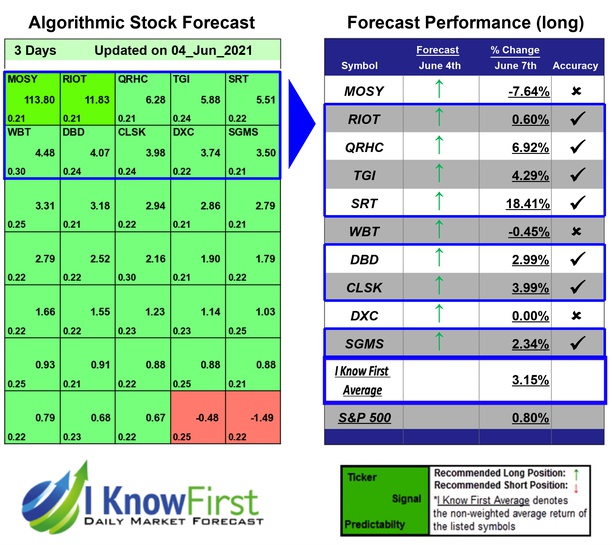

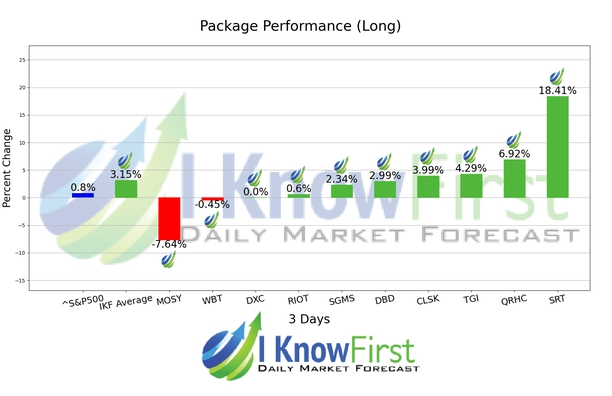

Best Technology Stocks Based on a Self-learning Algorithm: Returns up to 18.41% in 3 Days

Best Technology Stocks

This Tech Stock forecast is based on stock picking strategies for investors and analysts who need predictions for the 10 best tech stocks in the Technology Industry (see Tech Stocks Package). It includes 20 stocks with bullish and bearish signals:

- Top 10 Tech stocks for the long position

- Top 10 Tech stocks for the short position

Package Name: Tech Stocks Forecast

Recommended Positions: Long

Forecast Length: 3 Days (6/4/21 – 6/7/21)

I Know First Average: 3.15%

In this 3 Days forecast for the Tech Stocks Forecast Package, there were many high performing trades and the algorithm correctly predicted 7 out 10 trades. The top-performing prediction in this forecast was SRT, which registered a return of 18.41%. The suggested trades for QRHC and TGI also had notable 3 Days yields of 6.92% and 4.29%, respectively. The package’s overall average return was 3.15%, providing investors with a 2.35% premium over the S&P 500’s return of 0.8% during the same period.

StarTek, Inc. (SRT) provides business process outsourcing services in the United States, Canada, Honduras, Jamaica, and the Philippines. It operates in three segments: Domestic, Nearshore, and Offshore. The company’s service offerings include customer care, sales support, inbound sales, complex order processing, accounts receivable management, technical and product support, up-sell and cross-sell opportunities, and other industry-specific processes. It offers technical and product support services through telephone, e-mail, chat, facsimile, and Internet; and sales support services comprising lead generation, direct sales, account management and retention programs, and marketing analysis and modeling. The company’s provisioning and order processing services comprise order management and technical sales support for wire-line, wireless, data, and customer premise equipment; order fallout from its clients’ automated systems; and direct-to-consumer services, such as provisioning, order processing, and transfer of accounts between client service providers. StarTek, Inc. (SRT)’s receivables management services consist of first and third party collections services for clients in the telecommunication, cable and media, and healthcare industries; healthcare services include customer care, sales support, accounts receivable management, remote patient care, and medical triage to providers, payers, pharmaceutical, and device manufacturer businesses; and industry-specific processes comprise training curriculum development, workforce management, customer analytics, quality monitoring services, and dispositions. The company was founded in 1987 and is headquartered in Greenwood Village, Colorado.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.