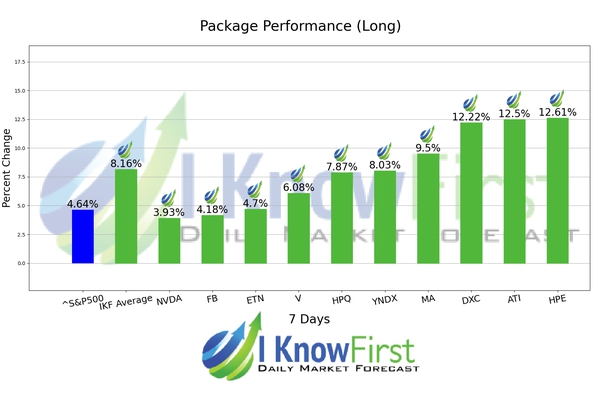

Best Technology Stocks Based on Big Data Analytics: Returns up to 12.61% in 7 Days

Best Technology Stocks

This Tech Giants Stocks forecast is designed for investors and analysts who need predictions for the best technology stocks to invest in the Tech Giants sector. It includes 20 best technology stocks with bullish and bearish signals:

- Top 10 Tech Giants’ stocks for the long position

- Top 10 Tech Giants’ stocks for the short position

Package Name: Tech Giants Stocks Forecast

Recommended Positions: Long

Forecast Length: 7 Days (3/5/21 – 3/13/21)

I Know First Average: 8.16%

The algorithm correctly predicted 10 out 10 of the suggested trades in the Tech Giants Stocks Forecast Package for this 7 Days forecast. HPE was the highest-earning trade with a return of 12.61% in 7 Days. Additional high returns came from ATI and DXC, at 12.5% and 12.22% respectively. The package saw an overall yield of 8.16% versus the S&P 500’s return of 4.64% implying a market premium of 3.52%.

Hewlett Packard Enterprise Company (HPE) provides technology solutions to business and public sector enterprises. It operates through Enterprise Group, Software, Enterprise Services, and Financial Services segments. The Enterprise Group segment offers industry standard servers and business critical systems to address the array of its customers’ compute needs; storage products, such as 3PAR StoreServ, a storage platform; and networking products comprising switches, routers, points, controllers, wireless local area network, and network management products. This segment also provides software-defined networking and unified communications capabilities; and support and consulting services. The Software segment offers software to capture, store, explore, analyze, protect, and share information and insights within and outside organizations; HP Vertica, an analytics database technology for machine, structured, and semi-structured data; and HP IDOL, an analytics tool for human information, as well as solutions for archiving, data protection, eDiscovery, information governance, and enterprise content management. This segment also provides application delivery management, enterprise security, and IT operations management software products. The Enterprise Services segment offers technology consulting, outsourcing, and support services in infrastructure, applications, and business process domains; and application and business services that help clients to develop, revitalize, and manage their applications and information assets. The Financial Services segment provides leasing, financing, IT consumption and utility programs, and asset management services. The company markets and sells its products through resellers, distribution partners, original equipment manufacturers, independent software vendors, systems integrators, and advisory firms. Hewlett Packard Enterprise Company (HPE) is headquartered in Palo Alto, California.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.