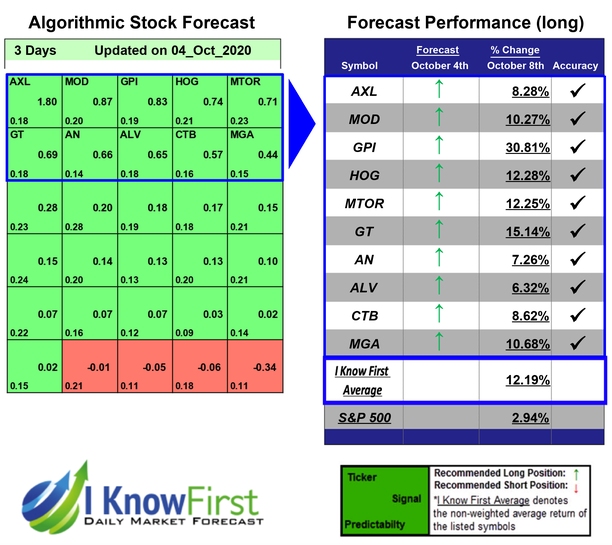

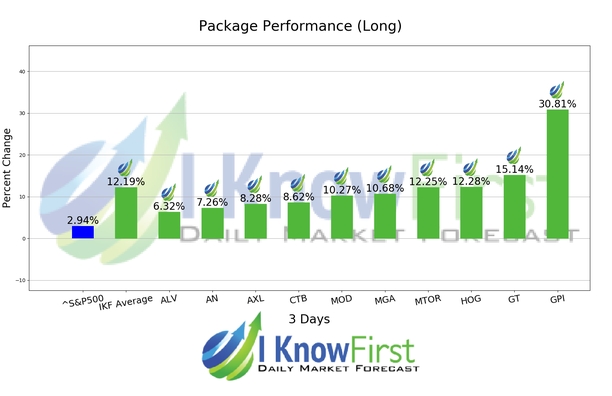

Automotive Stocks Based on Big Data Analytics: Returns up to 30.81% in 3 Days

Automotive Stocks

This Automotive Stocks forecast is designed for investors and analysts who need predictions of the best-performing stocks in the automotive industry (see Automotive Stocks Package). It includes 20 stocks with bullish and bearish signals and indicates the best auto stocks to trade:

- Top 10 Automotive stocks for the long position

- Top 10 Automotive stocks for the short position

Package Name: Automotive Stock Forecast

Recommended Positions: Long

Forecast Length: 3 Days (10/4/2020 – 10/8/2020)

I Know First Average: 12.19%

Several predictions in this 3 Days forecast saw significant returns. The algorithm had correctly predicted 10 out 10 stock movements. The greatest return came from GPI at 30.81%. Other notable stocks were GT and HOG with a return of 15.14% and 12.28%. The Automotive Stock Forecast package had an overall average return of 12.19%, providing investors with a premium of 9.25% over the S&P 500’s return of 2.94%.

Group 1 Automotive, Inc. (GPI), through its subsidiaries, operates in the automotive retail industry. It sells new and used cars, light trucks, and vehicle parts; arranges vehicle financing; sells service and insurance contracts; and provides automotive maintenance and repair services.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.