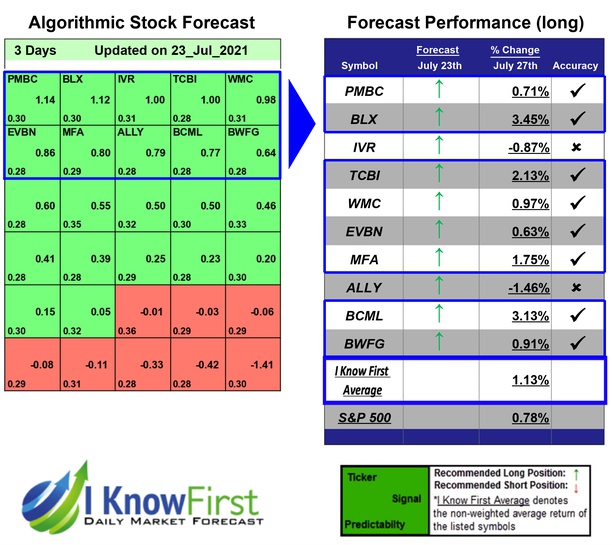

Best Financial Stocks Based on Big Data Analytics: Returns up to 3.45% in 3 Days

Best Financial Stocks

This Best Financial Stocks forecast is designed for investors and analysts who need predictions of Bank Stocks (see Bank Stocks Package). It includes 20 stocks with bullish and bearish signals and indicates the best bank stocks to buy:

- Top 10 Bank stocks for the long position

- Top 10 Bank stocks for the short position

Package Name: Bank Stock Forecast

Recommended Positions: Long

Forecast Length: 3 Days (7/23/21 – 7/27/21)

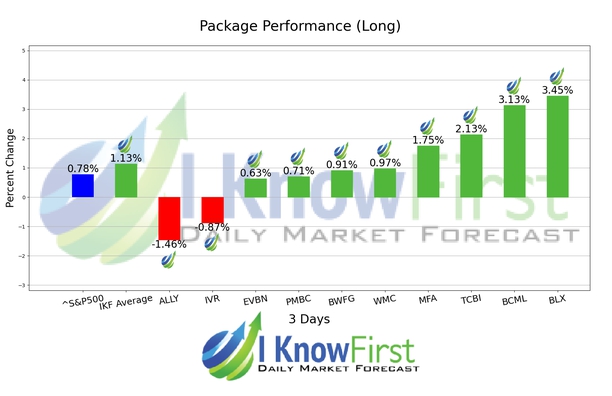

I Know First Average: 1.13%

During the 3 Days forecasted period several picks in the Bank Stock Forecast Package saw significant returns. The algorithm had correctly predicted 8 out 10 returns. BLX was our best stock pick this week a return of 3.45%. Further notable returns came from BCML and TCBI at 3.13% and 2.13%, respectively. The package saw an overall yield of 1.13% versus the S&P 500’s return of 0.78% implying a market premium of 0.35%.

Banco Latinoamericano de Comercio Exterior, S.A. (BLX), a multinational bank, engages in promoting foreign trade finance in Latin America and the Caribbean. It operates in two segments, Commercial and Treasury. It offers short and medium-term bilateral, collateral-backed, short and medium term trade, and pre-export financing structured loans; and discounting of notes, cross-border leasing, pre- and post-export financing, import financing, letters of credit, standby documentary credits, guarantees, irrevocable reimbursement undertakings, bankers’ acceptance, vendor finance, and ECA-backed financing services. The company also provides working capital financing solutions, such as short and medium-term loans, collateral-backed bilateral loans, leases, and vendor finance solutions; and medium and long-term syndicated loans, primary market syndication, financing for acquisitions, A/B loans financing with multilateral agencies, bridge loans, and structures for liability management. In addition, it offers trade-related and working capital financing solutions for banks, as well as medium and large-size corporations engaged in foreign trade; debt capital market and deposit products for investment and cash flow optimization, as well as treasury services. Further, it is involved in the derivative and hedging activities. The company was formerly known as Banco Latinoamericano de Exportaciones, S.A. and changed its name to Banco Latinoamericano de Comercio Exterior, S.A. (BLX) in June 2009. Banco Latinoamericano de Comercio Exterior, S.A. (BLX) was founded in 1977 and is headquartered in Panama, Republic of Panama.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.