BABA Stock Forecast: Why Alibaba Remains An Attractive Investment

This BABA stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This BABA stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Alibaba’s $2 billion purchase of Kaola further fortifiee its lead in China’s growing e-commerce.

- Kaola is China’s leading B2C shopping portal where Chinese customers purchase imported American and European-made luxury products.

- The push to cater more to the rich is a good reason to go long BABA. Recession or not, the rich can still buy anything they want.

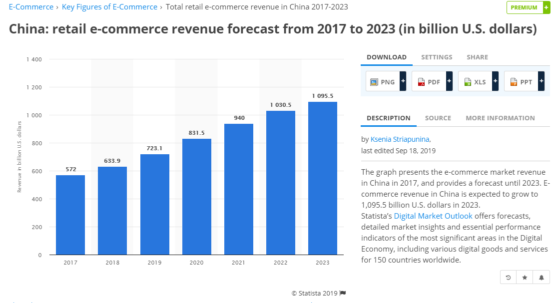

- Alibaba is a buy because it remains dominant in China’s $723.1 billion/year retail e-commerce. This market will grow to $1.095 trillion by 2023.

- I Know First has a bullish one-year algorithmic score for BABA. Going long on this stock right now is the right thing to do.

We should all go long (or remain long) on Alibaba (BABA). The retirement of Jack Ma as chairman of Alibaba is not a headwind. What is more important is that, before Ma retired, he likely supervised the $2 billion purchase of Kaola. It is commendable that Alibaba successfully persuaded NetEase (NTES) to choose it as the final buyer of Kaola. Alibaba was able to prevent Amazon (AMZN) China from acquiring Kaola.

The long-term importance of Kaola is that it is the second-biggest company for China’s cross-border (or imported) online retail of goods. As of Q4 2018, Kaola enjoyed 24.5% market share, just behind Alibaba’s Tmall Global, which touts a 31.7% market share. Paying only $2 billion, Alibaba quickly became the runaway leader in China’s cross-border online retail.

Further, Kaola specializes in online retail of imported luxury or pricey products for the Chinese market. This is great for Alibaba. Recession or not, the affluent or wealthy citizens of China can still buy anything they want whether. It makes sense for Alibaba to prioritize providing online shopping to the affluent residents of China.

The much larger purchasing power of the rich can help Alibaba maintain its impressive 5-year average revenue growth rate of 48.1%. More importantly, selling pricey imported products likely produces better net margins for any retailer. Rich customers will most likely do not mind it if Kaola charges 4 to 8% (instead of 1% to 3%) margins on imported products.

Achieving better margins on sales of imported luxury goods can help improve or sustain Alibaba’s 42.10% 5-year average EPS Diluted Growth. Alibaba now owns Tmall Global and Kaola. It has more than 55% of the cross-border e-commerce. It therefore has greater negotiating power to persuade more American and European manufacturers to provide it with exclusive products for the Chinese market.

Why Staying Number One Is Super Important

Alibaba buying other online retailers ensures its number one position in China. Staying number one in China is paramount. China’s online retail business is worth $723.1 billion this year. It will grow to $1.095 trillion by 2023. This huge business opportunity is why Alibaba should remain a big part of your investment portfolio. No other company can dethrone Alibaba in China’s massive online retail industry.

The acquisition of Kaola is also a perfect fit. Sales of fashion/personal care-related products for more than 40% of China online retail sales. Going forward, a notable number of Alibaba’s 654 million online shopping customers are future repeat clients of Kaola’s imported goods.

The chart below is a strong reason for you to stay long (or buy more BABA shares). Alibaba’s massive 654 million online shopping customers gives the company a long-term tailwind. Alibaba is now so big. The company can only get bigger.

Why Alibaba Is A Bargain Bet

Amazon has a lower 25.70% 5-year average annual revenue growth rate than Alibaba’s 48.1%. Amazon’s average 5-year net income margin is only 1.7% – way below Alibaba’s average 5-year net income margin of 36.71%. Sad but true, being a Chinese company, Alibaba is way undervalued compared to U.S.-based Amazon. BABA’s forward P/E is only 39.24x while AMZN 76.59x.

The persistent undervaluation of BABA against its rival AMZN offers judicious investors a wonderful opportunity. Alibaba is a better investment than Amazon because of BABA’s significantly lower valuation. Going forward, I believe Alibaba’s forward P/E valuation will appreciate beyond 50x.

Conclusion

A Decades-long run of hyper-growth and high profitability gave Alibaba a strong balance sheet. Alibaba’s total long-term debt is only $16.94 billion. This is almost only half of the company’s total cash & short-term investments of $32.13 billion. Alibaba’s free cash flow from operations is also $5.04 billion/quarter.

The deep cash hoard and strong free cash flow of Alibaba should convince us that it will do more acquisitions. Alibaba acquiring more of its smaller rivals is healthy for the industry. Better margins can come from constant consolidation in e-commerce. Manufacturers who want to sell online will have less bargaining power when they can only negotiate with 3 to 6 (not dozens) e-commerce site operators.

My buy rating for BABA is congruent with its bullish one-year algorithmic forecast trend score (138.24) from I Know First. The BABA stock forecast’s predictability score of 0.74 also denotes that I Know First has a great track record of correctly predicting the 12-month market trend pattern of Alibaba’s stock.

Past Success With BABA Stock Forecast

The BABA stock forecast above refers to a previous successful I Know First algorithm prediction that gave a bullish long term BABA stock forecast which was included in a premium article on why Alibaba’s stock has more upside potential. The prediction was bullish in both in short and long term with a 3-month signal of 2.27 and a predictability indicator of .59. The Algorithm correctly predicted Alibaba’s share trend.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.