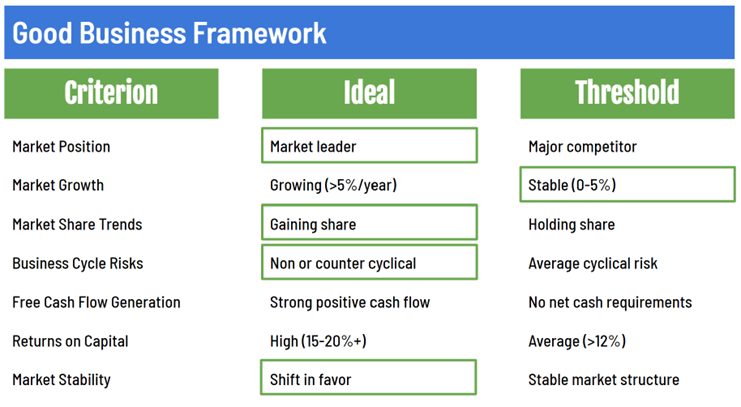

Is Chewy a Good Business?

Based on the “Good Business” framework, CHWY missed meets all the criteria but free cash flow generation and returns on capital. CHWY did not generate positive net income in the past, thus it does not have a strong ability to generate free cash flows and its returns on capital were negative. However, things will change since CHWY turned profitable in the most recent quarter.

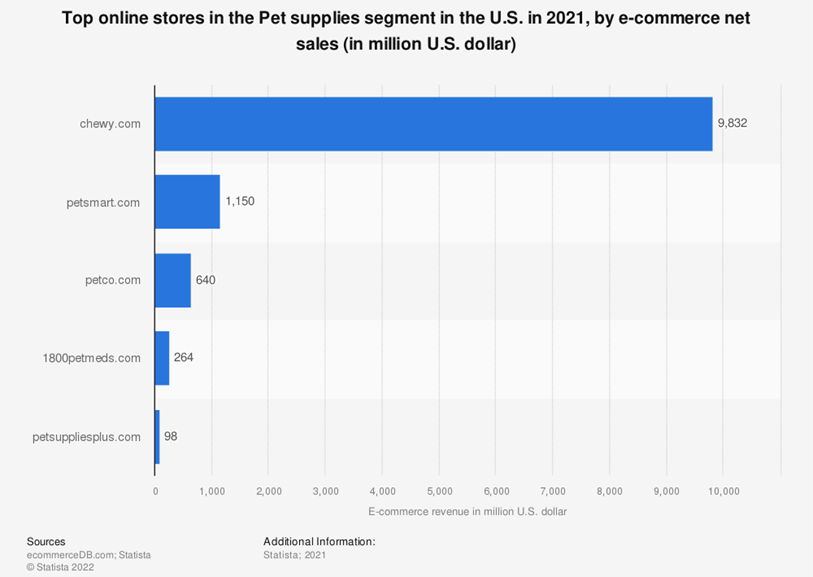

CHWY is the largest pet food and supplies online retailer, securing its market leader position. As shown in the figure below, CHWY generated much more sales than its competitors. According to IBIS Online Pet Food & Pet Supply Sales industry report, the industry is expected to have a CAGR of 4.3% from 2021 to 2026, meeting the 5% stable growth threshold. CHWY grew at a 5-year CAGR of 43% from 2017 to 2021 and has a revenue growth rate of 14% currently, much higher than the industry growth rate. CHWY was gaining market shares for the past and is expected to expand its market share in the future as well. CHWY was one of the stocks that performed well during the pandemic and has low cyclical risk. Since more pet owners treat their pets as family members and the trend of pet humanization are reshaping the industry, the market stability shifts in favor of CHWY.

CHWY has great and 24/7 customer services, offer over 100,000 pet products and fulfill pet medical needs, which Amazon, the e-commerce giant, is not capable of. CHWY’s brand image, exceptional customer services, and wide product selections are strong moat for the company. Overall, CHWY is a good business.

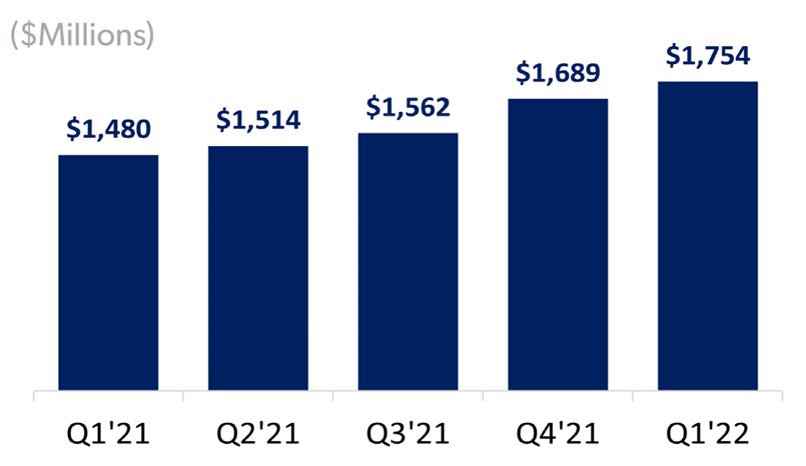

Chewy Turned Profitable in Q1 FY2022

Revenue for Q1 2022 was $2.43 billion, representing 14% growth year-over-year and 2% growth quarter-over-quarter. CHWY currently has 20.7 million active customers and the net sales per active customer (NSPAC) grew to $446 from $388 one year ago. 72.2% of CHWY’s total net sales come from its Autoship program. As shown in the figure below, Autoship revenue increased 18.5% year-over-year and 4% quarter-over-quarter.

Figure: Autoship Customer Sales

As shown in the table below, CHWY had losses in the past three quarters and turned profitable again in Q1 2022. The EPS of $0.04 beats expectation by 128%.

CHWY plans to launch a pet health insurance and wellness offering in the second quarter of this year. The Pet insurance industry is expected to have a CAGR of 9% from 2022 to 2027 according to IBIS World. Customers who purchase CHWY pet health insurance may also buy prescription medicines on the CHWY website, increasing net sales per active customer (NSPAC) even more. By doing so, CHWY is able to maintain a high growth rate for its top line.

CHWY May Provide Some Protection from Recession

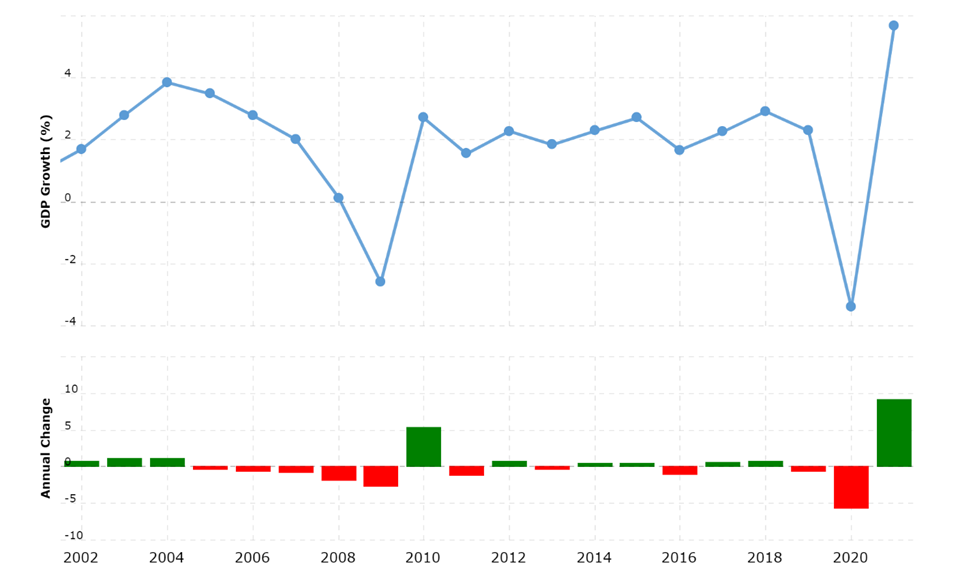

Figure: US GDP Growth Rate 2002 – 2022

As shown in the figure above, the US GDP growth rates for 2008 and 2009 were 0.1% and -2.6% respectively. However, during the financial crisis of 2007 – 2008, the US pet industry expenditure still grew at 5%, much higher than the GDP growth rate. During the pandemic, the US GDP growth rate in 2020 was -3.4%, but the pet industry expenditure growth rate was 6.7%.

Due to the non-discretionary nature of pet supplies and food, the pet space is defensive and CHWY is considered recession resilient.

DCF Valuation Model Indicates 15% Upside Potential in 1 Year

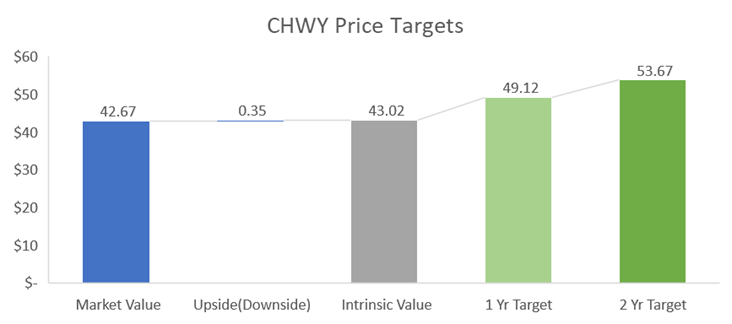

Based on a five-year DCF model shown in the Figure below, the one-year target price of CHWY stock is $49.12, inferring a 15% upside from the current price of $42.67 as of July 13, 2022. When comparing the current market price to the intrinsic value, CHWY is fairly priced right now as shown in the Figure above.

The main assumptions made are revenue growth rates and margins based on historical data and macroeconomic expectations. As CHWY’s competitor, Petco (WOOF) has a gross margin of 42%, an EBIT margin of 3.4%, and a net margin of 1.7%. CHWY’s current gross margin and EBIT margin are about 27% and 0%, much lower compared to Petco. CHWY’s margins have a lot of room to be improved if the supply chain issues can be solved. Being an online retailer, CHWY should have lower operating costs compared to Petco, thus higher or at least a similar level of EBIT margin is expected for CHWY in the future. The tax rate is assumed to be 25%.

Beta used to calculate the cost of equity by using CAPM is 0.96, which is the result of regression analysis between 3-year historical returns of the SP500 index and CHWY. WACC is 7.92%, which is almost the same as the cost of equity since CHWY is primarily financed by equity. The perpetuity growth rate assumption is 3%, which is slightly lower than the US GDP growth rate average.

Based on Yahoo Finance coverage for CHWY as shown in Figure above, out of 24 analysts: 13 take Strong Buy and Buy positions, 10 take the Hold position, and1 take the Underperform position. The analysts’ community puts the average target price for the stock at $44.36 while it is currently traded at $42.67 as of July 1, 2022.

Conclusion

CHWY is a BUY or HOLD stock with strong top-line growth and cross-sell potential. Based on a 5-year DCF valuation model, the one-year target price for CHWY stock is $49.12, inferring a 15% upside from the current price of $42.67 as of July 13, 2022. Although CHWY faces some supply chain issues and increasing costs due to inflation, it still grows fast since the demand for pet supplies and food products is inelastic.

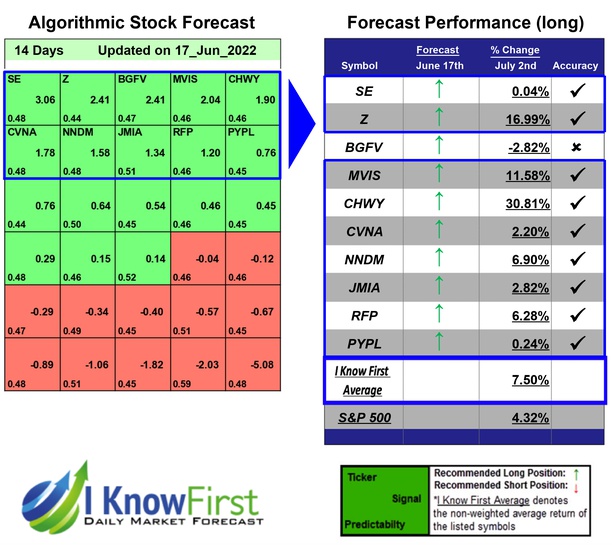

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the CHWY stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with CHWY Stock Forecast

I Know First has been bullish on the CHWY stock forecast in the past. On June 17, 2022, the I Know First algorithm issued a forecast for CHWY stock price and recommended CHWY as one of the best stocks to buy. The AI-driven CHWY stock prediction was successful on a 14-day time horizon resulting in more than 30.81%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.