What Happened in the Banking Sector Since COVID-19?

This banking sector article was written by Meiru Zhong – Financial Analyst at I Know First.

Highlights

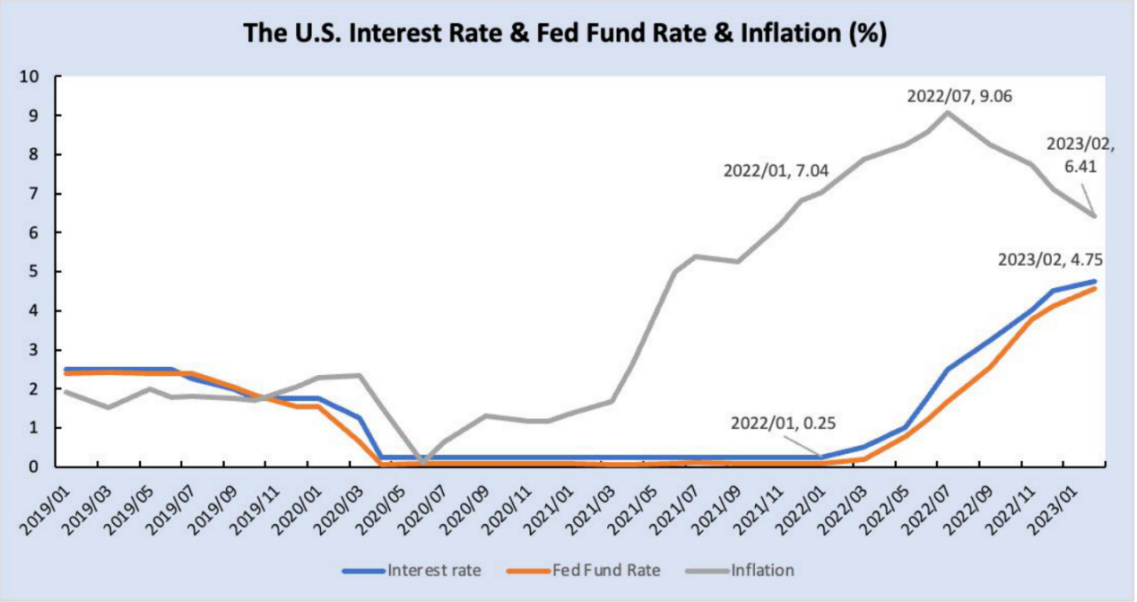

- Interest rates have had a roller-coaster ride during the pandemic, dropping to around 0% and then surging to 5%. Severe market volatility and soaring interest rates have negatively impacted banks’ operations.

- The collapse of Silicon Valley Bank (SVB) was mainly attributed to two reasons: interest rate risk and liquidity risk.

- To restore public confidence in banks, the Fed reimbursed deposits of over $250,000 in each account for the two banks, created the Bank Term Funding Program (BTFP), and reviewed the 2018 law for stricter banking rules.

Interest Rates Take Roller-coaster Ride

The Board of Governors of the Federal Reserve System reduced reserve requirement ratios to zero percent effective on March 26, 2020, which means all depository institutions were no longer required to have reserves. Prior to the change, the reserve requirement ratios differed based on the amount of net transaction accounts at the depository institution and these reserves served to protect the bank and its customers from a bank run.

Reserve requirements are tools used to influence the money supply and interest rates. Because the COVID-19 pandemic dragged down the market severely, the Fed decided to conduct expansionary monetary policy by lowing the reserve requirement to zero so that banks didn’t need to keep as much cash on hand and can lend more to consumers and companies. Therefore, we can see the Fed Fund Rate, an indicator of interest rate, plummeted to about zero when the zero reserve requirements took action.

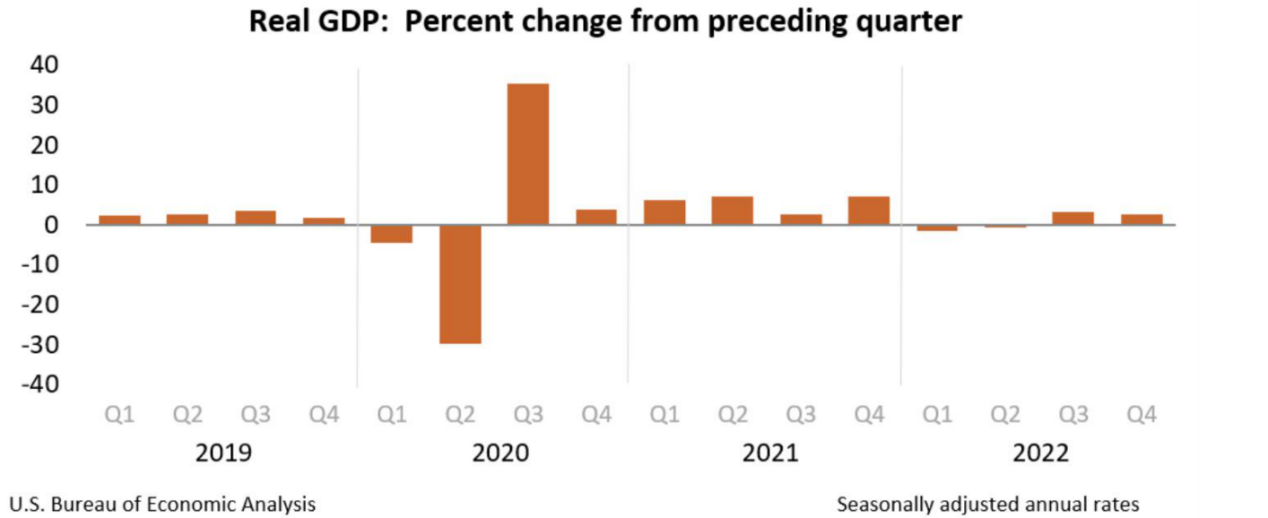

The lower interest rate did flourish the economy. It’s apparent that the percentage change in real GDP bounced back from the preceding quarter in Q3 2020 and then remained in an upward trend since then. The consumption and investment in residential and non-residential were all fueled during this period and the Fed continued buying billions of dollars of bonds every month to stimulate the economy. But behind this prosperity, a crisis was waiting.

Since money is no longer expensive, people rushed to borrow money to consume or invest, pushing up inflation from 0.3 in April 2020 to 7.5 in January 2022. The skyrocketing inflation scared regulators, who decided to gradually raise the benchmark interest rate from 0.25% in January 2022 to 5.08% in May 2023 to control inflation. Today, the inflation was under control and down to 4.9 in April 2023.

Interest rates have had a roller-coaster ride during the pandemic, dropping to around 0% and then surging to 5%. Although inflation has fallen from a high level to around 5, it is still higher than the target of around 2, so it is expected that interest rates will be raised in the near future to reduce market heat. Wild market volatility and soaring interest rates have had a negative impact on banks’ operations. Under the pressure of multiple risks, several banks failed, most notably Silicon Valley Bank.

SVB Banking Crisis

The collapse of Silicon Valley Bank (SVB) can mainly be boiled down to two reasons: Interest Rate Risk and Liquidity Risk. Why did the SVB bank run happen? That is because the depositors had lost confidence in the bank and were worried that they would not be able to get all their deposits back. Where did this concern come from? Why didn’t the public trust SVB anymore? The answer was unraveled in its financial statements.

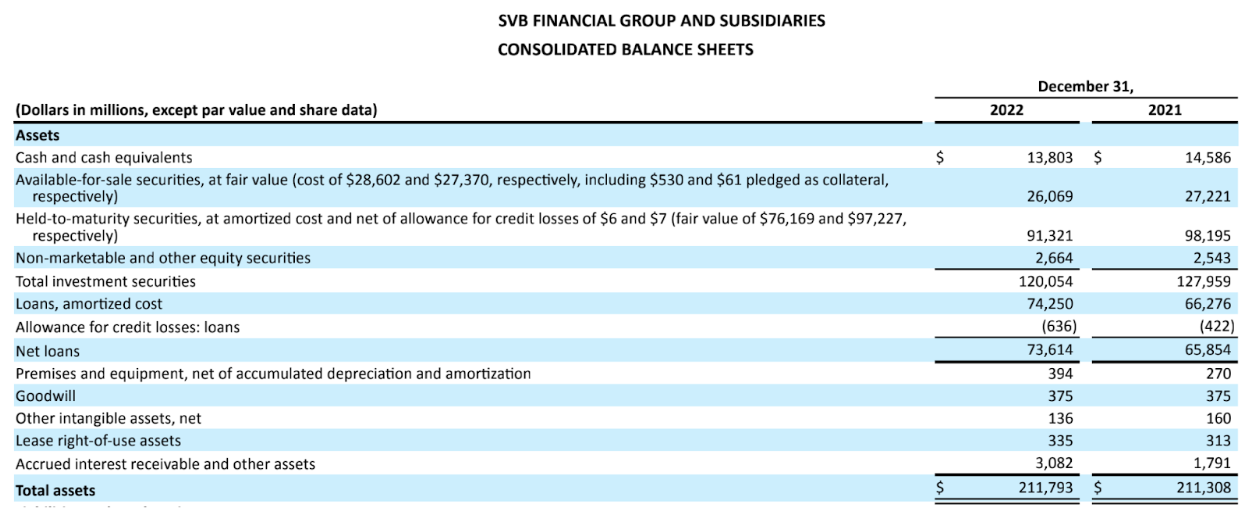

The expansion of SVB was dramatic since the Covid-19. Standing at the end of 2022 and comparing figures with 2019 level, its total assets had increased by 198%, net loan climbed up by 124%, cash and cash equivalents grew by 104%, and securities and investments raised by 313%, which AFS added by 119% and HTM increased by 560%. It’s clear that SVB focused on investing more in securities and investments, especially HTM, to maximize its profits instead of attracting more loans to earn interest rate differentials. This shift is also understandable as the companies have less need to borrow from banks due to the market downturn.

From the 2022 balance sheet, we can see that cash and cash equivalents accounted for 6.5% of total assets, while securities and investments made up 57% of the total, of which 1.3% were available-for-sale (AFS) mark-to-market and 43.1% were held-to-maturity (HTM). The unrealized gain or loss in AFS will be listed in Accumulated Other Comprehensive Income (AOCI) in the equity section of the balance sheet while HTM is assumed to be held until the end of maturity and is recorded at a notional value. The unrealized part will reflect on the balance sheet but won’t impact the income statement. Only if it converts to realized gain or loss by selling AFS, it will show in the income statement. Assuming SVB decided to sell AFS at the end of 2022, the unrealized losses became realized and the approximately $1.8 billion of losses could be found under AOCI.

At the beginning of the crisis, the depositors just withdrew cash normally, but after seeing a series of actions of the bank, they realized that something was wrong. So they started frantically asking the bank to get back all their deposits. The start of the bank run happened. What could SVB do at this moment? They had no choice but to keep selling their assets to meet their obligations.

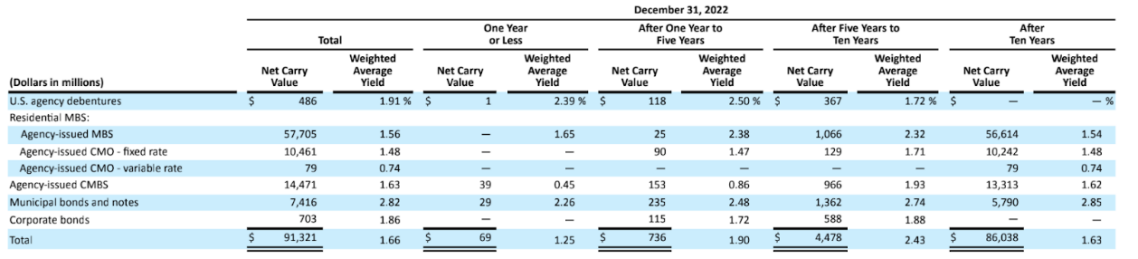

As we said before, HTM is security that companies will hold until they mature, if the holder did so, they would earn the projected return otherwise they would undertake unexpected gain or loss due to the economic outlook. Since the Fed continued its year-long rate-hiking campaign and the Fed fund rate soared between 4.75% and 5% in March 2023, the bond market was arguably wrecked and values of fixed-income portfolios plunged far away. According to an insider in SVB, the bank had unrealized losses of $15.1 billion in HTM, which means if the bank sold HTM for money, the $15.1 billion losses became real and showed in the income statement. However, the net income before noncontrolling interests and dividends was $1.5 billion in 2022. Obviously, these investment losses could not be absorbed and the bank had to announce bankruptcy.

Here, the interest rate risks played an important role when SVB decided to sell HTM and the risk can actually be quantified. Back to SVB’s 2022 10K, the estimated weighted-average duration of fixed income investment securities portfolio was 5.7 years on December 31, 2022, of which the weighted-average duration of the AFS securities portfolio was 3.6 years and that of HTM was 6.2 years. The average duration of 5.7 years in a fixed income portfolio means it takes the bank 5.7 years to be repaid by the future total cash flows from coupon payments and principal. The larger duration, the higher the interest rate risks.

Apart from the interest rate risks, SVB also suffered liquidity risks. Its percentage of uninsured deposits to the total deposits accounted for 94% at the end of 2022, indicating that once the bank run happened, about 94% of depositors could not get their money back and be compensated by FDIC, which would be a huge disaster to individuals, companies, and the financial market. The bank obviously lacked the capital to satisfy the depositors’ needs and absorbed the potential losses. Its management team was aware of the dangers of insufficient capital and announced to raise new capital by offering $1.25 billion in common stock and $500 million of depositary shares. Since most of SVB’s depositors are startups and venture capital firms in the tech community, these closed groups, spooked by the news that the bank is underfunded, rush to withdraw their deposits. Therefore SVB shut down on March 10, 2023.

The story also repeated in the failure of Signature Bank and First Republic Bank. It is the weakening of supervision, the increase of market uncertainty, and the inadequacy of the bank’s internal risk control that led to the crisis. The damage it brought to individuals and families was immeasurable and regulators should take immediate action to minimize negative impacts, improve the system, and restore public confidence in the banking sector.

FED Responses to Banking Challenges

In March 2023, the Federal Reserve responded quickly to the failures of Silicon Valley Bank (SVB) and Signature Bank by reimbursing deposits of over $250,000 in each account for the two banks to restore depositors’ confidence in the bank’s ability. This action would cost the insurance fund $20 billion, the largest impact in the history of the Federal Deposit Insurance Corp. (FDIC). The institution plans to recoup those funds from a heavy levy on all banks, which might be passed on to consumers.

Apart from that, the Bank Term Funding Program (BTFP) was created and accomplished on March 12, 2023, to lend to other banks to provide liquidity and lower the possibilities of bank runs. The loans offered are up to one year with an interest rate equal to the one-year overnight index swap rate plus 10 basis points (0.10%) to depository institutions, who need to pledge collateral eligible for purchase by the Fed in open markets. Moreover, the Department of the Treasury would provide $25 billion from the Exchange Stabilization Fund to support the program.

As the bank failure mainly contributed to mismanagement, the Fed is considering posing stronger bank rules to prevent such a crisis from happening again. For example, the Fed will review the 2018 law that weakened stricter bank rules, widely known as the Dodd-Frank Law signed by then-President Barack Obama in 2010.

Investing in Banking Stocks with I Know First

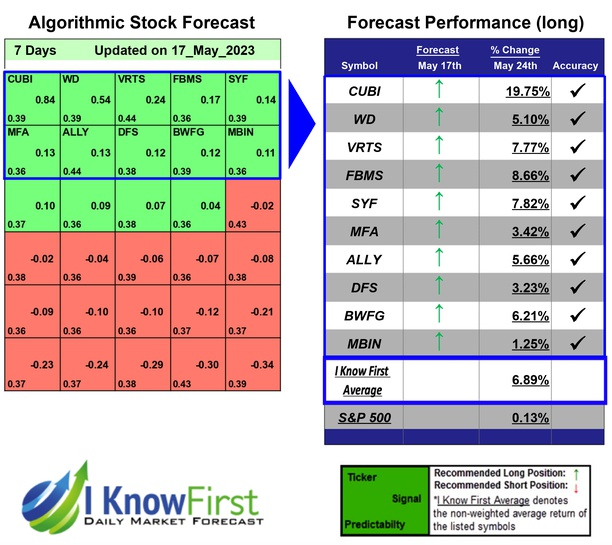

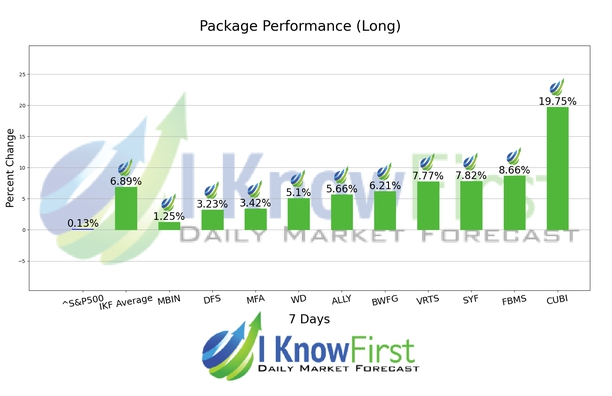

I Know First provides predictions for the Bank stocks based on the AI algorithm for six horizons: 3-day, 7-day, 14-day, 1-month, 3-months, and 1-year. Below, we can observe the performance of the prediction of the Bank stocks package which was sent to our clients (you can access our forecast packages here).

Conclusions

Bank regulation and management is a major theme in ensuring the healthy development of the financial system. Although black swans are difficult to predict (e.g. Covid-19), banks can still take actions to control internal and external risks by stress testing capital and liquidity. What’s more, regulators should scrutinize banks’ financial situations more carefully and rigorously and conduct stress tests to verify their resilience to prevent such crises from happening again.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.