BLDR Stock Forecast: Will Their Success Continue?

This “BLDR Stock Forecast: will their success continues?” article was written by Rafi Rees – Financial Analyst at I Know First.

- BLDR has increased its EPS 8 fold in the last two years while the share price has only doubled.

- Structural underinvestment in the US housing market poses significant opportunities for BLDR to grow.

- Given a 5x PE multiple, is this company undervalued?

Company Overview:

Builders FirstSource (ticker: BLDR) is a leading supplier and manufacturer of building materials, components, and construction services to professional homebuilders, contractors, and re-modellers in the United States. The company was founded in 1998 and is headquartered in Dallas, Texas. Builders FirstSource operates over 550 locations across 40 states, offering a diverse range of products such as lumber, windows, doors, roofing, siding, and trim, as well as turnkey installation and framing services.

Builders FirstSource’s (BLDRs) customers include large national homebuilders, regional and local homebuilders, and repair and remodelling contractors. The company has a strong reputation for providing high-quality building materials and services, as well as exceptional customer service. Builders FirstSource has built a culture of safety, teamwork, and innovation, which has helped the company become a leading player in the building materials industry.

The chart below displays the revenue mix by product. The diversified nature of BLDRs products as a percent of revenue adds to the resilience of the overall business, as it prevents over-reliance on any one revenue source.

Builders FirstSource’s mission is to be the preferred supplier of building materials and services to the residential construction industry. The company is committed to providing innovative solutions and outstanding customer service to its customers, while also creating long-term value for its shareholders.

Growth Strategy

Mergers and acquisitions have been a key component of Builders FirstSource’s growth strategy. The company has made several strategic acquisitions over the years to expand its product offerings, geographical reach, and customer base. For example, in 2020, Builders FirstSource completed the acquisition of BMC Stock Holdings, Inc., which significantly expanded the company’s market share and product offerings. A strategy replicated many times in 2021 as BLDR pursued a tuck in M&A strategy to assist with its growth plans.

Looking forward, Builders FirstSource is well-positioned for growth in the residential construction industry, which is expected to continue to grow over the next several years. The company has a strong presence in the markets it serves, and its diversified product portfolio allows it to capture a wide range of opportunities in the industry. Additionally, Builders FirstSource is focused on expanding its market share through organic growth initiatives such as enhancing its digital capabilities, improving operational efficiency, and investing in new technologies.

With the rise in interest rates and weakening demand in the commercial and residential property markets, Builders FirstSource may face some headwinds in the short-term as construction activity may slow down. However, it is important to note that the demand for new homes and home renovations is still expected to remain strong in the long-term, especially as supply constraints in the housing market persist. There has been a fundamental undersupply in the housing market, and it may take several years of increased construction activity to bridge the gap. The US population is expected to grow to 400 million by 2060 and those extra people are going to need places to live. Therefore, while Builders FirstSource may experience some fluctuations in demand due to short-term economic conditions, the long-term growth prospects for the company in the residential construction industry remain intact. This suggests that the housing market may perform better than anticipated, as the limited supply is likely to prevent significant drops in prices, thereby allowing builders to maintain profitability and pursue new projects.

Moreover, the underinvestment in US infrastructure presents a potential opportunity for Builders FirstSource. The Biden administration has passed a $1 trillion infrastructure plan that includes significant investments in transportation, water systems, and broadband networks, among other things. Although the plans are not tied directly to the real estate market, increased demand for building materials and construction services may end up benefiting companies such as Builders First that provide these products and services.

Shareholder Value and Catalysts

BLDR had a strong history of not diluting its shareholders pre-pandemic with the number of shares outstanding hovering around 115 million. The shares outstanding increased significantly in 2021, rising from 118 million shares in 2020 to 203 million shares in 2021 in response to the challenges posed by the COVID-19 pandemic in which the company needed to raise funds through the capital markets in order to survive. Whilst obviously not optimal for shareholders, I believe this speaks to management’s ability to get scrappy when times are tough and do what is required to weather the storm. Management’s commitment to shareholders is further demonstrated by the institution of a buyback when business returned to normal, and the share count was reduced by 40 million in 2022.

Another positive catalyst for the stock is the management’s intention on delivering the balance sheet and as a result reducing the risk associated with the business. Between 2017 and 2022, the company decreased its net leverage from 4.2x AEBITDA in 2017 to 0.7x AEBITDA in 2022. This should provide a margin of safety for the company should difficult times befall them, as they are no longer encumbered by debt so it can maneuver more freely.

Builders FirstSource’s impressive growth in its base business is another positive catalyst for the company. The growth is no fluke, but rather a strategic part of the company’s long-term plan. By shifting its focus from supplying raw materials to providing value-added products such as windows, doors, and manufactured products, the company has been able to achieve a remarkable 12-fold increase in revenue and a staggering 24-fold increase in free cash flow since 2007. This shift to a higher margin and more differentiated products was a deliberate move that has continued to drive growth even before the post-COVID boom. Despite this 24-fold increase in free cash flow, the stock has only returned a sixfold return since the same period. This could demonstrate a potential source of upside as the company’s share price is yet to catch up with its fundamentals.

The success of this value add strategy is evident in the company’s recent financial guidance. Despite a slowdown in the housing market, Builders FirstSource’s base sales growth was only revised down by 2%, to a range of 8-12%, demonstrating the resilience of the business. This is a testament to the company’s ability to weather the housing market fluctuations and highlights the value of its focus on high-margin products. Even as housing starts are predicted to decline, the company’s EBITDA is expected to grow by 18-22%, indicating the durability of the business model. As a result, the company’s free cash flow midpoint has increased by $550 million to $2.75 billion, an impressive feat when compared to the previous year’s commodity-supported figure of $1.5 billion.

BLDR Stock Forecast: Conclusion

In conclusion, Builders FirstSource’s strategic shift towards value-added products has positioned the company for long-term success, with strong growth and financial resilience despite the recent challenges faced by the housing market. While the recent rise in interest rates has led to market pessimism regarding the outlook for real estate and BLDR, this overlooks the significant underinvestment in US infrastructure, which could provide a potential shock to the upside and create a real source of returns for the company. As such, investors should consider the potential opportunities that arise from overly pessimistic market sentiment and the potential for significant growth in the US infrastructure sector. Overall, Builders FirstSource’s focus on value-added products and forward-thinking approach to market opportunities make it a company to watch in the coming years.

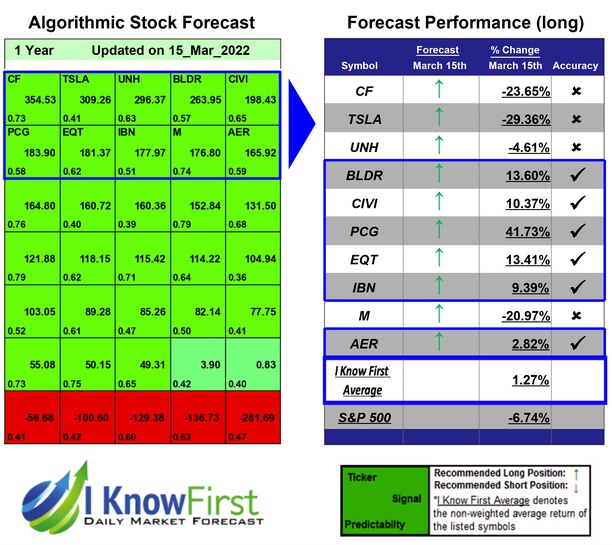

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with BLDR Stock Forecast

I Know First has been bullish on the BLDR stock forecast in the past. On March 15th, 2022 the I Know First algorithm issued a forecast for BLDR stock price and recommended BLDR as one of the best stocks to buy. The AI-driven BLDR stock prediction was successful on a 1-year time horizon resulting in more than 13.60%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.