Best Small Cap Stocks Based on Predictive Analytics: Returns up to 29.16% in 1 Month

Best Small Cap Stocks

The Small Cap Package includes recommendations by the I Know First algorithm for small cap stocks to buy with a market capitalization of less than $1 billion:

- Top 10 Small Cap stocks to buy for the long position

- Top 10 Small Cap stocks to buy for the short position

Package Name: Small Cap Forecast

Recommended Positions: Long

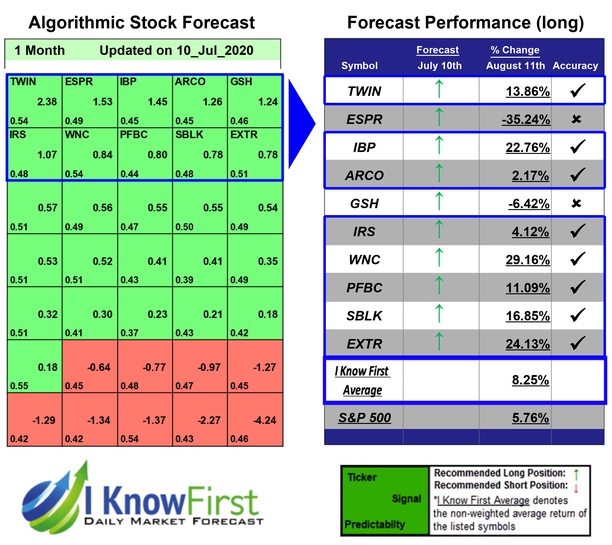

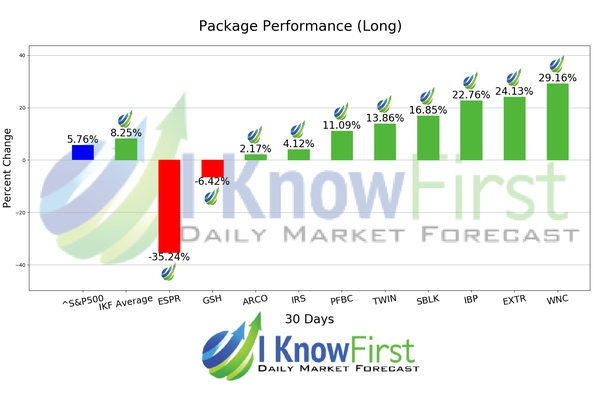

Forecast Length: 1 Month (7/10/2020 – 8/11/2020)

I Know First Average: 8.25%

The algorithm correctly predicted 8 out 10 of the suggested trades in the Small Cap Forecast Package for this 1 Month forecast. The prediction with the highest return was WNC, at 29.16%. Additional high returns came from EXTR and IBP, at 24.13% and 22.76% respectively. This algorithmic forecast package presented an overall return of 8.25% versus S&P 500’s performance of 5.76% providing a market premium of 2.49%.

Wabash National Corporation (WNC) designs, manufactures, and markets truck and tank trailers, intermodal equipment, and transportation related products in North America. Its Commercial Trailer Products segment provides dry van trailers; platform trailers; refrigerated trailers; specialty products, such as converter dollies, big tire haulers, steel coil haulers, and roadrailer trailers; aftermarket parts and rail components; truck bodies; used trailers; and laminated hard wood oak products. The company’s Diversified Products segment offers transportation products, including stainless steel and aluminum liquid and dry bulk tank trailers and other liquid transport solutions for the dairy, food and beverage, chemical, environmental, petroleum, and refined fuel industries; aircraft refuelers and hydrant dispensers for in-to-plane fueling companies, airlines, freight distribution companies, and fuel marketers; military grade refueling and water tankers; truck mounted tanks for fuel delivery; and vacuum tankers. This segment also provides engineered products comprising products for storage, mixing, and blending, including process vessels, as well as round horizontal and vertical storage silo tanks; containment and isolation systems for the pharmaceutical, chemical, and nuclear industries; containment systems for the pharmaceutical, chemical, and biotech markets; and mobile water storage tanks used in the oil and gas industry. The Retail segment operates 15 owned retail branch locations, which sell new and used trailers, aftermarket parts, and services. The company offers its products under the Wabash, Wabash National, DuraPlate, DuraPlate HD, DuraPlate XD-35, DuraPlate AeroSkirt, ArcticLite, RoadRailer, TrustLock Plus, Transcraft, Benson, Walker Transport, Walker Engineered Products, Brenner Tank, Garsite, Progress Tank, Bulk Tank International, Extract Technology, and Beall brand names. Wabash National Corporation (WNC) was founded in 1985 and is headquartered in Lafayette, Indiana.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.