Can a Machine Beat the Stock Market?

This article was written by the I Know First Research Team.

This article was written by the I Know First Research Team.

Executive Summary

Recently, several articles expressed opinion that artificial intelligence and machine learning will never beat the stock market. According to a report published by Allied Market Research, the global neural network market was valued at $7.03 billion in 2016, and is estimated to reach at $38.71 billion by 2023. The rapid development of computational powers and the fast pace of changes in the stock market forces investors to wonder whether they should trust machines to predict the stock market or continue to use old-fashioned methods. In this article I am going to show that the average returns and hit ratios from three days to one year show I Know First AI-driven algorithm’s long efficacy.

The Missing Component for AI to Beat the Stock Market

In the first article, the author argues that “There’s a major flaw in algorithms built solely to predict future market moves: they don’t. They only respect the technical aspects of an asset by taking into account past price movements, avoiding any consideration for future fundamentals”. In addition, he compares that feeding an algorithm with data based purely on technical details is similar to playing with darts blindfolded. “You hit the board 1 out of 10 times, but the rest hit the wall”.

Another message expressed in this article is that the stock market provides infinite loop of complexity and that the chance of succeeding to beat the market is “way less than 50%, and, in some cases, even less than 1%”. Finally, he claimed that “machines incapable of predicting a black swan event but are more likely to cause one”.

The above considerations are very powerful, especially in during volatile and unstable times. However, there are a few counter-factors to be considered. First, there are special market regulations in place that were designed to prevent such critical situations and minimize the “black swan” risks. You simply can’t sell or buy too many stocks at once and trigger certain stock prices crashing the market. While this is theory, from historical perspective one can observe that so far AI was not responsible for black swan events, while human decisions and natural disasters were. Finally, even though AI is powerful tool to predict and even act in the stock market, the optimization nature of the algorithms could not be easily marked as the causes for such adverse scenarios – the algorithms act upon the real and fundamental market conditions and companies’ fundamental features. As a result, we should consider the performance of those algorithms within market context and the specific time horizons such that it is reasonable to compare their performance to traders. In other words, sometimes traders may perform better than AI momentarily, but because computers can process way more data and take “helicopter view” from market data context they may be way more reliable and robust in terms of trading predictions and decisions. Therefore, the argumentation suggested by the above article should always be considered within real market context and not just from technical theoretical perspective.

The second article by Vasant Dhar describes his research on “uncertainty in the decision-making behavior of machine learning systems”. His research tries to “explain why a collection of models trained on small variations of the market’s history are likely to disagree about tomorrow’s market direction”. This “translates into more uncertain behavior of AI systems in low-predictability domains like the stock market compared to vision.”

With this the article tackles the key fundamental issue – predicted system’s stationary or non-stationary nature. As such, the comparison of the financial market system to the computer vision case in autonomous driving system is very important. Indeed, the AI application in these fields both involve human behavior which may be sometimes hardly predictable as well as the overall systematic patterns and activity patterns. However, if we consider the driving systems, one can see that human behavior is heavily restricted and governed by traffic rules and physics which makes AI job way easier in terms of predicting and acting upon these predictions. In the case of financial systems, although they are also heavily regulated and market players need to act accordingly, still there is way more freedom and unpredictability caused by human decisions and their consequences on the AI stock price and market movements predictions. It makes sense, however, the last decades were characterized by increasing presence of computers, algorithmic trading solutions and AI applications that improved the precision and returns of investment strategies. Another consequence of such changes is that the more algorithms and the wider scale AI achieves, the more organized, less human-driven, more structured, hence more stationary the financial system becomes and more predictable it will be from AI and machine learning point of view. As a result, the main solution to the issue lies primarily with the wider applications of the machine learning and AI technologies by increasing number of market players boosting the overall predictive power of such algorithms. Of course, there always will be systematic portion of risks that could not be predicted or diversified, but AI will definitely help and truly unleash its power to minimize the unsystematic risks and predict market within the above context in the foreseeable future.

About the I Know First Algorithm

The I Know First model is 100% empirical, meaning it is solely based on historical data. Human derived assumptions are not included in the model. The algorithm constantly proposes “theories”, testing them on years of market data, then validating them on the most recent data. The algorithm is using 15 years stock data in order to make its predictions. It’s not a small variation but rather a large data set. We use statistical methods to find patterns in order to predict the future market behavior.

The examples below will show that the algorithm hits the so-called dartboard not only once, but closer to 6 out of 10 already nowadays. Moreover, the algorithm has successfully predicted some of the major recent market declines before they actually happened. This can be seen in November 2016, June 2019 and October 2019, just to name a few examples.

Can We Detect the Best Stocks?

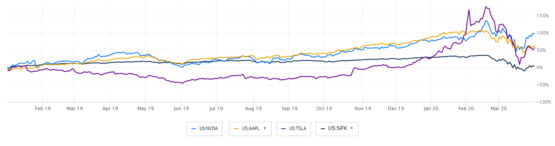

Let us consider a few examples from January 2019 to March 2020. During this time period the stock market was extremely volatile. While predicting NVIDIA, Apple and Tesla stocks, the I Know First algorithm had a 100% hit ratio on a 1-year time horizons. The predictions consistently resulted in above 58%, 65%, 57% hit rate, respectively, for all the other time horizons.

As we see from the above chart, during the same time period, the S&P 500 index performance was performing lower than the individual stocks. As the results speak for themselves, it is to be highlighted that the above results were obtained using the very simple passive investment strategy purely following AI-driven predictions for the above stocks. As such, the I Know First algorithmic predictions would have given investors a higher return on their investment if utilized.

Can We Detect How the Whole Market Behaves?

One of the most recent studies conducted by I Know First R&D team evaluated the algorithm’s performance for S&P 500 and NASDAQ predictions from March 13th 2019 to May 13th 2020. This period covers the COVID-19 pandemic since its beginning until the most active phase of worldwide lock-downs and economic crisis. The forecasting accuracy remained more than 60% across all time horizons.

During this period, the S&P 500 and NASDAQ indexes grew by 1.02% and 16.76% respectively. The SPY and QQQ stocks grew by 0.75% and 24.84% respectively.

Conclusion

The authors of the mentioned articles show skeptical attitude towards the involvement of AI and Machine Learning in the stock market trading. Sure, AI can lose in specific cases (like “black swan” events), but in the other cases they are able to withstand and even win in the competition with the strongest and most bright investors like Warren Buffet – just recent “Airlines stocks” case has shown this result. The I Know First algorithm uses a large data set of historical information. This data is used to learn how to beat and win over the market by studying bigger picture and learning from past success and failures, which for sure can occur. While there is a obviously a room for improvement, artificial intelligence is on the right evolution direction.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.