Best Stocks To Buy Based on Algo Trading: Returns up to 13.0% in 7 Days

Best Stocks To Buy

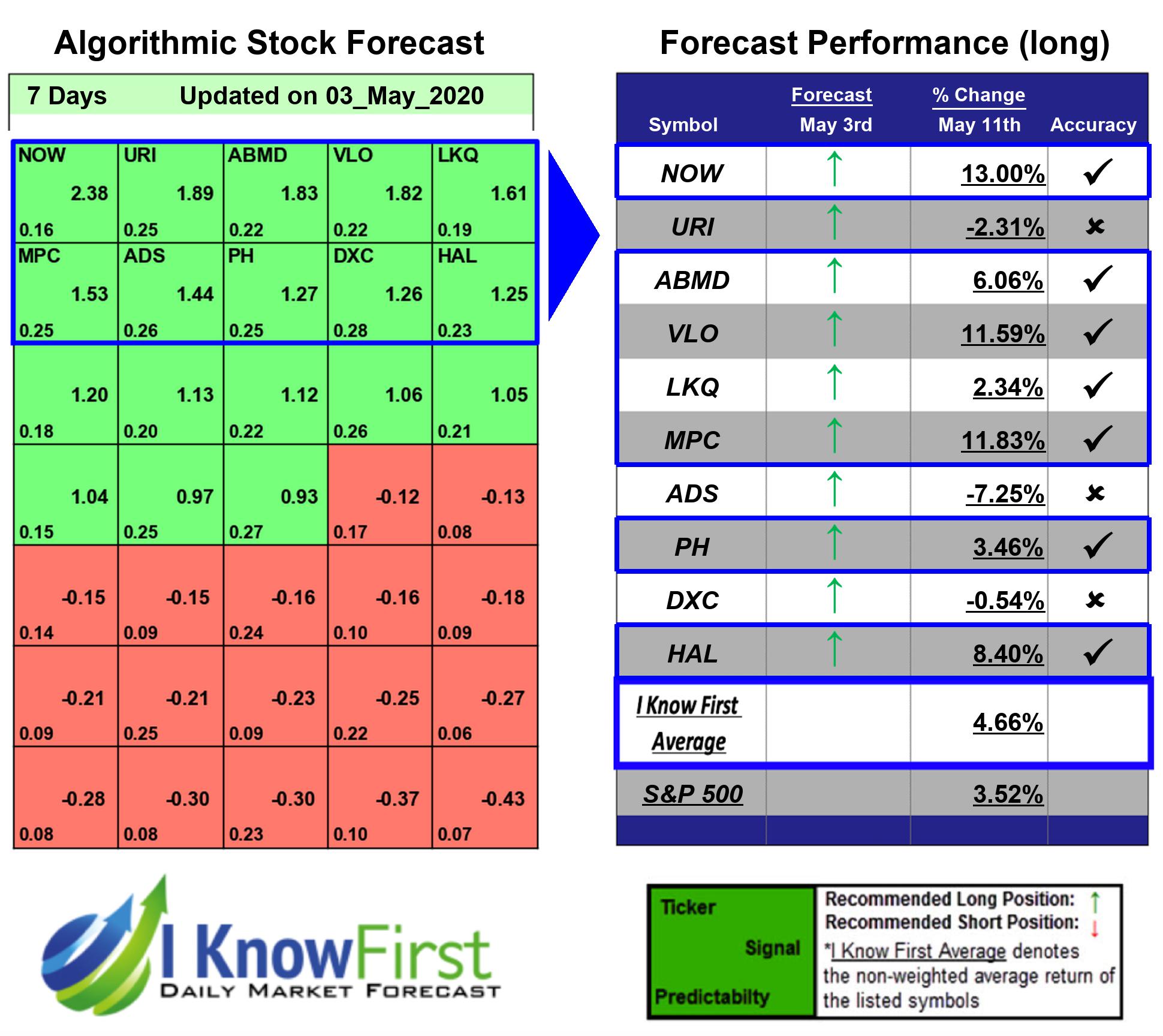

This top S&P 500 stocks forecast is designed for investors and analysts who need predictions for the whole S&P 500 (See S&P 500 Companies Package). It includes 20 stocks with bullish and bearish signals and indicates the best S&P 500 Companies stocks to buy:

- Top 10 S&P 500 stocks for the long position

- Top 10 S&P 500 stocks for the short position

Package Name: Top S&P 500 Stocks

Recommended Positions: Long

Forecast Length: 7 Days (5/3/2020 – 5/11/2020)

I Know First Average: 4.66%

In this 7 Days forecast for the Top S&P 500 Stocks Package, there were many high performing trades and the algorithm correctly predicted 7 out 10 trades. The prediction with the highest return was NOW, at 13.0%. Additional high returns came from MPC and VLO, at 11.83% and 11.59% respectively. The Top S&P 500 Stocks package had an overall average return of 4.66%, providing investors with a premium of 1.14% over the S&P 500’s return of 3.52%.

ServiceNow, Inc. (NOW) provides enterprise cloud-based solutions that define, structure, manage, and automate services in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally. It offers service management solutions, including incident management, problem management, change management, and request management, as well as service catalog and knowledge base; and information technology (IT), HR, customer service, security operations, facilities, and field service management solutions. The company also provides business management solutions, such as financial management solutions; project portfolio suite that provides capabilities to plan, organize, and manage projects; governance, risk, and compliance solution that provides clarity into compliance and audit initiatives; and performance analytics solutions, as well as offers ServiceNow platform that integrates various business applications. In addition, it offers IT operations management solutions that include ServiceWatch Mapping, a service mapping and discovery solution; ServiceWatch Insight that adds event management to the ServiceWatch Mapping bundle, as well as offers insight on the issues affecting service availability and performance; and ServiceWatch Suite that adds orchestration and cloud management to the ServiceNow ITOM products. Further, the company offers professional, education, and customer support services. It serves enterprises in various industries, including financial services, consumer products, IT services, health care, and technology. The company sells products through its direct sales team, as well as indirectly through third-party channels by partnering with systems integrators, managed services providers, and resale partners. The company was formerly known as Service-now.com and changed its name to ServiceNow, Inc. (NOW) in May 2012. ServiceNow, Inc. (NOW) was founded in 2004 and is headquartered in Santa Clara, California.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.