AVGO Stock: Broadcom Deserves A Price Target of $360

The AVGO stock article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The AVGO stock article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- Trump is still ramping his anti-China rhetoric but analysts and the quant rating AI of Seeking remains very bullish on Broadcom.

- Broadcom makes most of its revenue from China. Chinese factories are now back to full operations.

- The greater demand for internet bandwidth is a tailwind for Broadcom.

- The new U.S. sanctions against Huawei is another tailwind for Broadcom.

- Broadcom’s long list of acquisitions has made it pandemic-resistant. Its products and services now cater to various industries.

The stock of Broadcom (AVGO) already has a 1-month price return of +13.33%. I am still endorsing AVGO as a strong buy. Broadcom is the no. 6 company involved in the global semiconductor industry. Broadcom also boasts 38 acquisitions. AVGO is a buy because Broadcom’s penchant for acquiring other companies has made the company more relevant in the $500 billion semiconductor industry.

The chart above also states that Seeking Alpha’s Quant AI rating system is very bullish on AVGO. Wall Street analysts and Seeking Alpha authors are all bullish on Broadcom. I checked my employer’s (I Know First) forecast and it also has a super bullish one-year forecast score for AVGO. Everybody is optimistic on Broadcom. I am therefore giving AVGO a 1-year price target of $360.

The universal optimism over AVGO is thanks to its well-diversified products and services. The screenshot below highlights Broadcom’s wide products for data center storage and connectivity. This product segment alone already gives AVGO a decent long-term tailwind. As per Technavio’s forecast, the global data center storage business is growing at 28% CAGR. Technavio expects this particular industry to grow by $126.3 billion between 2020 and 2024.

The new U.S. sanctions against Huawei is another strong long-term tailwind for Broadcom’s Ethernet switches and fiber optic for broadband internet and high-speed networking.

The international ostracization of Huawei is also a massive boost to Broadcom’s 5G strategy. The $15 billion chip supply deal with Apple (AAPL) announced last January obviously covers 5G products. Nokia (NOK) has also recently hired Broadcom to supply it with 5G chips. The many acquired subsidiaries of Broadcom perfectly complements its 5G efforts. The chart below convinced me that 5G applications will boost Broadcom’s fortunes for many years to come.

Broadcom has been a key player in the data center industry since 1990s. More than 50% of 5G related IT hardware spending will be from data centers. Investors, analysts and stock prediction AI algorithms are bullish on AVGO because Broadcom is well-positioned to prosper from the expected $326 billion 5G-related IT hardware spending until 2025.

Why AVGO Has More Upside Potential

My takeaway is that AVGO deserves higher valuation ratios. The super-diversified products and services of Broadcom should be higher. It is a stock market aberration that Advanced Micro Devices (AMD) and Nvidia (NVDA) has far higher valuation ratios than AVGO. This gross relative undervaluation will eventually get corrected. It is better to go long on Broadcom while the stock market is not yet giving it fair valuation.

AVGO’s TTM Price/Sales valuation is only 5.46. This is way below AMD’s 8.48 and Nvidia’s 19.76. This undervaluation is not fair. Broadcom actually outpaced the growth performance of AMD and Nvidia. The 5-year Revenue CAGR of Broadcom is 30.24%. This is higher than AMD’s 7.11%, and Nvidia’s 20.02%. Investors should give a higher valuation to the company that is producing the best sales growth performance.

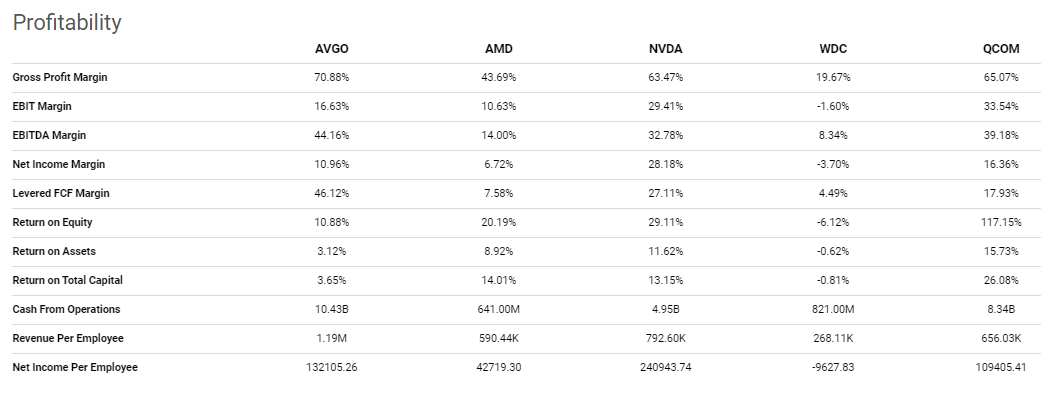

In terms of profitability, AVGO also touts better profitability than most of its Semiconductor sector peers. Broadcom’s gross profit margin is 70.88%. This is much higher than AMD’s 43.69% and WDC’s 19.67%. Broadcom’s net income margin of 10.96% is also higher than that of WDC and AMD’s. Broadcom’s wide array of products and services also helps it generate a Cash From Operations of $10.43 billion. This is higher than NVDA’s $4.95 billion, and QCOM’s $8.34 billion.

AVGO is a buy because it made a net profit in 9 nine years out of the past decade. It is always best to invest in profit-making companies.

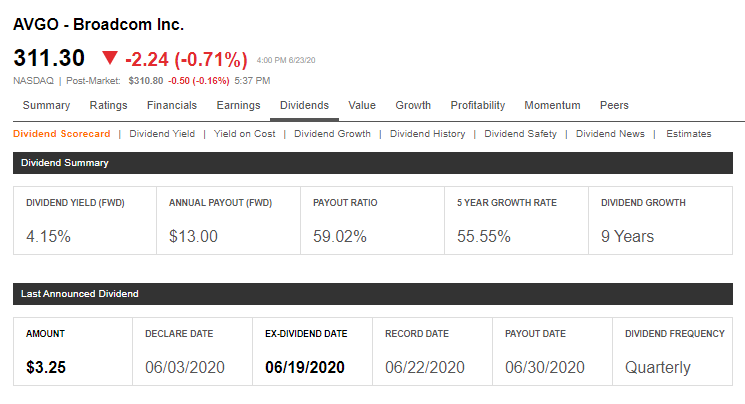

Being profitable has been helped Broadcom increased its dividend for the past five years. AVGO is a buy because its profitable enough that it can do a forward dividend yield of 4.15%. Any company that’s doing a 5-year revenue of 30% and also growing its dividend payments by 55.55% for the past five years is a true golden value investment.

Conclusion

The only unattractive feature of Broadcom is its huge total debt load of $46.51 billion. AVGO’s total cash and ST investments is only $9.2 billion. AVGO’s effective interest rate on its debt is 4.07%. This 4.07% figure is still lower than AMD’s 7.75. AVGO is a buy because it generates far more cash and managed to get a more affordable to maintain debt.

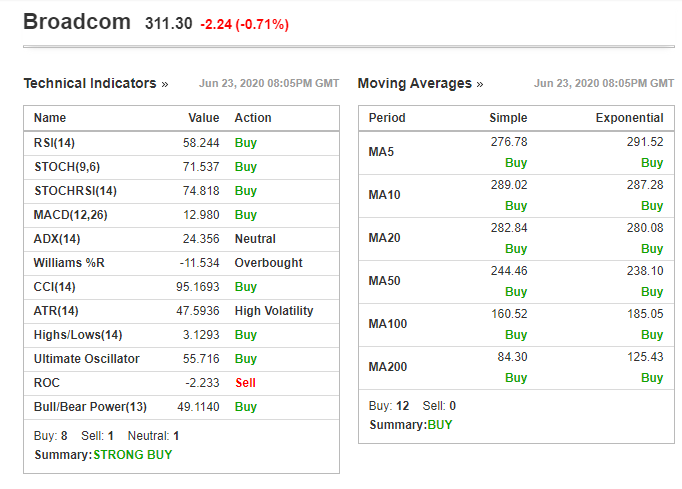

Broadcom’s fast revenue growth over the last five years is thanks to its debt-causing acquisition spree. Using debt to grow your company’s revenue at 30% CAGR for the past five years is a valid business tactic. The company is now so big and well-diversified that it can easily manage its $46 billion total debt. Broadcom is a safe long-term investment because despite of its huge debt, it still managed to produce a TTM levered free cash flow of $10.59 billion. Lastly, the monthly technical indicators and moving averages of AVGO still produced a strong buy recommendation.

Past I Know First AVGO Stock Forecast Success

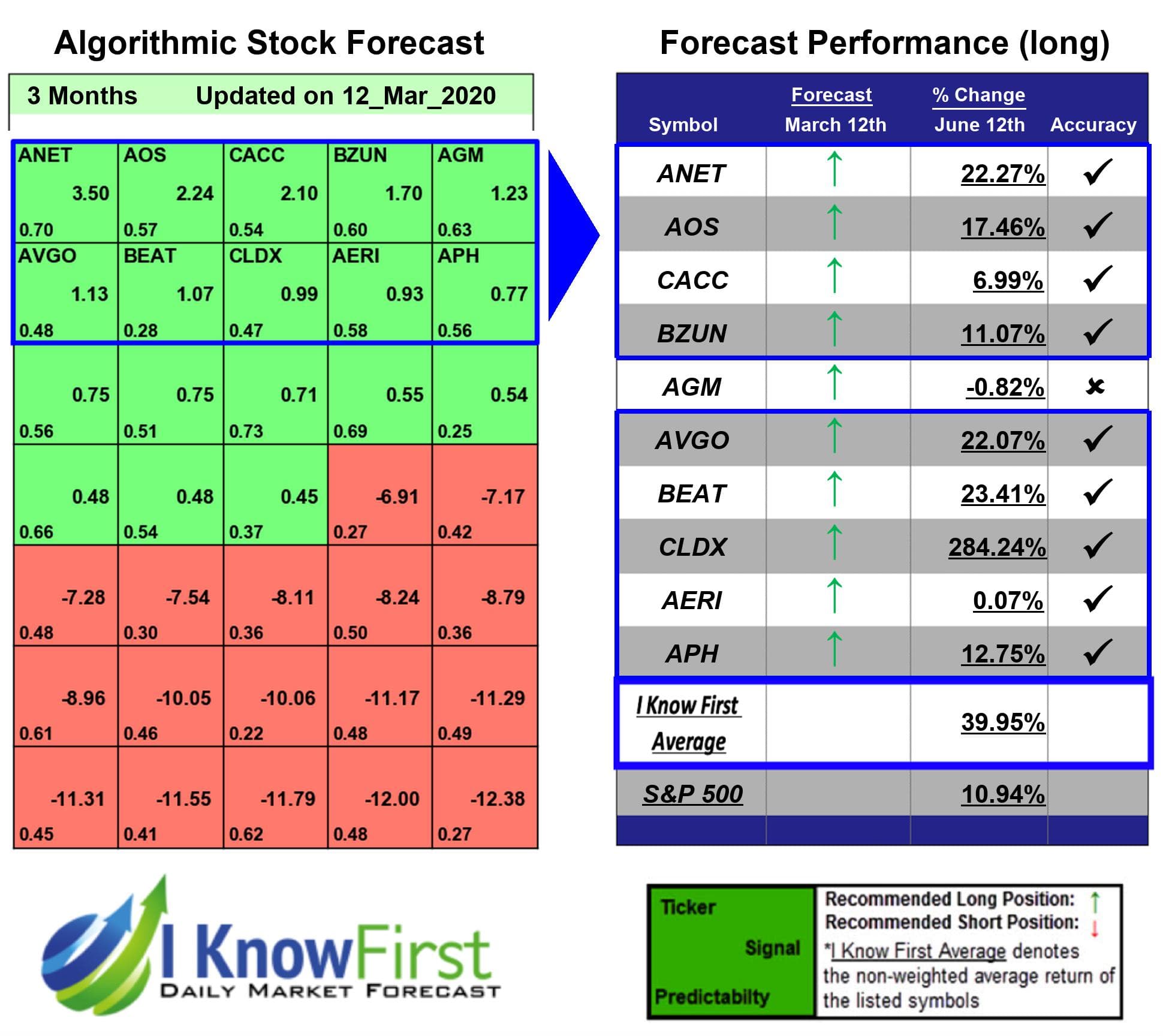

I Know First gave bullish AVGO stock recommendation in the past. On March 12 2020, the I Know First algorithm issued a bullish 3-month AVGO stock recommendation and the algorithm successfully forecasted the movement of the AVGO stock. After 3 months, AVGO shares rose by 22.07% in line with the I Know First algorithm’s forecast. See chart below.

Here at I Know First, our algorithmic trading AI have modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing machine learning stock prediction, for example aggressive stocks, S&P 500, forex forecast as well as Apple stock updates. Today, we are producing artificial intelligence stock prediction for over 10,500 assets, including commodity forecasts and gold forecast. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast