Best Aggressive Stocks Based on Big Data: Returns up to 55.58% in 14 Days

Best Aggressive Stocks

This forecast is part of the Risk-Conscious Package, as one of I Know First’s equity research solutions. We determine our aggressive stock picks by screening our algorithm daily for higher volatility stocks that present greater opportunities but are also riskier. The full Risk-Conscious Package includes a daily forecast for a total of 40 Best Aggressive Stocks divided into four main categories:

- Top 10 Aggressive stocks for the long position

- Top 10 Aggressive stocks for the short position

- Top 10 Conservative stocks for the long position

- Top 10 Conservative stocks for the short position

Package Name: Aggressive Stocks Forecast

Recommended Positions: Long

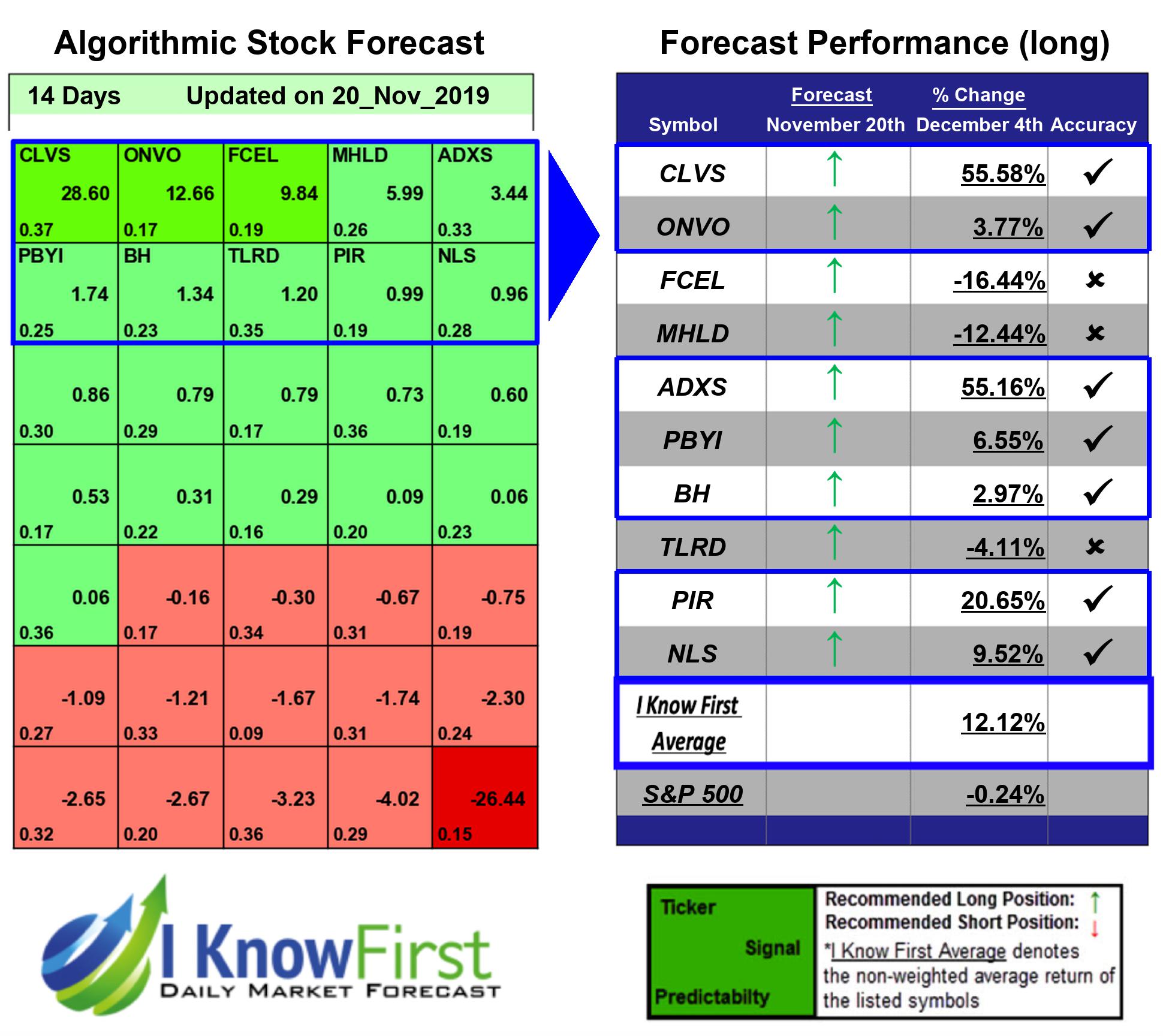

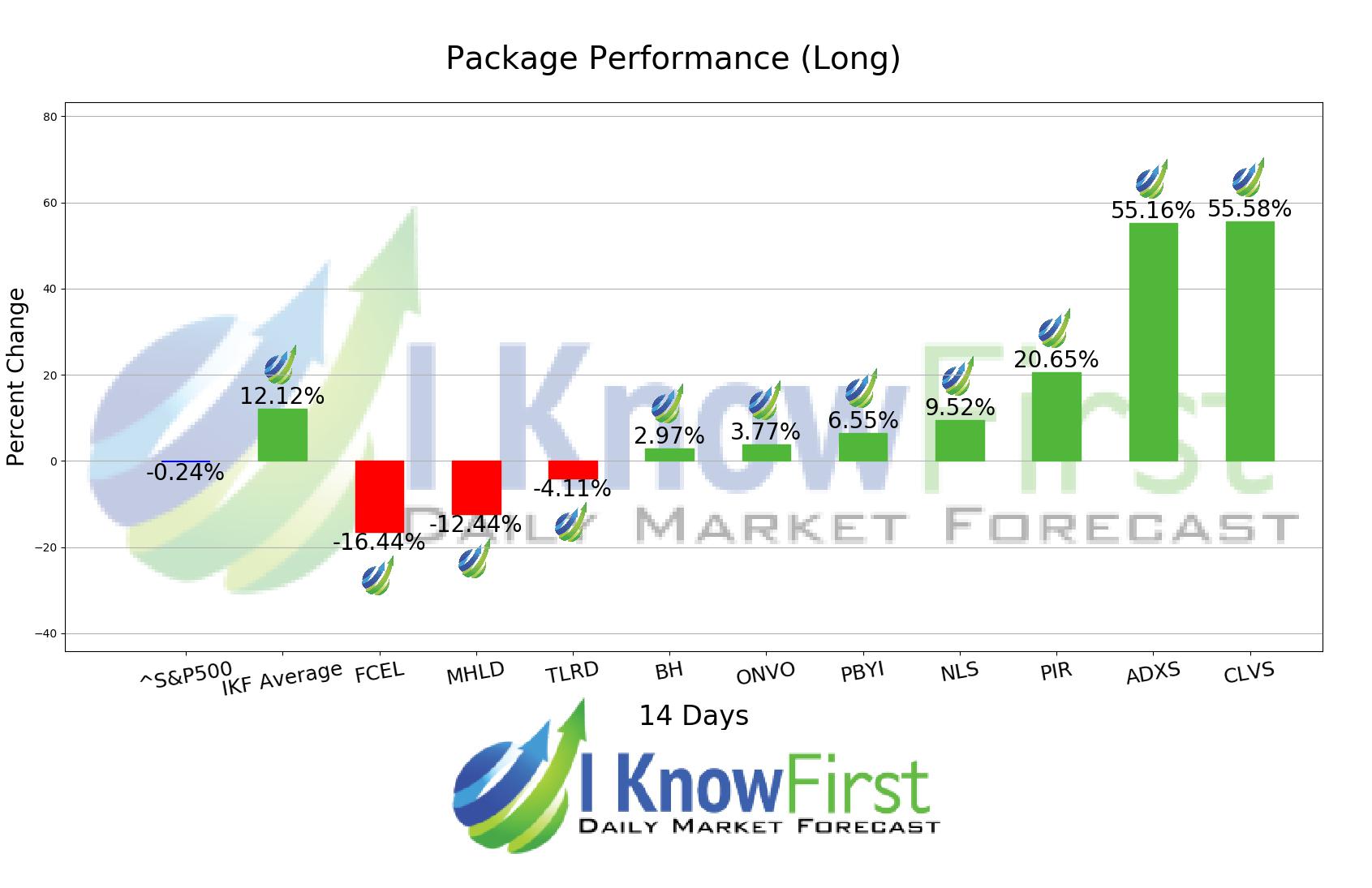

Forecast Length: 14 Days (11/20/2019 – 12/4/2019)

I Know First Average: 12.12%

The algorithm correctly predicted 7 out 10 of the suggested trades in the Aggressive Stocks Forecast Package for this 14 Days forecast. The top-performing prediction in this forecast was CLVS, which registered a return of 55.58%. Other notable stocks were ADXS and PIR with a return of 55.16% and 20.65%. The overall average return in this Aggressive Stocks Forecast package was 12.12%, providing investors with a 12.36% premium over the S&P 500’s return of -0.24% during the same period.

Clovis Oncology, Inc., incorporated on April 20, 2009, is a biopharmaceutical company focused on acquiring, developing and commercializing anti-cancer agents in the United States, Europe and other international markets. The Company’s product candidates include Rociletinib, Rubraca (Rucaparib) and Lucitanib. Its commercial product Rucaparib is an oral, small molecule poly adenosine diphosphate (ADP)-ribose polymerase (PARP), inhibitor of PARP1, PARP2 and PARP3 approved in the United States by the Food and Drug Administration (FDA), as monotherapy for the treatment of patients with deleterious breast cancer (BRCA) (human genes associated with the repair of damaged deoxyribonucleic acid (DNA)) mutation (germline and/or somatic) associated advanced ovarian cancer, who have been treated with two or more chemotherapies, and selected for therapy based on an FDA-approved companion diagnostic for Rubraca.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.