Best Dividend Stocks Based on Data Mining: Returns up to 24.89% in 14 Days

Best Dividend Stocks

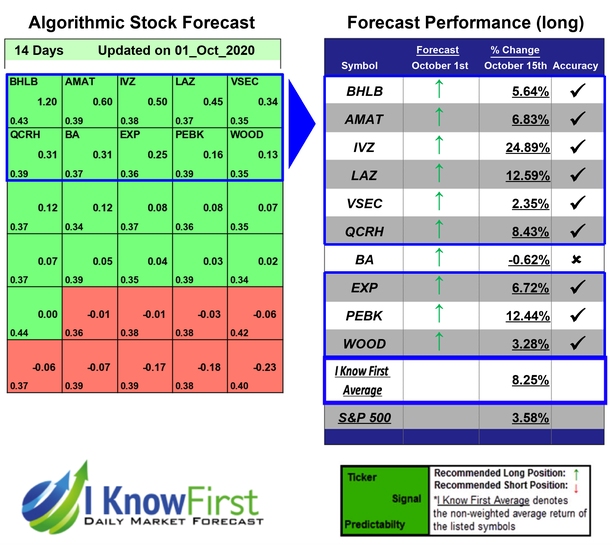

This forecast is part of the Dividends Package, as one of I Know First’s quantitative investment solutions. We determine the best stocks carrying a dividend by screening our database daily using our advanced algorithm. The full Dividends Package includes a daily forecast for a total of 20 stocks with bullish and bearish signals:

- Top 10 Dividend stocks for the long position

- Top 10 Dividend stocks for the short position

Package Name: Dividend Stocks Forecast

Recommended Positions: Long

Forecast Length: 14 Days (10/1/2020 – 10/15/2020)

I Know First Average: 8.25%

In this 14 Days forecast for the Dividend Stocks Forecast Package, there were many high performing trades and the algorithm correctly predicted 9 out 10 trades. The prediction with the highest return was IVZ, at 24.89%. Other notable stocks were LAZ and PEBK with a return of 12.59% and 12.44%. The package had an overall average return of 8.25%, providing investors with a premium of 4.67% over the S&P 500’s return of 3.58% during the same period.

Invesco Ltd. is a publicly owned investment manager. The firm provides its services to retail clients, institutional clients, high-net worth clients, public entities, corporations, unions, non-profit organizations, endowments, foundations, pension funds, financial institutions, and sovereign wealth funds. It manages separate client-focused equity and fixed income portfolios. The firm also launches equity, fixed income, commodity, multi-asset, and balanced mutual funds for its clients. It launches equity, fixed income, multi-asset, and balanced exchange-traded funds. The firm also launches and manages private funds. It invests in the public equity and fixed income markets across the globe. The firm also invests in alternative markets, such as commodities and currencies. For the equity portion of its portfolio, it invests in growth and value stocks of large-cap, mid-cap, and small-cap companies. For the fixed income portion of its portfolio, the firm invests in convertibles, government bonds, municipal bonds, treasury securities, and cash. It also invests in short term and intermediate term bonds, investment grade and high yield bonds, taxable and tax-free bonds, senior secured loans, and structured securities such as asset-backed securities, mortgage-backed securities, and commercial mortgage-backed securities. The firm employs absolute return, global macro, and long/short strategies. It employs quantitative analysis to make its investments. The firm was formerly known as Invesco Plc (IVZ), AMVESCAP plc, Amvesco plc, Invesco PLC, Invesco MIM, and H. Lotery & Co. Ltd. Invesco Ltd. was founded in December 1935 and is based in Atlanta, Georgia with an additional office in Hamilton, Bermuda.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.