AVGO Stock Forecast for 2022: Broadcom Inc. Is a Growth Stock Looking at Sustain Dividends

![]() This AVGO Stock Forecast for 2022 article was written by Opher Joseph – Financial Analyst, I Know First.

This AVGO Stock Forecast for 2022 article was written by Opher Joseph – Financial Analyst, I Know First.

Summary

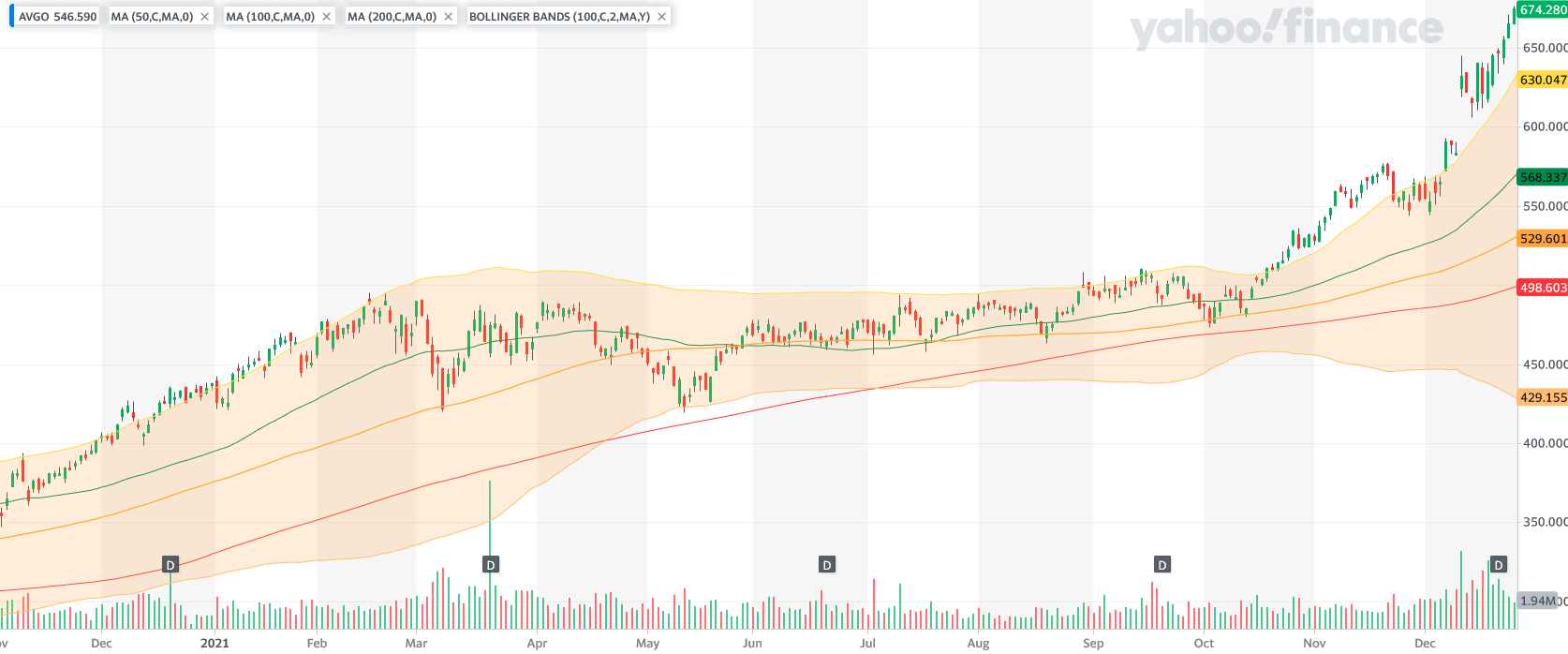

- The stock is trading close to its 52-week high of $ 674.28 and there is good reason for optimism that it will attain new highs given its strong financials and positive business outlook.

- Broadcom is amongst other 3 companies that are touted to join the current list of 6 companies to reach the $ 1 trillion market capitalization by 2035.

- The company has announced that it will buy back $10 billion worth of shares from its shareholders in 2022.

- The current Price to Book ratio is 11.16, which is considerably below its competitors’ pricing.

Overview

Broadcom-the combined entity of Broadcom and Avago boasts a highly diverse product portfolio across an array of end markets. Avago focused primarily on radio frequency filters and amplifiers used in high-end smartphones, such as the Apple iPhone and Samsung Galaxy devices, in addition to an assortment of solutions for wired infrastructure, enterprise storage, and industrial end markets. Legacy Broadcom targeted networking semiconductors, such as switch and physical layer chips, broadband products (such as television set-top box processors), and connectivity chips that handle standards such as Wi-Fi and Bluetooth. The company has acquired Brocade, CA Technologies, and Symantec’s enterprise security business to bolster its offerings in software. The company was founded in 1961 and is headquartered in San Jose, CA.

(source: wikimedia.org)

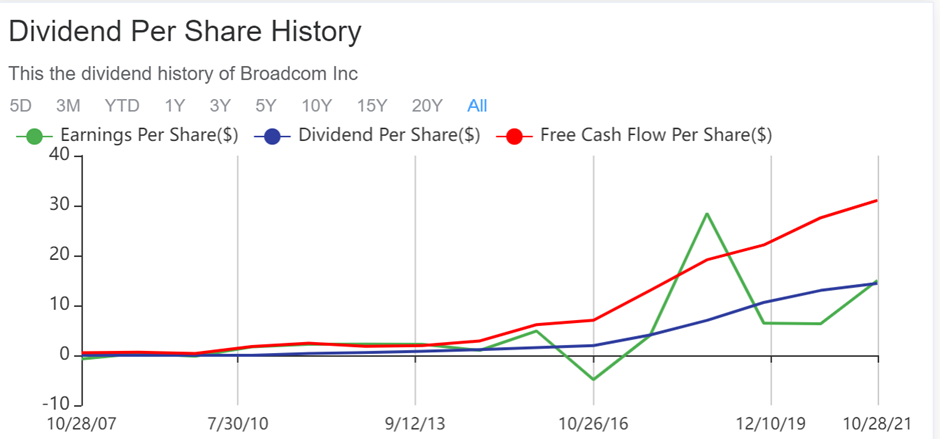

Broadcom is amongst 3 other companies that are touted to join the current list of 6 companies to reach the $1 trillion market capitalization by 2035. The current demand in semiconductors and potential demand for 5G chips in 2022 lead to promising avenues of business for Broadcom Inc. It is certainly amongst the rare dividend stocks favored by all which pays 96% of its earnings per share as dividends. Generally, when companies pay out higher dividends (hence not investing their profits back in their own business), it indicates that the company would not be able to attain sustainable growth in its business for a longer period. The dividend payout ratio of 96% is also too high for it to be sustained consistently over a longer period of time. However, AVGO so far has not only increased its dividend per share but also managed to attain higher revenue growth and free cash flows to cover its high dividend pay-out and also its high-interest expenditure incurred on the large debt balances.

Strong Operating Margins Drive the Broadcom Inc. Growth Story

Earnings are forecasted to grow at an average of 19.4% per year for the next 3 years vis-à-vis the US market growth rate of 13.7% per year (based on consensus estimate rating of 26 analysts). AVGO’s Operating Margin % is ranked higher than 93% of the 861 companies in the Semiconductors industry. In Oct-2021 it grew to 31.57% from 17.63% in Oct-2020, as did the Net margin from 12.39% to 24.54%. The Return on Equity (ROE) of the company is 26.55% while the Return on Assets (ROA) is 8.87%, which is better than 65.64% of 861 companies in the Semiconductors industry. (source – GuruFocus.com). Following these strong financial indicators, there has been a strong trend of large buy quantities of the company by institutional investors. This trend is well depicted in the figures below from the past 12 months

There are about 50 hedge funds actively investing in AVGO in Sep-2021 holding stakes worth $ 2.7 billion in Broadcom Inc. (source – 10 5G Stocks to Buy for 2022 (yahoo.com)). Among the hedge funds being tracked by Insider Monkey, New York-based investment firm Cantillon Capital Management is a leading shareholder in Broadcom Inc. (NASDAQ: AVGO) with 1 million shares worth more than $525 million.

Can Broadcom Inc. Sustain Its High Dividend Pay-Outs?

The company has announced to pay a healthy dividend and raise it from $ 3.60 per share to $ 4.10 per share to be paid on December 31, 2021. This explains the recent rally in the stock price which has gone up 16.36 % just from the start of the month of Dec-2021 to date. The stock is trading close to its 52-week high of $ 644.75 and there is good reason for optimism that it will attain new highs given its strong financials and positive business outlook. The dividend pay-out ratio of AVGO was 2.05 in Oct-2020, while it has decreased to 0.96 in Oct-2021. Despite this drop, the company still has an exceptionally high dividend distribution ratio. Since 2011, the dividend has gone from US$0.32 to US$16.40. This works out to be a compound annual growth rate (CAGR) of approximately 48% a year over that time. There haven’t been any significant cuts in dividend during this time, while its Earning per Share (EPS) has increased by 16% over the past 5 years.

The dividend coverage ratio of the company is 2.02, while the operating cash flow per share is 8.25 and the free cash flow per share is 8.05. These are favorable ratios and the dividend is covered by both profit and cash flow. This generally suggests the dividends are sustainable, as long as earnings don’t drop precipitously. The company has cash and cash equivalents of $ 12,163 million, while the retained earnings of the company amount to $ 748 million. The company is expected to grow its revenues at commensurate rates to fulfill high market expectations and it has ensured the availability of several business avenues to achieve this growth. However, the high dividend pay-out ratio of 96% may not be sustainable over time.

AVGO Stock Forecast: Promising Growth Prospects

At the investor day event hosted by Broadcom Inc. the company highlighted its highly focused business model of strategic customers leveraging multiple solutions to drive revenue sustainability and growth. The company has a complementary product portfolio across infrastructure and security software serving 80% of the Fortune 500. Broadcom Software generates approximately $5.2 billion in annual recurring revenue, of which more than half of it is subscriptions, and has increased more than 25% over the last three quarters. The combination of DX NetOps by Broadcom Software and AppNeta provides IT teams with precise, end-to-end visibility into network performance from the end-user’s perspective. By combining AppNeta’s end-to-end visibility with Broadcom’s award-winning and proven Infrastructure and AIOps capabilities, the world’s largest enterprises running the most complex networks will now have access to a single source of truth to support their cloud journey (source: yahoo.com ).

Broadcom Software has a successful history of integrating acquired companies and businesses with mission-critical products toward Broadcom’s goal of building one of the world’s leading enterprise software businesses (source: yahoo.com). The company also announced on 9th November 2021 that Meta is now deploying the world’s highest bandwidth Ethernet switch chip, the Broadcom StrataXGS® Tomahawk® 4 switch series, in its data center network fabric. A leading-edge 25.6 Tbps Ethernet switch, the Tomahawk4 is now shipping in high volume in Meta’s Minipack2 platform— an industry first (source: yahoo.com). Further to its existing initiatives towards open computing, the company announced its continued commitment to open computing at the 2021 Open Compute Project (OCP) Global Summit, held on November 9-10, 2021 at the San Jose Convention Center, showcasing Leading-Edge and Wide Range of Initiatives (source: yahoo.com).

On 20th December 2021, Apple announced that it will be producing its own semi-conductors. The market might react to this sentiment, thus affecting the strong momentum gain rally of AVGO, as Apple previously relied on AVGO to source its semiconductors. However, Broadcom is under contract with Apple of $ 15 billion which runs through 2023. Hence, the above news would have an immaterial effect on the revenue of Broadcom Inc. for now.

AVGO Stock Forecast: The Existing High Debt-Equity Ratio of the Company is on Course to Worsen in 2022

If there is one chink in the armor of Broadcom Inc. is its high debt-equity ratio of 1.59. The company’s interest coverage ratio is 6.01. The company utilizes its profits and cash flows to pay a consistent level of dividend payback to its shareholders. Further, it has also announced that it will buy-back $ 10 billion worth of shares from its shareholders in 2022. Also, the key stakeholders of the company which include the company insiders have consistently sold the company’s stock as illustrated in the below statistics

The number of shares outstanding of the company has increased by 2.1% in the past year and has thus witnessed dilution in ownership. The effect of share buyback will counter the effect of this dilution in equity but would worsen the Debt-Equity ratio of the company. Assuming no change in the current debt levels of the company in the next year, the debt-equity ratio would worsen to 1.65 (an increase of 4 %) after the above buy-back of shares in 2022. Also, the company’s current Return on Invested Capital (ROIC) is 14.89 and the Weighted Average Cost of Capital (WACC) of the Company is 6.88. The effective interest rate on debt is 4.33% which has decreased from 5.49% from the start of the year 2022. Given the expected interest rate revision by the Fed in 2022, borrowing costs are expected to rise to higher levels. However, with the current market sentiments, analyst predictions, and the staggering institutional investments witnessed in the company as illustrated in the past 12 months, the company is expected to outperform market expectations.

AVGO Stock Forecast: Strong Technical Indicators Reflect a Strong Growth Forecast for AVGO

The current Price to Book ratio is 11.16, which is considerably below its competitors’ pricing and the current continuing positivity in the price surge of this stock will look to boost this valuation going ahead. The technical indicators do not suggest any adverse signs for the trend direction changing in the long term. However, the stock is currently trading well above the Bollinger Bands level and we can expect a correction in the short-term when the price goes inside of the Bollinger range.

The strong operating margins and the industry’s high dividend pay-out ratios for AVGO have always been a star attraction for the stock. Based on its strong financial performance, it scores a favorable rating in Piotrski F-Score on financial health (8/9), a safe ranking score on Altman Z-Score based on bankruptcy indicator, and also an unlikely manipulator rank in Beneish M-score, however, it only scores a 4/10 on its financial strength given its comparatively high debt levels (source – GuruFocus.com). However, the strong market sentiment around the stock for it to outperform market expectations will see it reach new highs in the coming year.

AVGO Stock Forecast: Conclusion

The positivity around IT stocks for exponential growth during the in-course pandemic effects and the new Omicron variant wave would certainly drive growth at AVGO. According to a market forecast report of 2022 by the Global Investment Strategy Group of J.P. Morgan, we should expect that digital transformation is continuous that will require not only higher investments from the business but also government spending will increase in the IT sector in 2022.

Thus, given all the optimism around the stock market and especially the technology stocks, AVGO is a recommended buy for growth pick with an upside target of $ 730.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the AVGO stock forecast. The dark green for all forecasts is a strong bullish signal.

Past Success With AVGO Stock Forecast

I Know First has been bullish on AVGO’s shares in past forecasts. On our September 13, 2021 premium article, the I Know First algorithm issued a bullish AVGO stock forecast. The algorithm successfully forecasted the movement of AVGO’s shares on the 3-month time horizon. AVGO’s shares rose by 26.81% in line with the I Know First algorithm’s forecast.

Here at I Know First, our AI-based stock forecast algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. The database used is 100% historical data free from human-derived assumptions and is constantly evolving with newly added data and adapting to changing market situations. Today, we are producing daily forecasts for over 10,500 assets such as forex forecasts, as well as gold predictions, while also providing the latest Apple stock news. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.