AVGO Stock Forecast: Broadcom Deserves A Price Target Of $560

The AVGO Stock Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The AVGO Stock Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

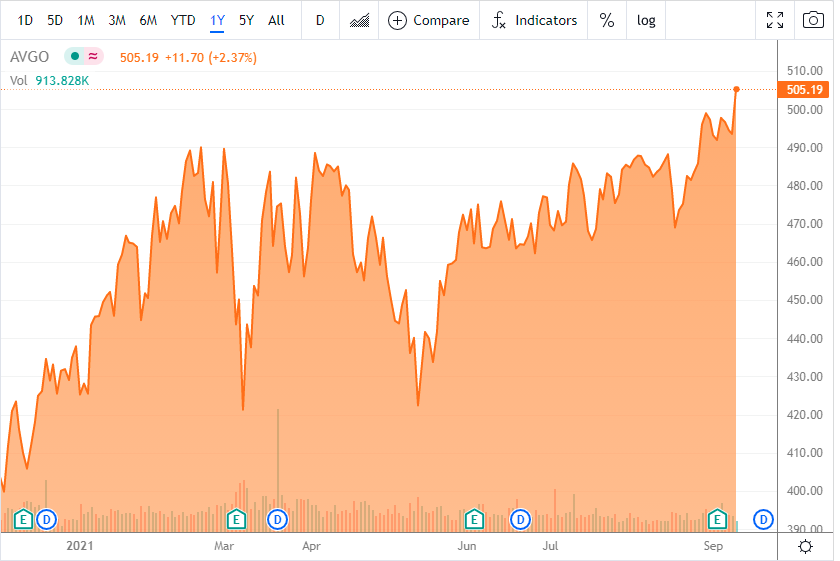

- The stock price of Broadcom is trading far above my old June 25, 2020 price target of $360. AVGO’s price return since that day is +61.12%.

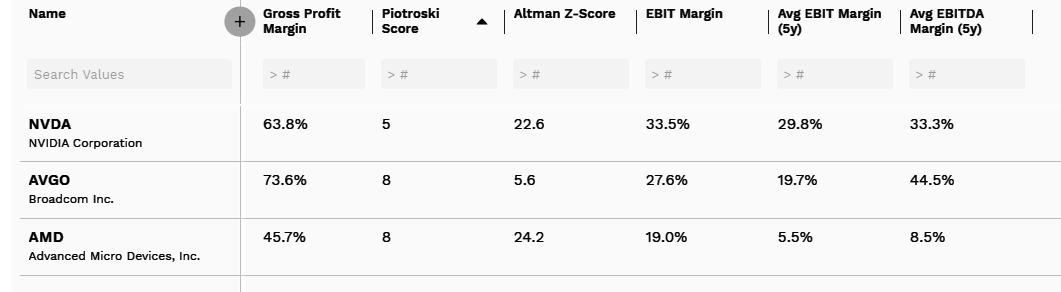

- Broadcom’s stock is significantly undervalued when compared against AMD and NVDA.

- The Piotroski Score of AVGO is 8. This is excellent because the highest possible score is 9. AVGO’s Altman-Z score is 5.6. Broadcom has a low probability of going bankrupt.

- The AI algorithm of I Know First is bullish on AVGO.

Congratulations to those who heeded my June 25, 2020 buy recommendation for Broadcom. AVGO’s price performance since that day is +61.12%. Broadcom’s stock is now trading above $505, way higher than my old 1-year price target of $360. I am again endorsing Broadcom as a buy. AVGO’s YTD price performance is only 12.71%. Broadcom’s stock underperformed against the S&P 500’s YTD performance of 19.63%.

Growth At Reasonable Price

Broadcom’s 5-year average revenue CAGR is 29.68%. Its 5-year average EBITDA CAGR is 32.98%, EBIT 5-year average CAGR is 28.87%. Professional quantitative stock analysts like me use correlative and/or comparative data to find asymmetrical investing opportunities. AVGO is a buy because it has lower valuation ratios than Nvidia (NVDA) and Advanced Micro Devices (AMD). The forward GAAP P/E valuation ratio of AVGO is only 32.09. This is significantly lower than AMD’s 46.82 and NVDA’s 63.28.

There is unfair market bias because AVGO is valued at 7.60 P/S. AMD gets 9.59 and NVDA has 25.14. AVGO also deserves a higher forward Price/Book valuation. Broadcom has a well-diversified product portfolio. Unlike AMD, Broadcom is not competing against mega-cap giants Intel (INTC), and Nvidia.

The undervaluation of AVGO is temporary. Investors will eventually realize the potential upside of Broadcom. AVGO is a consistent dividend payer for the past 10 years. Its forward yield is 2.92% and its forward annual payout is $14.40.

A Safe Buy-and-Hold Investment

The quarterly revenue of Broadcom is $6.8 billion. Its quarterly net income is $1.9 billion. Broadcom’s total cash is $11.11 billion which could cover the interest payments from its total debt of $40.46 billion. AVGO’s net operating cash flow is $13.57 billion. This is higher than Broadcom’s 10-year average cash flow of $4.79 billion. AVGO’s current ratio is 2.4. Broadcom can cover its current liabilities with its current assets.

The Piotroski score is my favorite tool when evaluating the investment quality of stocks. Broadcom’s Piotroski score is 8. This is already excellent. The highest possible Piotroski score is 9.

Another important tool to use when evaluating stocks is Altman Z-score. It let us know the probability of bankruptcy of any company. AVGO’s Z-score is 5.6. Any company that has a Z-score of 4 or higher is considered in the safe zone. As for volatility, the 24-month beta of AVGO is only 1.31. Short interest is very low, 1.16%.

Conclusion

AVGO is a buy. Broadcom is highly profitable with diversified hardware and software products. AVGO is undervalued with great growth potential. The consistent dividend growth payment is another reason to buy Broadcom’s stock. Broadcom’s $40.46 billion total debt is a heavy load but it’s manageable. My one-year PT for AVGO is $560. AVGO could finish FY2021 with an EPS of $30.

My reiterated buy rating for Broadcom is aligned with the bullish algorithmic forecast from I Know First. The AI algorithm of I Know First gave AVGO a 1-year algorithmic forecast score of 170.09 with a predictability factor of 0.61.

Past Success With AVGO Stock Forecast

I Know First has been bullish on AVGO’s shares in past forecasts. On our June 25, 2020 premium article, the I Know First algorithm issued a bullish AVGO stock forecast. The algorithm successfully forecasted the movement of AVGO’s shares on the 1 year time horizons. AVGO’s shares rose by 48.84% in line with the I Know First algorithm’s forecast.

Here at I Know First, our AI-based stock forecast algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. The database used is 100% historical data free from human-derived assumptions and is constantly evolving with newly added data and adapting to changing market situations. Today, we are producing daily forecasts for over 10,500 assets such as forex forecasts, as well as gold predictions, while also providing the latest Apple stock news. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.