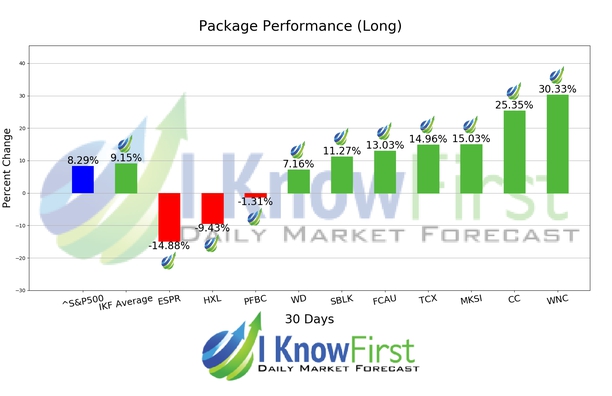

Best Mid Cap Stocks Based on Algo Trading: Returns up to 30.33% in 1 Month

Best Mid Cap Stocks

This Best Mid Cap Stocks forecast is designed for investors and analysts who need predictions for the best companies with market capitalization between USD 500m and USD 50b. It includes 20 stocks with bullish and bearish signals:

- Top 10 Mid Cap stocks for the long position

- Top 10 Mid Cap stocks for the short position

Package Name: Best Mid Cap Stocks

Recommended Positions: Long

Forecast Length: 1 Month (6/28/2020 – 7/29/2020)

I Know First Average: 9.15%

In this 1 Month forecast for the Best Mid Cap Stocks Package, there were many high performing trades and the algorithm correctly predicted 7 out 10 trades. WNC was the top performing prediction with a return of 30.33%. Further notable returns came from CC and MKSI at 25.35% and 15.03%, respectively. With these notable trade returns, the package itself registered an average return of 9.15% compared to the S&P 500’s return of 8.29% for the same period.

Wabash National Corporation (WNC) designs, manufactures, and markets truck and tank trailers, intermodal equipment, and transportation related products in North America. Its Commercial Trailer Products segment provides dry van trailers; platform trailers; refrigerated trailers; specialty products, such as converter dollies, big tire haulers, steel coil haulers, and roadrailer trailers; aftermarket parts and rail components; truck bodies; used trailers; and laminated hard wood oak products. The company’s Diversified Products segment offers transportation products, including stainless steel and aluminum liquid and dry bulk tank trailers and other liquid transport solutions for the dairy, food and beverage, chemical, environmental, petroleum, and refined fuel industries; aircraft refuelers and hydrant dispensers for in-to-plane fueling companies, airlines, freight distribution companies, and fuel marketers; military grade refueling and water tankers; truck mounted tanks for fuel delivery; and vacuum tankers. This segment also provides engineered products comprising products for storage, mixing, and blending, including process vessels, as well as round horizontal and vertical storage silo tanks; containment and isolation systems for the pharmaceutical, chemical, and nuclear industries; containment systems for the pharmaceutical, chemical, and biotech markets; and mobile water storage tanks used in the oil and gas industry. The Retail segment operates 15 owned retail branch locations, which sell new and used trailers, aftermarket parts, and services. The company offers its products under the Wabash, Wabash National, DuraPlate, DuraPlate HD, DuraPlate XD-35, DuraPlate AeroSkirt, ArcticLite, RoadRailer, TrustLock Plus, Transcraft, Benson, Walker Transport, Walker Engineered Products, Brenner Tank, Garsite, Progress Tank, Bulk Tank International, Extract Technology, and Beall brand names. Wabash National Corporation (WNC) was founded in 1985 and is headquartered in Lafayette, Indiana.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.