Baidu Stock: Baidu’s Diversification Efforts Make It a Good Long-term Pick

The article was written by Ayush Singh Tip Ranks #4 Financial Blogger – Senior Analyst at I Know First.

The article was written by Ayush Singh Tip Ranks #4 Financial Blogger – Senior Analyst at I Know First.

Baidu Stock

Improving cost structures will boost margins.

Improving cost structures will boost margins.- Core business will continue generating cash.

- Diversification efforts will drive growth.

- I Know First has a bullish view on BIDU Stock for the next short and long time horizons.

I have been bearish on the Chinese stock market and companies that rely heavily on China since the last four months. Due to the overvaluation of the stocks in China, I was expecting a crash, which was the primary reason I was bearish. However, despite the overvaluation, investors can find value in some companies and one of those companies is Baidu (BIDU).

Baidu is a Chinese language Internet search provider. The Company offers a Chinese-language search platform on its website Baidu.com. The company has a high penetration rate in China and I am sure that it can outperform even if there’s a slowdown in the Chinese economy. Hence, investors who want to buy and hold a stock for the long-term (about 5 years) can take a look at Baidu.

(Source: Google)

Eliminating Costs

Towards the end of 2015, Baidu sold Qunar stake to its rival Ctrip. The foremost thing about selling the Qunar position to Ctrip is the removal of the rising prices of the online travel site from the financials. For the third quarter, Qunar reported negative operating margins of 41.3 percent. The agreement with Ctrip is likely to display refining yields and higher margins, but the guidance for fourth quarter proposed no enhancements in the operating margins.

Moving back to October 26, 2015, keeping in mind the expenses reported for the fourth quarter, the Qunar numbers were no longer involved in outlays of Baidu contributing to the stumpy growth speed. Despite that, throughout the fourth quarter, the transaction services affected Baidu’s total operating margins by around 24.9 percent. In spite of this cost and additional 5.9 percentage point smash from iQiyi, the company still produced an operating margin of 20.7 percent. Given the strong growth, Baidu is still trading at a decent multiple, especially since it is known as the Google of China.

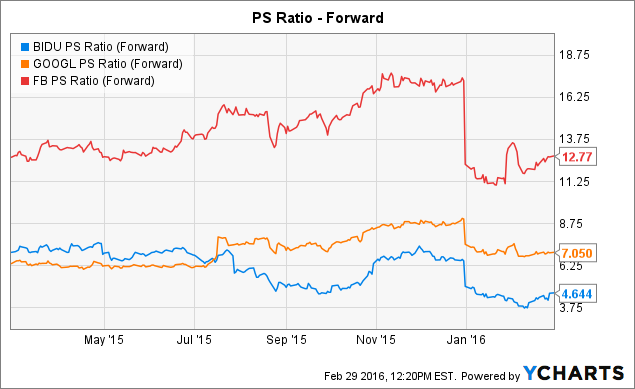

Price–sales ratio (Source: SeekingAlpha)

Eliminating the Qunar costs completely this year will help Baidu focus the investment theme back on the fundamental Internet search business of the company that has a top-line growth rate of around 20 percent and profit margins of approximately 50 percent. Apart from this, the company strategies a more dignified outlay on transaction services with an aim of a better focus on computing the efficiency of advancements.

The core cash cow

Baidu’s total revenue in 2015 was up 35.3 percent as compared to 2014’s revenue. The major portion of the revenue came from Baidu’s online search business. According to the company, online marketing revenues accounted for more than 96 percent of the yearly total. The company’s client list jumped around 29 percent and the average revenue per client by approximately 2 percent.

(Source: Google)

The online search business is the most perilous part of the company for the short term. Furthermore, it delivers the cash that Baidu is spending to enlarge its contribution in maps and transaction services. It is fine to focus on Baidu’s next growth driver, but the core search business has enormous tailwinds behind it, and the company’s growth story still has a lot to show.

Risk is controllable

Any investment contains risk, and Baidu is an investment whose risks are relatively controllable. The most significant risk it that the company is mainly dependent on China, as its business operates in China, which points towards a financial and supervisory risk profile that is very exclusive.

There are several reports which put forward that China’s economy is approaching towards a phase of more retained growth, which could definitely act to shrink advertiser expenditure over the coming few years. However, this is not likely to be a substantial grinch on the company’s long-term growth.

(Source: Google)

The digital advertising landscape in China is also at a state of flux as various new players create new value proposals. Recently, Tencent is the one to attract many advertisers and is seizing a disproportionate share of social advertising mainly due to the reason because advertisers start to shift investments from search in the direction of more personalized content offerings and social commerce.

My bullish sentiment is shared by the analysts covering Baidu. According to TipRanks, out of the 9 analysts covering Baidu, 7 rate it a Buy, whereas 2 rate it a Hold. Also, analysts have an average price target of roughly $212, representing almost 16% upside potential from the current value. In addition, out of the bloggers covering the stock, 81% are bullish whereas only 19% are bearish. Given the positive sentiments, I think Baidu definitely has more upside to offer.

Additional services

Apart from this, the company introduced several new mobile facilities in recent times, comprising a mobile cloud offering and mobile navigation as well as mobile music streaming package. Baidu’s new services should aid to surge the adhesiveness of search users, if not subsidize to additional revenue.

These new services also provide a new mobile catalogue, where Baidu can influence prevailing advertising relations and propose new properties to advertisers. The company’s mobile music service nowadays claims over 150 million MAUs.

The company is continuously putting efforts to make its services advance and is not standing still as far as next-generation service improvement is alarmed. As Google, Baidu is also working on its moonshot projects, together with the self-driving car concept. These new businesses should ultimately produce new revenue streams.

Conclusion

To sum it up, Baidu is the Google of China. While the concerns surrounding the Chinese economy may put downward pressure on the stock, I think it is a perfect for long-term investors. Baidu has a strong core business and is also actively diversifying into other sectors. The favorable risk/reward ratio makes Baidu a great pick for long-term investors.

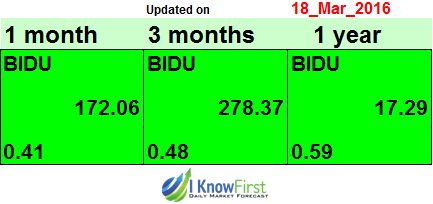

My long-term bullish Baidu outlook is echoed by algorithmic forecasts of I Know First. I Know First uses an advanced state of the art algorithm based on artificial intelligence and machine learning to foresee market performance for more than 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The algorithm generates a forecast with a signal and a predictability indicator. The signal is the number at the center of the box. The predictability is the figure at the bottom of the box. At the top, a particular asset is identified. This format is standardized across all forecasts. The middle number indicates strength and direction, not a price target or percentage gain/loss. The bottom figure, the predictability, signifies a confidence level.

As you can see from the image above, the green bullish signals of 278 and 17.29, 3 months and the 1-year forecast indicates that the stock can head a lot higher in the long-term. Hence, I think long-term investors can use the recent pullback as an entry point as Baidu is still in the red YTD.

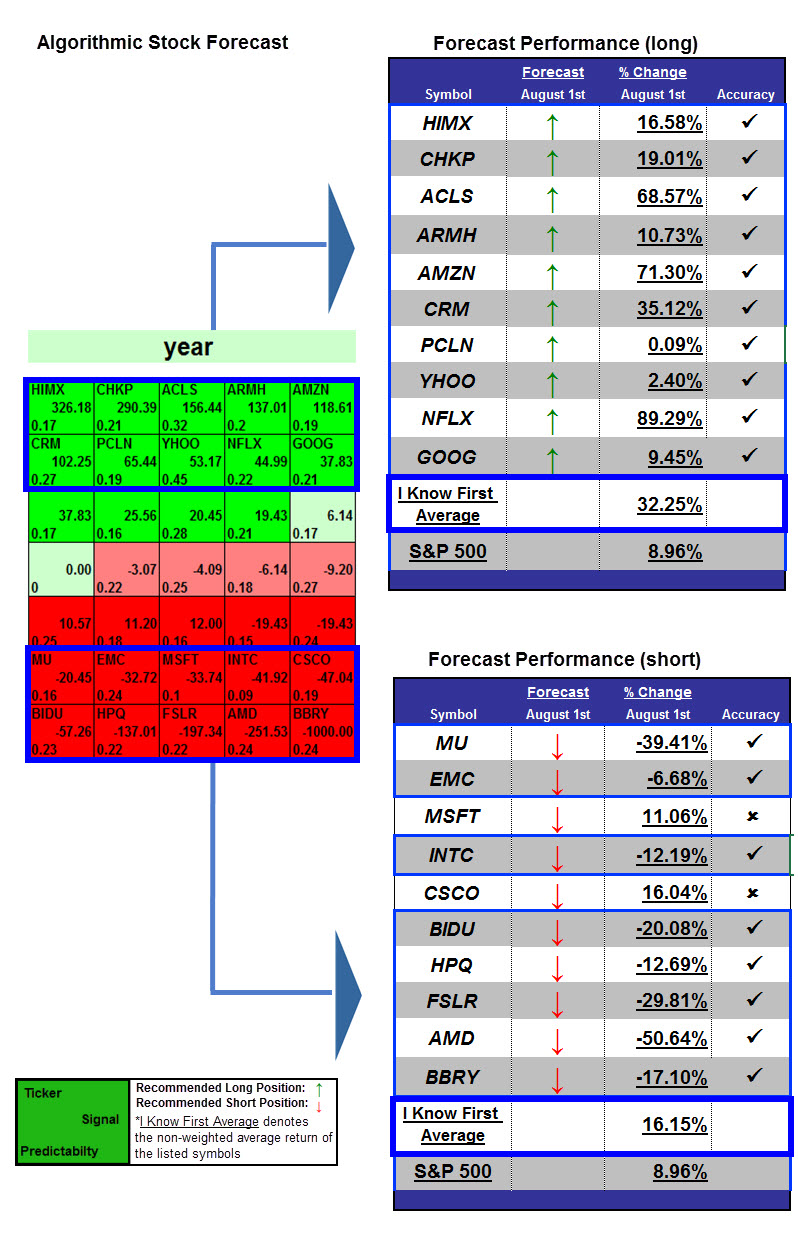

In the past, I Know First has correctly predicted the bearish movement of BIDU stock thanks to their advanced algorithm. The forecast from August 1st, 2014 correctly predicted the great fall they had bringing to investors who took a short position on BIDU a 20.08% return for the 1 year period. The forecast had predicted a bearish signal of -57.26 and predictability of 0.23 as seen below in the forecast.

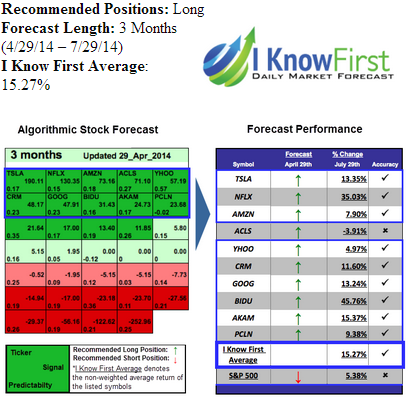

Also, I Know First has previously predicted successfully BIDU stock movement with a bullish signal in this forecast from April 29th to July 29th, 2014.The algorithmic bullish signal of 31.43 and predictability of 0.16 was enough for the stock to bring returns of 45.76% for the three-month position.

Improving cost structures will boost margins.

Improving cost structures will boost margins.