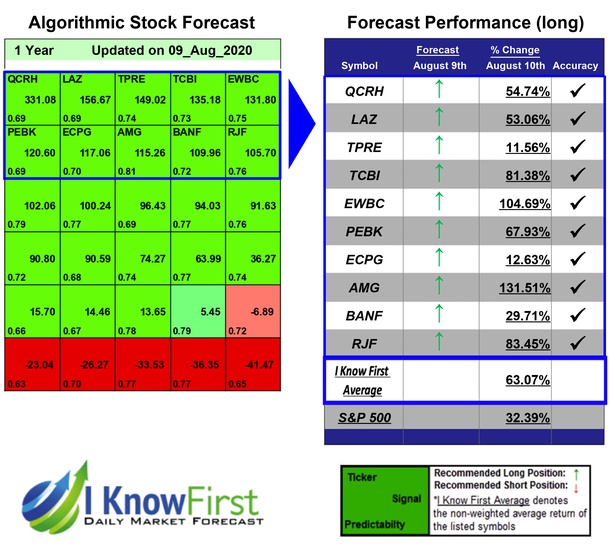

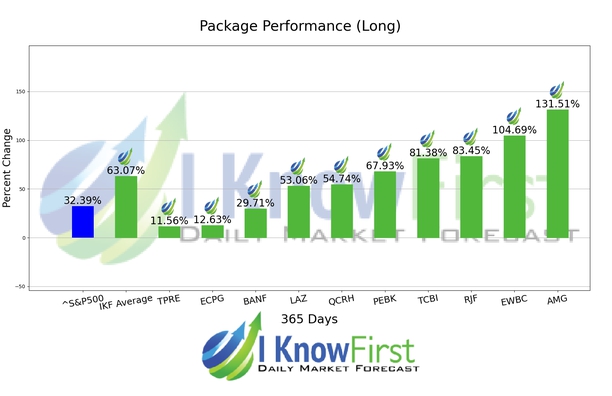

Bank Stocks Based on Big Data: Returns up to 131.51% in 1 Year

Bank Stocks

This forecast is designed for investors and analysts who need predictions of Bank Stocks (see Bank Stocks Package). It includes 20 stocks with bullish and bearish signals and indicates the best bank stocks to buy:

- Top 10 Bank stocks for the long position

- Top 10 Bank stocks for the short position

Package Name: Bank Stock Forecast

Recommended Positions: Long

Forecast Length: 1 Year (8/9/20 – 8/10/21)

I Know First Average: 63.07%

10 out of 10 stock prices in this forecast for the Bank Stock Forecast Package moved as predicted by the algorithm. The highest trade return came from AMG, at 131.51%. EWBC and RJF also performed well for this time horizon with returns of 104.69% and 83.45%, respectively. The package had an overall average return of 63.07%, providing investors with a premium of 30.68% over the S&P 500’s return of 32.39% during the same period.

Affiliated Managers Group, Inc., incorporated on December 29, 1993, is an asset management company with equity investments in boutique investment management firms (Affiliates). The Company is focused on investing around the globe in investment management firms that manage active return-oriented strategies, including traditional, alternative and wealth management firms. The Company operates through three business segments, which represent its principal distribution channels: Institutional, Mutual Fund and High Net Worth. The equity method investments in the Institutional distribution channel are made in relationships with public and private client entities, including foundations, endowments, sovereign wealth funds and retirement plans for corporations and municipalities. The equity method investments in the Mutual Fund distribution channel are made in advisory or sub-advisory relationships with active return-oriented mutual funds, Undertakings for Collective Investment in Transferable Securities (UCITS) and other retail products. The equity method investments in the High Net Worth distribution channel are made in relationships with high net worth and ultra-high net worth individuals, families, trusts, foundations, endowments and retirement plans.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.