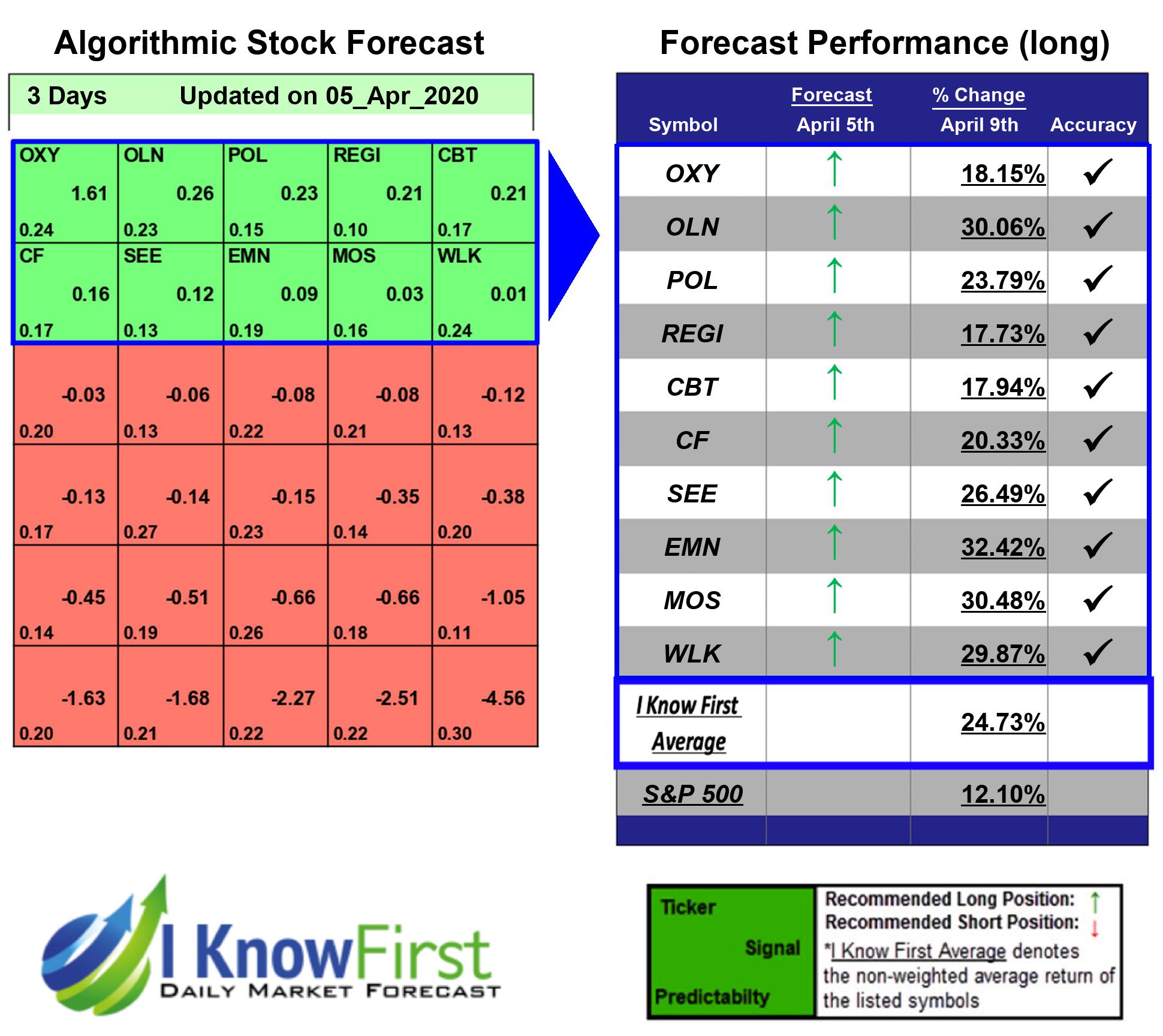

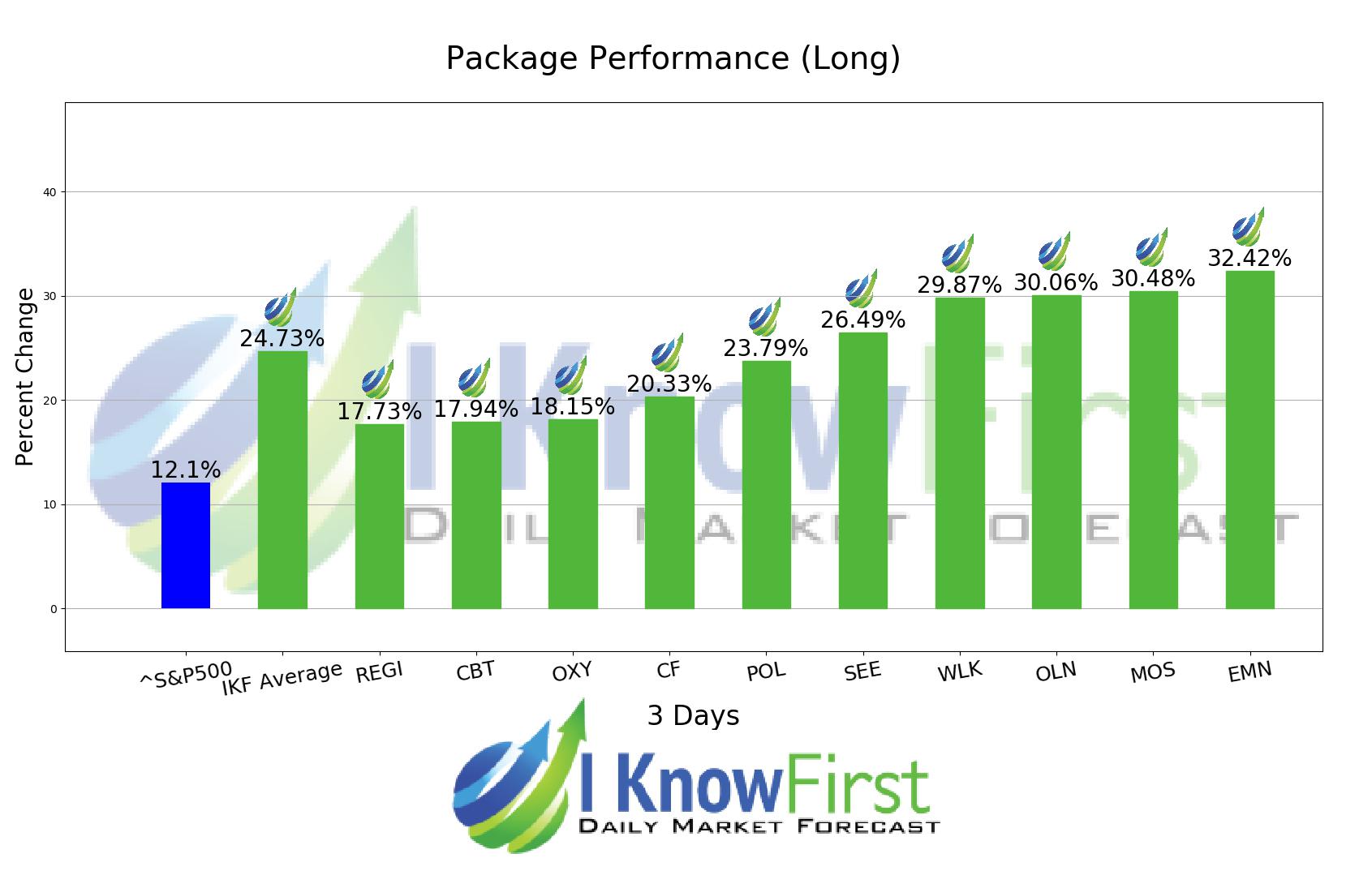

Chemical Stocks Based on Deep-Learning: Returns up to 32.42% in 3 Days

Chemical Stocks

This Chemicals Stocks forecast is designed for investors and analysts who need predictions of the best chemical stocks to buy for the whole Chemistry Industry (see Chemicals Stocks Package). It includes 20 stocks with bullish and bearish signals and indicates the best chemical stocks to buy:

- Top 10 Chemical stocks for the long position

- Top 10 Chemical stocks for the short position

Package Name: Chemicals Stocks

Recommended Positions: Long

Forecast Length: 3 Days (4/5/2020 – 4/9/2020)

I Know First Average: 24.73%

This Chemicals Stocks Package forecast had correctly predicted 10 out of 10 stock movements. The highest trade return came from EMN, at 32.42%. Additional high returns came from MOS and OLN, at 30.48% and 30.06% respectively. The package saw an overall yield of 24.73% versus the S&P 500’s return of 12.1% implying a market premium of 12.63%.

Eastman Chemical Company (EMN), a specialty chemical company, manufactures and sells materials, chemicals, and fibers in the United States and internationally. The company’s Additives & Functional Products segment offers solvents, including specialty coalescents, ketones and esters, glycol ethers, and alcohol solvents; cellulose and polyester-based specialty polymers, and paint additives; insoluble sulfur products; antidegradants; hydrocarbon resins; specialty intermediates, performance products, and formic acid; and alkylamine derivatives. This segment’s products are used in the coatings, tires, consumables, animal nutrition, crop protection, and energy markets. Its Adhesives & Plasticizers segment manufactures adhesives resins and plasticizers used in the consumables, building and construction, health and wellness, industrial chemicals and processing, and durable goods markets. The company’ Advanced Materials segment provides specialty copolyesters, cellulose esters, polyvinyl butyral, and window film products for value-added end uses in transportation, consumables, building and construction, durable goods, and health and wellness products. Its Fibers segment offers Estron acetate tow and Estrobond triacetin plasticizers for manufacturing cigarette filters; Estron natural and Chromspun solution dyed acetate yarns for use in apparel, home furnishings, and industrial fabrics; and cellulose acetate flake and acetyl raw materials for other acetate fiber producers, as well as acetyl chemical products. The company’s Specialty Fluids & Intermediates segment provides specialty fluids, acetyl chemical intermediates, olefin derivatives, and alkylamines used in industrial chemicals and processing, building and construction, health and wellness, and agrochemicals markets. The company also offers aviation turbine engine oil; wet-laid nonwovens; and specialty films. Eastman Chemical Company (EMN) was founded in 1920 and is headquartered in Kingsport, Tennessee.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.