AVGO Stock Forecast: a Global Semiconductor Leader with Full Possibilities

This AVGO stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

This AVGO stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

Highlight:

- AVGO stock has risen by 14.2% since January 2021

- Broadcom’s Wi-Fi 6E breakthrough is a major tailwind for its growth

- Broadcom Inc. has a solid competitive financial advantage with a ROC ratio of 258.61% and operating margin of 25.55%, outperforming 98% and 90% of companies in the semiconductor industry

- With Broadcom’s innovation and competitive leadership, the target price for AVGO will hit $520 for the upcoming year

Overview of Broadcom Inc.

Broadcom Inc. designs, develops, and supplies a wide range of semiconductors and infrastructure software products. Broadcom offers semiconductor devices with a focus on complex digital and mixed-signal complementary metal oxide semiconductor-based devices and analog III-V based products worldwide. Its infrastructure software solutions enable customers to plan, develop, automate, manage, and secure applications across mainframe, distributed, mobile, and cloud platforms. The company was incorporated in 2018 and is based in San Jose, California. Since last July, Broadcom’s stock (NASDAQ: AVGO) has shot up 53.24% over this 1-year time.

Broadcom: An Expanding Semiconductor Leader

Broadcom Inc. has been a global leader with outstanding innovation and technology excellence. Its wide range of wireless networking products has long been worth noticing. Investors may give attention to Broadcom’s recent Wi-Fi 6E enhancement. On Jan 14, 2021, Broadcom announced that its BCM4389 chip enables the world’s first Wi-Fi 6E phone, the Samsung Galaxy S21 Ultra. Wi-Fi 6E, the latest generation of Wi-Fi, has enabled a greater speed and decreased latency by using an increase in spectrum bandwidth. As this breakthrough continues to open up in countries across the world, we can be optimistic to see remarkable profits and opportunities it can bring to Broadcom.

Additionally, one major customer of Broadcom is Apple. In 2020, Broadcom announced its $15 billion deal with Apple to sell its iPhone parts through 2023. With Apple’s plan to go all-in on 5G for its 2022 iPhone lineup, this will make Broadcom a crucial supplier for Apple’s 5G phones production and will also be a key driver to Broadcom’s revenue growth.

Another opportunity for Broadcom is its expansion in the infrastructure software segment through acquisition. In 2018, the company first acquired CA Technologies, aiming to become one of the world’s leading infrastructure technology companies. “With its sizable installed base of customers, CA is uniquely positioned across the growing and fragmented infrastructure software market, and its mainframe and enterprise software franchises will add to our portfolio of mission-critical technology businesses,” CEO Hock Tan stated. In 2019, Broadcom also completed the acquisition of Symantec Enterprise Security Business. The company’s acquisition strategy not only helps Broadcom’s infrastructure software expansion but also strengthens its position as one of the top infrastructure technology companies with a stronger customer base.

From the below chart, we can also see an optimistic sales growth Broadcom has achieved in the second quarter of 2021 as compared to the same period last year. In Q2 2021, Broadcom’s net revenue was 6.6 billion, up by 15% year on year. This rise in revenue was attributed to a strong 19.6% semiconductor solutions growth and a 4.4% infrastructure software increase.

(Figure 1: Net Revenue by Segments)

Broadcom’s Solid Financial Footing

According to Broadcom’s 10-Q form of Q2 2021, the company’s free cash flow is reaching $3.4 billion, increased by 15% compared to Q1. This free cash flow also accounted for half of its total revenue, which demonstrates that the company has enough cash to expand and develop new products. Moreover, Broadcom has paid $1.47 billion in dividends in Q2, around 43% of its free cash flow. This can suggest that the company has kept a sustainable dividend payout relative to its free cash flow. It is also a good sign of the company’s healthy financial status.

Next, we can select several comparable companies of Broadcom Inc. and the industry benchmark to evaluate its financial performance as a global leader in the semiconductor industry. These companies are Qualcomm Inc. (USD, QCOM), Archer-Daniels-Midland Co (USD, AMD), Micron Technology Inc. (USD, MU), NXP Semiconductors NV (USD, NXPI), and Microchip Technology Inc. (USD, MCHP).

According to GuruFocus, Broadcom Inc.’s ROC (Joe Greenblatt) ratio of 258.61% is the greatest among all its rivals we picked and the industry average. This ratio also outstripped 98% of companies in the semiconductor industry, indicating that the company is using its investments effectively to maintain and protect its long-term profits against its competitors.

(Figure 2: ROC)

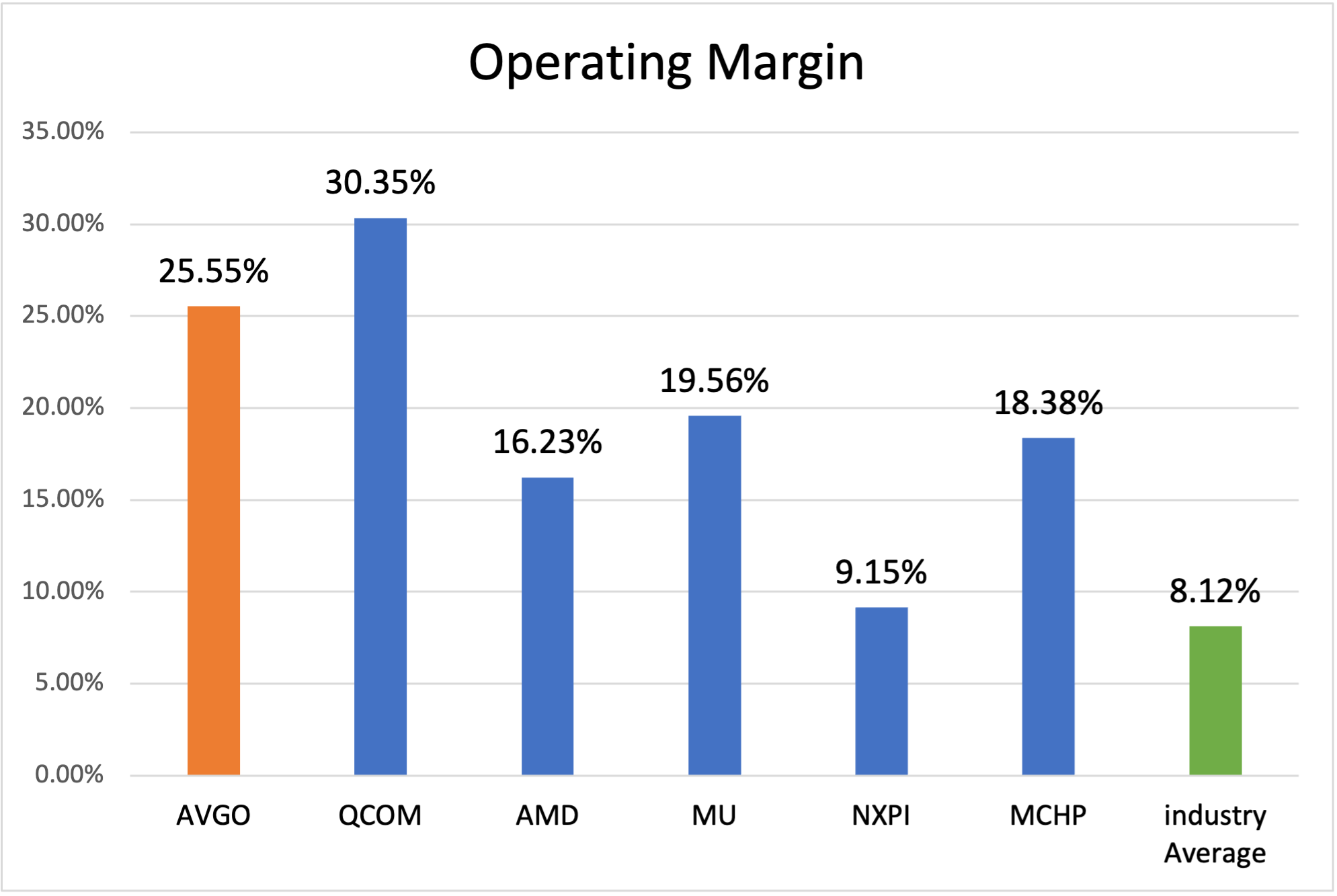

Besides, AVGO has an operating margin of 25.55%. Even though this ratio is not the highest one among the competitors we selected, AVGO’s operating margin is still ranked higher than 90% of companies in the industry, which can demonstrate Broadcom’s high profitability.

(Figure 3: Operating Margin)

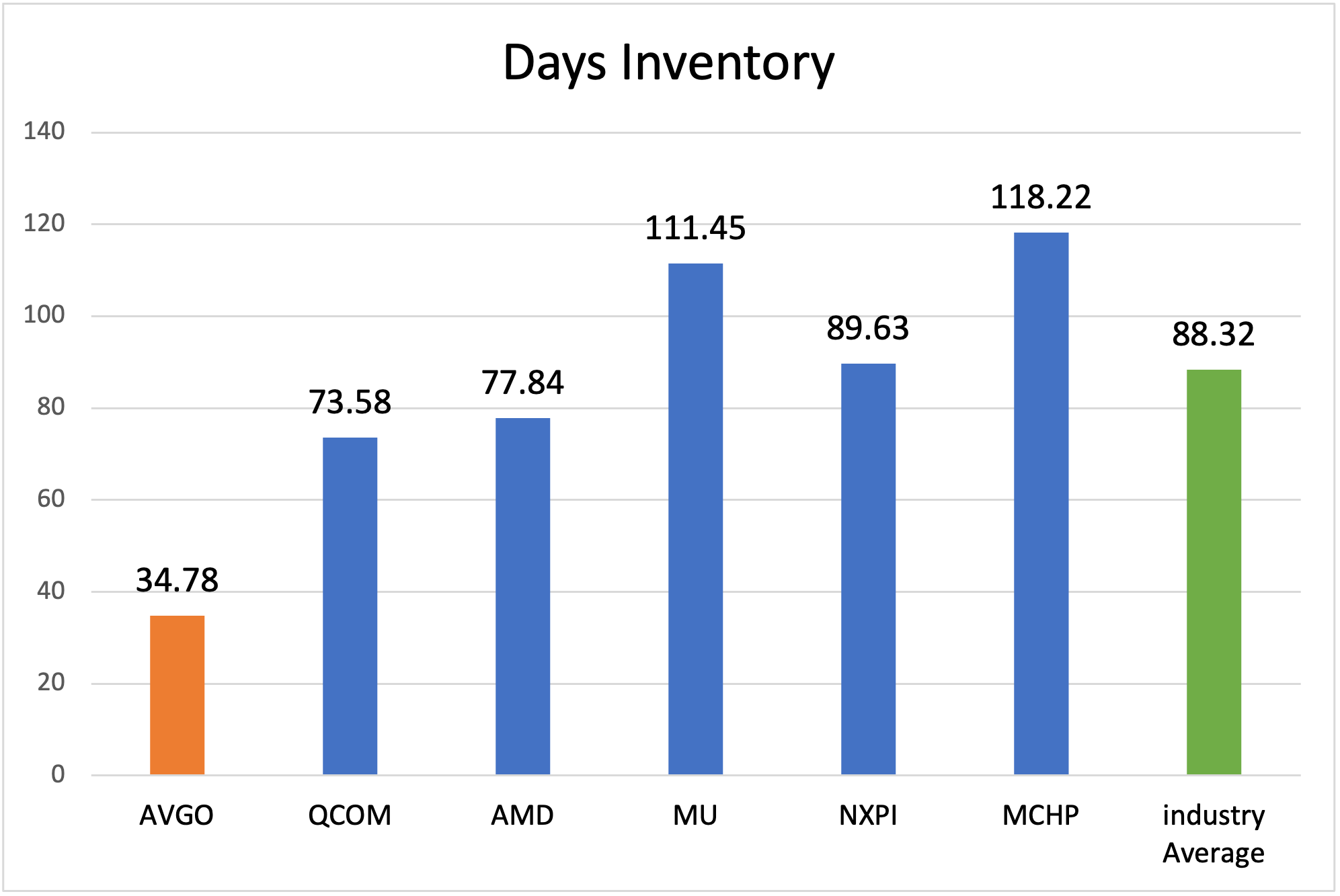

In addition, we can see that AVGO has the lowest days inventory, outperforming 86% of companies in the semiconductor industry. The lower the number is, the shorter the period that the company is able to turn its inventory into sales. Thus, this can demonstrate Broadcom’s excellent sales performance, and thereby, the lower risk of its stock.

(Figure 4: Days Inventory)

Furthermore, AVGO’s current P/B ratio of 8.31, P/S ratio of 8.09, and P/E ratio of 45.24 appear to be slightly overvalued against the semiconductor industry benchmark and some of its peers. Nevertheless, given the company’s technology leadership, its solid financial performance, and other factors we discussed, these price ratios can also represent and be in line with the company’s huge potential and fleeting growth.

(Figure 5: Price Ratios of Comparable Companies)

In addition, Figure 6 displays slightly rising trends on AVGO’s price ratios, which can also be seen as a sign of its potential growth. Therefore, AVGO is still a top-picking stock for investors.

(Figure 6: The Historical Dynamic of AVGO’s Price Ratios)

AVGO’s Targeted Stock Price Hit $520 in 2022

From the above price chart, AVGO’s current stock price is above all three moving averages (the purple line is MA-50, the orange line is MA-100, and the blue line is MA-200). We can also notice the Bollinger Bands getting narrowed in recent months, indicating a period with low volatility, and can be seen as a potential sign for future increased volatility and possible trading opportunities.

From a long-term perspective, AVGO’s stock price has an overall upward trend and is also constantly above its MA-200 line in this 1-year time horizon. All the indicators can demonstrate AVGO’s long-term growth potential and a strong-buy position for investors. Therefore, my AVGO stock forecast is that the target price for AVGO in 2022 will hit $520 with a return of 7.13%, and it also has great potential to go higher depending on its business expansion and technological advancement as we discussed earlier.

Conclusion

In a nutshell, Broadcom Inc. is a global semiconductor company that can lead the industry into the future. Broadcom still has a lot of room for its growth, supported by its continued technological development, its expansion through acquisitions, and its robust financial position in the semiconductor industry. Therefore, we can believe that Broadcom will remain a promising long-term investment as its future growth is full of potential.

From I Know First’s forecast above, AVGO stock has positive signals for all long-term time horizons from 1 month to 1 year, which can be a sign of its potential growth. More notably, we can notice a very strong signal of 208.69 with predictability of 0.56, indicating again a strong-buy position of AVGO.

Past Success with AVGO Stock Forecast by I Know First

On July 15th, 2021, I Know First’s 52 Week High Stocks package had successfully predicted 8 out of 10 movements on a 1-year time horizon and obtained great returns. AVGO stock forecast was one among the recommended long-position stocks that saw a notable return of 51.50%, which outperformed the S&P 500 benchmark (36.36%) with a market premium of 15.14%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.