Best Automotive Stocks Based on Predictive Analytics: Returns up to 8.83% in 3 Days

Best Automotive Stocks

This Automotive Stocks forecast is designed for investors and analysts who need predictions of the best-performing stocks in the automotive industry (see Automotive Stocks Package). It includes 20 stocks with bullish and bearish signals and indicates the best auto stocks to trade:

- Top 10 Automotive stocks for the long position

- Top 10 Automotive stocks for the short position

Package Name: Automotive Stock Forecast

Recommended Positions: Long

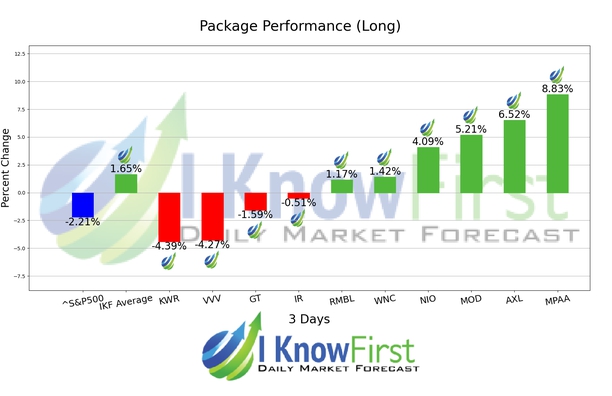

Forecast Length: 3 Days (6/6/22 – 6/9/22)

I Know First Average: 1.65%

The algorithm correctly predicted 6 out of 10 the suggested trades in the Automotive Stock Forecast Package for this 3 Days forecast. MPAA was our the best stock pick with a return of 8.83%. The suggested trades for AXL and MOD also had notable 3 Days yields of 6.52% and 5.21%, respectively. This algorithmic forecast package presented an overall return of 1.65% versus the S&P 500’s performance of -2.21% providing a market premium of 3.86%.

Motorcar Parts of America, Inc., incorporated on April 2, 1968, is a manufacturer, remanufacturer and distributor of automotive aftermarket parts, including alternators, starters, wheel hub assembly, brake master cylinders, brake power boosters and turbochargers utilized in imported and domestic passenger vehicles, light trucks and heavy-duty applications. The Company sells its products in North America to auto parts retail and traditional warehouse chains and to automobile manufacturers for both their aftermarket programs and their warranty replacement programs (OES). Its products meet equipment manufacturer specifications. The Company produces both new and remanufactured units. It recycles materials, including metal from the used cores and corrugated packaging. The Company carries over 13,000 stock keeping units (SKUs) for automotive parts that are sold under its customers’ recognized private label brand names and its Quality-Built, Pure Energy, Xtreme, Reliance and other brand names.

The Company sells its products to the automotive chains in North America, including Advance (inclusive of Carquest, Autopart International and Worldpac), AutoZone, Genuine Parts (NAPA), O’Reilly, and Pep Boys, with an aggregate of approximately 24,000 retail outlets. In addition, it sells its products to OES customers, professional installers, and a diverse group of automotive warehouse distributors. The Company also offers its products in Canada. Its facilities located in California, Mexico, Malaysia and China. The Company ships its products from its facilities and fee warehouses located in North America. The Company’s starter products include bushing, brushes and bearings, oversized solenoid contacts and aerospace-quality lubricants. Its alternators feature brushes and bearings, pressure-fit high capacity diodes and precision polished slip-rings. The Company’s wheel hub assemblies feature original equipment (OE) bearing design, integrated G111 induction hardened, raceway technology and heavy-duty seal design. The Company’s line of bearings feature OE form. Its brake master cylinders feature ethylene-propylene-diene-monomer (EPDM) seals and O-rings that are computerized multi-stage tested to provide the possible bore finish.

The Company competes with BBB Industries and Remy/BorgWarner Inc.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.