Brazil Stock Market – Ideal Place for a Bounce-Back After the Severe Hurt of Coronavirus

This Brazil stock market article was written by Chloe Peng, Analyst at I Know First. Master of Science of Finance candidate at Brandeis University.

This Brazil stock market article was written by Chloe Peng, Analyst at I Know First. Master of Science of Finance candidate at Brandeis University.

Summary

- Goldman Sachs reports that Wall Street is bullish on Brazilian stocks and projects the index to reach 90,000, 9% above current level.

- The macroeconomy of the country was significantly hurt by the pandemic and political issues with sectors performing differently.

- I Know First is accurately generating daily forecasts on Brazil market with stock picks outperforming the market index.

Highlights from Goldman Sachs report

According to the Goldman Sachs, Wall Street is bullish on the world’s hardest hit stock market, the Brazil stock market, and believes that the market is an ideal bounce-back candidate. “Down more than 48% this year when measured in dollars, Brazilian stocks will benefit from growing appetite for risk assets and a recovery in commodities prices during the second half of 2020’, strategists said.

Goldman Sachs recommended investors go long the benchmark Ibovespa index with a target of 90,000 points, or about 9% above current levels. Even the rally to 90,000 would leave the index 22% below where it was at the end of last year.

Macroeconomic Environment in Brazil

The country has become one of the world’s major coronavirus pandemic hot spots. Assets have been further undermined by political turbulence and a lack of confidence in President Jair Bolsonaro. 2 health ministers resigned in about one month while the president could face an impeachment battle as the country struggles to contain the spread of COVID-19.

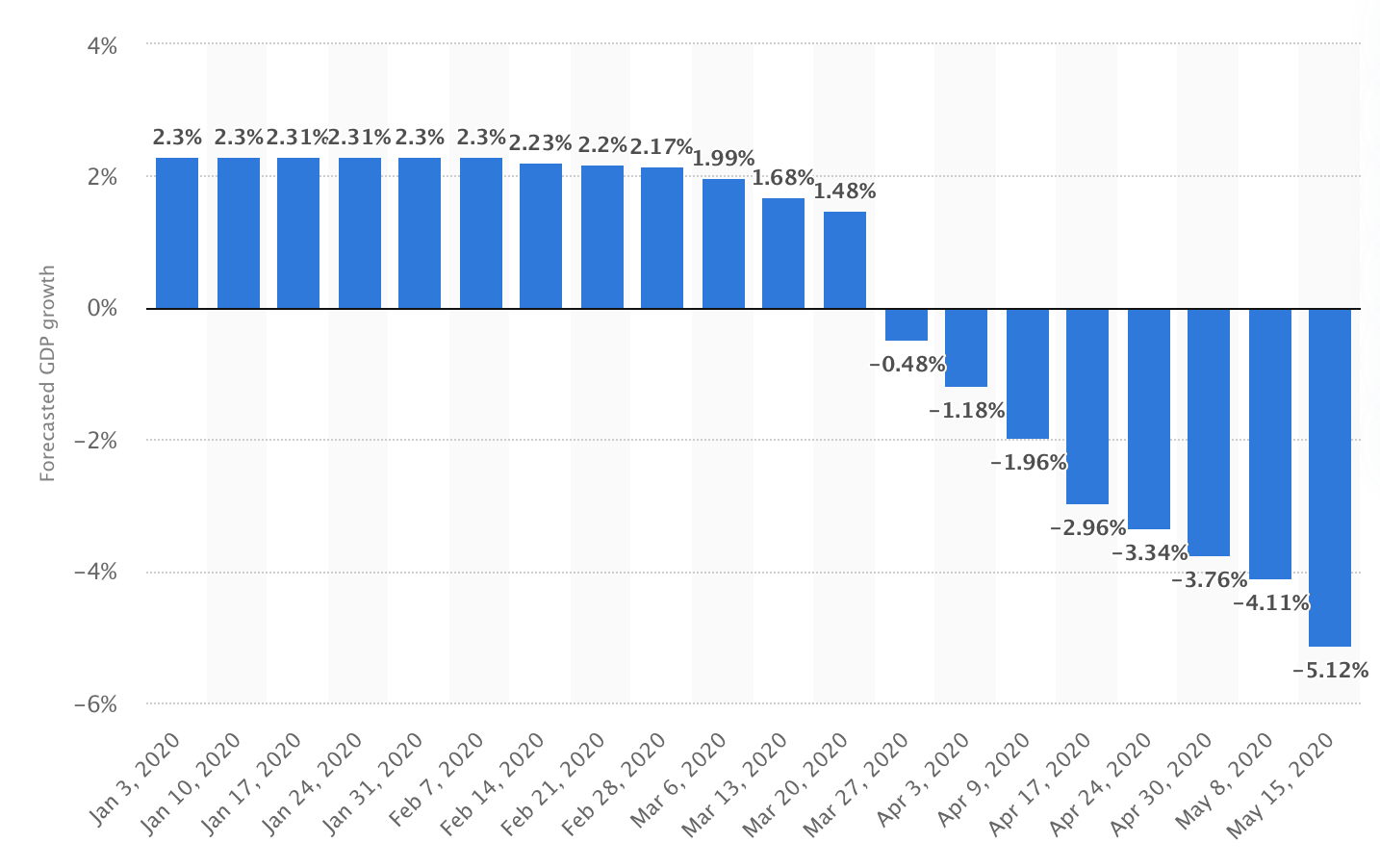

GDP is expected to fall this year as the Covid-19 pandemic deals a heavy blow to the economy. Although fiscal and monetary stimulus should provide a cushion, the extent of the shock and political tensions further cloud the outlook. The following graph shows forecasted impact of the COVID-19 on GDP growth in Brazil in 2020.

Brazilian assets have been punished more severely than emerging market peers. The country was among the hardest hit emerging markets when it comes to non-resident portfolio outflows in March. The chart below from the Institute of International Finance underlines the run for the exits.

Brazilian stocks are performing worse compared to its peers. The emerging markets index drops 16.71% until May, while Brazil index decreases by 48.45% as shown in the graph below.

Part of Brazil’s underperformance versus other emerging markets has to do with the high expectations relative to other countries that many investors had for the country before the pandemic struck. The real’s collapse amplified a rush for the exits by non-resident investors.

Sector Performance

According to Euromonitor, regardless of the industry, there are some important common denominators driving consumer behavior in Brazil over the next few months:

• Bottlenecks in production chains and distribution: Reduced workforces may create or worsen pre-quarantine scenarios;

• Sales concentration in some industries in Q1 and Q2 2020 may not be sustained throughout the whole year: The level of product inventories is unprecedented for Brazilian industry, and manufacturers were not prepared to manage unexpected production;

• Reframing of consumption occasions: While there are new occasions boosting demand for products like streaming and video games, others, like restaurants, hotels and entertainment, are being harmed by lost opportunities;

• Resistance test for retailing: Omnichannel structures have become more important than ever and will consistently be tested in a scenario where non-essential stores must remain closed;

Brazil Stock Market – Benefitted Sectors:

Beverages: Bottled water and coffee are set to see the greatest rises in demand in the short term, especially through larger pack sizes, as these are considered essential items for most Brazilians, who are looking for the most affordable unit prices.

Packaged food: As consumers are staying at home and replacing “eating out” occasions with homemade food, packaged food for example staples, frozen vegetables and fruits are undoubtedly benefitted in the short-term. But whether such a positive scenario lasts will also be affected by bottlenecks, such as reduced workforce and raw material shortage. The sector can also be worsened by leftovers of longer shelf-life products in the second half of 2020.

Technology and Connectivity: With quarantine stipulated in most states in the country, digitalization and online commerce and services have been greatly favored by the “stay-at-home policy”, with both e-commerce, delivery and streaming platforms seeing a surge in demand.

Consumer Health: Consumer health is one of the few industries to have been boosted by the outbreak. Consumers rushed to drugstores aiming to purchase all sorts of products that claim to boost immune systems and potentially target COVID-19 symptoms.

Brazil Stock Market – Harmed Sectors:

Fashion: it’s one of the most impacted sectors under the lockdown partly due to the weak macroeconomic situation and people are focusing on stocking up staples and hygiene items.

Technology and Connectivity: Although technology service has been growing, technology-based products – like smartphones, wearables and other small consumer appliances – have felt the COVID-19 blow. This is because of reduced production and distribution efficiency, fewer import products making their way from China, postponement of product launches and devaluation of the Brazilian currency, increasing manufacturing and import costs.

However, computer peripherals (as more people adopt home office standards), food preparation appliances and video games have acted as outliers.

I Know First’s Daily Method And Global Model Method on Brazilian Stock Market

We have been monitoring the Brazil stock market for some time and our predictive AI has been generating satisfying predictions for our customers by 2 models, the daily model method and the global model method.

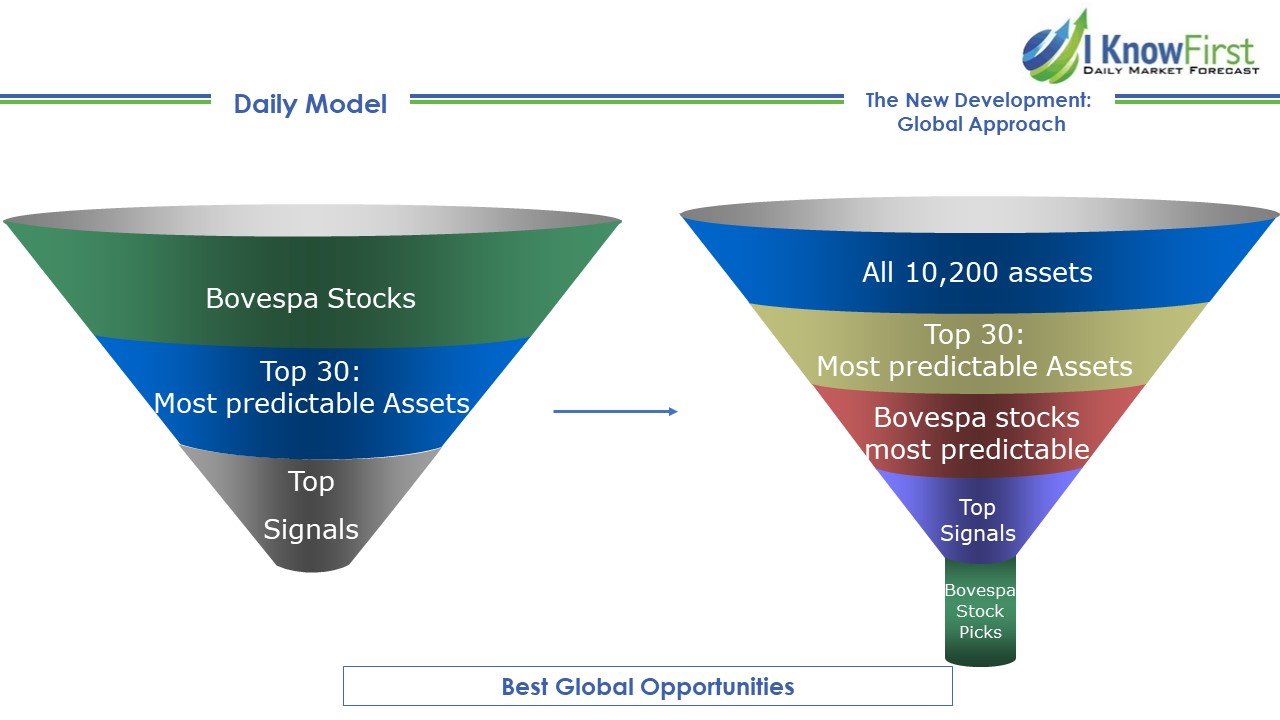

By using the daily model, we take the top 30 most predictable assets, and then we apply a set of signal-based filters: top 20, 10 and 5 based on predictability. By doing so we focus on the most predictable assets on the one hand, while capturing the ones with the highest signal on the other. We use absolute signals since these strategies are long and short ones. If the signal is positive, then we buy and, if negative, we short.

The new stock-picking method, global model method, takes all 10,200 assets that are forecasted by I Know First (the global set). The assets are then filtered by predictability and the top 30 most predictable assets are selected. Then those 30 stocks are scanned to see if there are any Brazilian stocks – if there are such stocks, they are selected and then, based on the number of available assets, the signal filtering is applied at available levels to arrive at the top Brazilian stocks.

Accuracy of I Know First’s forecast on the Brazil Stock Market

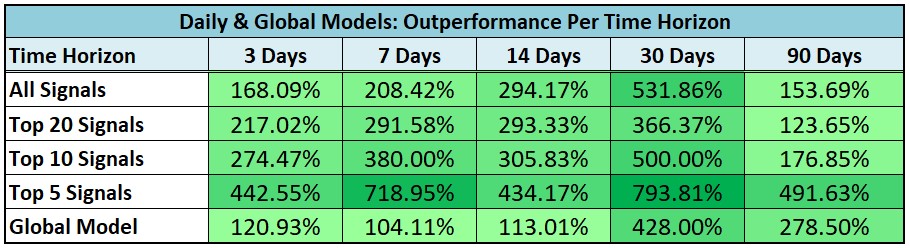

In order to evaluate our algorithm’s performance in comparison to the Brazilian stock market, we used the Bovespa Index (^BVSP) as a benchmark and we achieved the following outperformance during our evaluation period from 19 19 June, 2019, to December 26, 2019.

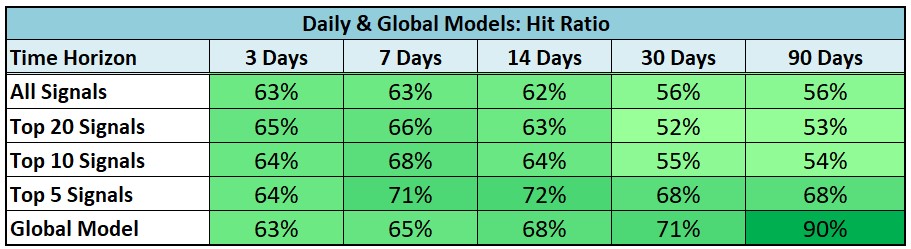

During the period, we successfully forecasted the performance of the forecasts for Brazilian Bovespa component stocks with an accuracy of up to 90% achieved by global model with 90-day horizon.

For all time horizons and filtering methods, hit ratios were higher than 50% accuracy. Besides the initial signal filtering (30-10) in the 30 and 90-day horizons, the algorithmic forecast was even more accurate with hit ratios ranging from 62% to 72%, and one extremely high hit ratio of 90% achieved by applying the Global Model for 90-day time horizon forecasts, meaning that we can precisely predict the market 9 out of 10 times.

As in the case of average returns, the Global Model’s effect on hit ratio was weak during short time horizons, but extremely strong during the time horizons of 30 and 90-days, when it achieved 71% and 90%, respectively. The signal effect of the Daily Model was consistent and strong, improving hit ratios in almost every case where the filtering by signal was applied (exceptions: 3-day – Top 10, 30-day – Top 20; 90-day – Top 20).

We are very proud of the high accuracy of our forecasts, and recommend our customers to use our predictions for decision making. I Know First’s research team will continue to monitor the algorithm’s performance and derive relevant insights that will help provide the best algorithmic trading solutions to our clients.

Conclusion

The macroeconomic environment is going through a hard time facing both Covid-19 and political issues. The Brazil stock market was the more severely hit by the coronavirus than general emerging markets, with beverage, packaged food and technology service sector benefitted, while fashion and electronic devices hurt. However, analysts are confident that Brazil market is an ideal place for a bounce-back. I Know First has been monitoring the market and generating daily predictions for customers with an accuracy of up to 90%. Our forecast package is able to outperform the index by a high percentage and we recommend that our customers seize the opportunities in Brazil.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast