Autodesk Stock Forecast: Prediction Missed, but Large Potential to Grow

The article was written by Kun Qiu, a Financial Analyst at I Know First.

Summary

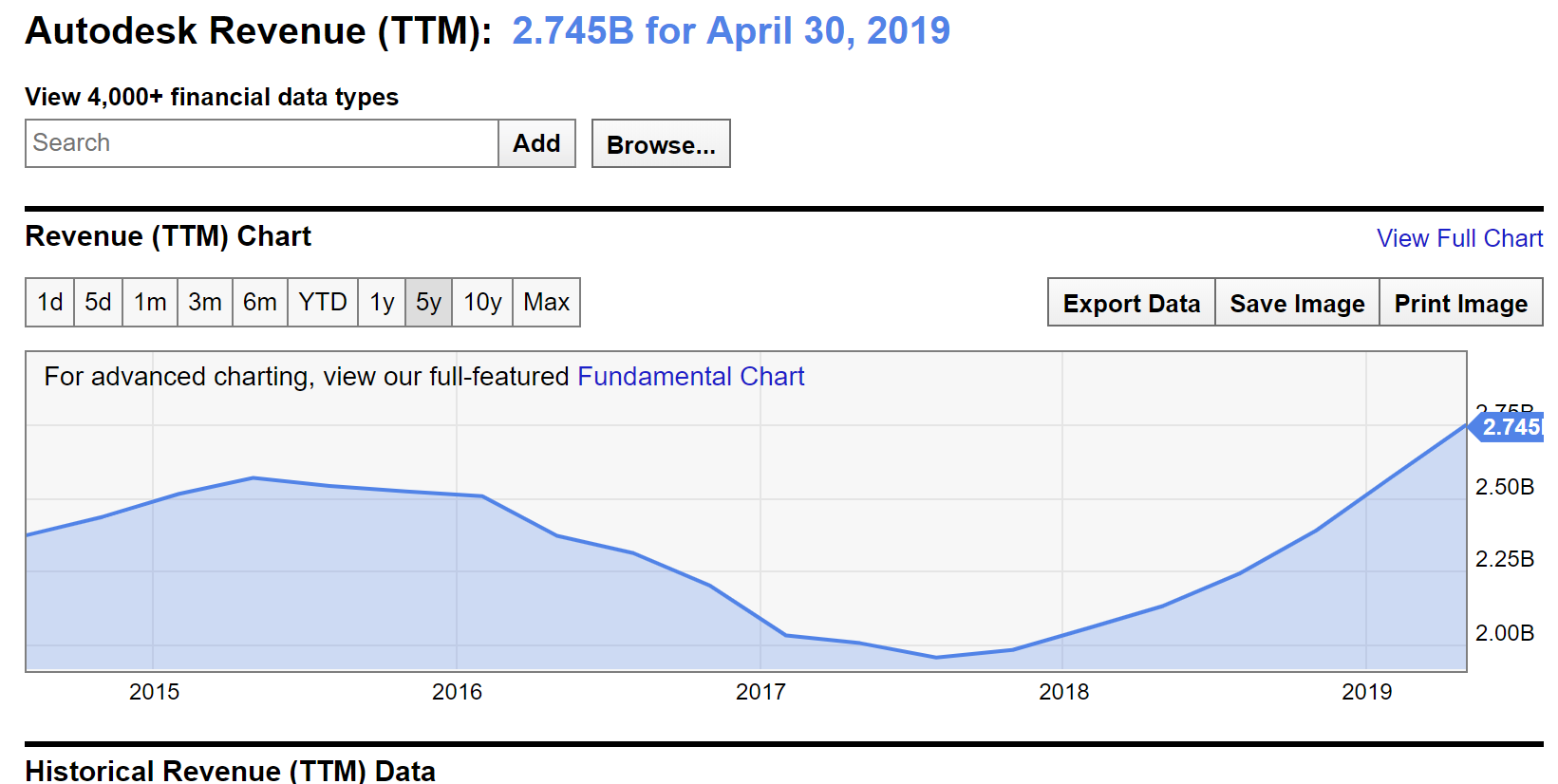

- Autodesk’s strategic shift from traditional software provider to innovation company was proven effective since the company’s revenue was steadily increasing.

- Autodesk failed to reach the consensus EPS anticipation, but the non-GAAP earnings of fiscal 2020 first quarter per share $0.45 is far beyond $0.06 for the same quarter last year.

- Autodesk’s stock price still has a large potential to grow if Autodesk could maintain its leading role in CAD industry and apply its core strategy successfully.

Autodesk Stock Forecast

Autodesk is an American multinational software corporation, recognized as the global leader in 3D design, engineering and entertainment software and services. It offers productive business solutions through powerful technology products and services. The software industry has undergone a transition from developing and selling perpetual licenses and on-premises products to cloud, mobile and social applications. To address this shift, Autodesk made a strategic decision to shift its business model from selling perpetual licenses to selling subscriptions. It has put great efforts to shifting itself to an innovative company from a traditional software provider.

In 2018, Autodesk acquired Assemble System Inc, PlanGrid Inc and BuildingConnected Inc in order to execute its adjustment strategy. The $275 million acquisition of BuildingConnected came exactly one month after $875 acquisition of PlanGrid, which means Autodesk paid $1.15 billion in one month for the startup companies. Such an aggressive strategy may be beneficial to the company’s strategy, but meanwhile it may adversely affect the financial performance. In the first quarter of fiscal year 2020, Autodesk missed its earnings prediction, resulting in a decrease in its stock price. In this article, we will operate strategic analysis and ratio analysis for Autodesk to predict how it will perform in the near future.

SWOT analysis for Autodesk

Strengths:

- Autodesk is the leading company in the fast-growing computer aided design industry.

- Company’s shift to a new business model makes positive outcomes currently.

According to Datanyze market research report, Autodesk accounts for 73% in total in CAD market, among which AutoCAD ranks first with 54%, followed by Autodesk Revit with 11%. With absolute advantage in market share, Autodesk now is recognized as the leading company in this industry. In February 2019, ReportLinker published its newest industry research report Global Computer-Aided Design (CAD) Market: Focus on Product Type, Operating System, and Application – Analysis and Forecast, indicating that the market is estimated to witness growth at a CAGR of 6.35% over the period of 2018 to 2028. As a prominent company in the industry, Autodesk has a large room for growth in the long run.

Besides, Autodesk’s strategy to shift business model brought about a preliminary positive outcome. In June 2017, Autodesk commenced a program to incentivize maintenance plan customers to move to subscription plan offerings. According to Autodesk’s fiscal year 2019 annual report, over 794,000 maintenance plan customers have converted to subscription plan offerings since the program was launched. In the near future, Autodesk plans to convert the remaining 796,100 maintenance plan customers to subscription through this program.

It is also presented in the latest annual report that during fiscal 2019, Autodesk’s net revenue increased 25%, mainly resulted from a 102% increase in subscription revenue. If this upward trend can be retained properly, Autodesk has an outstanding development prospect.

Weaknesses:

- Too much investment on R&D may result in unsatisfying financial performances.

- Obstacles in pre-evaluating financial performances and customers’ satisfaction towards future products.

From the 2019 fiscal year annual report, we can find that R&D expenditures for Autodesk were $725.0 million or 28% of fiscal 2019 net revenue, $755.5 million or 37% of fiscal 2018 net revenue and $766.1 million or 38% of fiscal 2017 net revenue. These numbers are far beyond 23%, the median ratio of R&D to revenue of SaaS companies in 2018. Excessive investment in R&D may adversely affect the company’s financial performance. In addition, since there are rapid technological changes happening on a daily basis at present, the strategy to develop and introduce new products and services may not be successful when Autodesk fail to develop the necessary services more quickly than its competitors. It also causes the concerns that such investment may not result in corresponding revenue if new products and services do not meet customers’ expectations.

Besides, Autodesk may not be able to predict subscription renewal rates and their impact on our future revenue and operating results. Since Autodesk just changed their business model and began the subscription services for about 5 years, it may have difficulties in predicting the customers’ renewal rates. The loss of customers together with the miss of revenue prediction leads to the decline of stock prices.

Opportunities

- Core strategy: transfer customers from AutoCAD to use cloud-based service.

- Recent acquisition and strategic investment prepares for the cloud-based service environment.

At present, a critical component of Autodesk growth strategy is to have customers of AutoCAD and AutoCAD LT products expand their portfolios to include other offerings and cloud-based functionality. If this strategy can be implemented as planned, it will help Autodesk generate stable revenue in the future.

On July 10, 2019, Autodesk made a strategic investment to Factory_OS company, a leading startup in revolutionizing home construction by building multifamily homes more affordable and sustainable. In 2018, Autodesk acquired PlanGrid Inc, which now becomes an essential product in Autodesk. It is a cloud-based field collaboration software that provides teammates’ access to construction information in real-time.With PlanGrid technology, any construction team member can manage and update blueprints, specs, photos, requests for information (RFIs), field reports, punchlists and other critical jobsite data. Since Autodesk has a strategy to build cloud-based services for CAD practitioner, PlanGrid is of great importance and has the potential to be the next core service provided by Autodesk.

Threats

- Limited barrier to enter CAD market, strong competitors such as Apple and Adobe.

- Global economy and political conditions could further impact the company’s performance.

Autodesk’s competitors consists of large and global companies and small, geographically focused firms, including Adobe, Apple and AVEVA. Competitions become even more intensive for the fact that the software has limited barrier to entry. What’s more, the industry is presently undergoing a platform shift from the personal computer to cloud and mobile computing. This shift further lowers barriers to entry and poses a disruptive challenge to established software companies.

Another big threat Autodesk is facing is the global economy and political conditions. Since the customers of Autodesk come from all over the world, if the economic growth of certain countries where Autodesk do business slows or regional economy recessions taking place, customers may delay or even cancel the subscriptions from Autodesk, thus adversely affecting the company’s revenue.

Autodesk Financial Performance

On May 23 2019, Autodesk published its fiscal 2020 first quarter result. The non-GAAP was $0.45, which missed the consensus EPS prediction, but was much better than $0.06 in the first quarter last year. Same condition occurred in the company’s revenue. The total revenue increased by 31% to $735 million, though it was slightly lower than analyst’s expectations.

For fiscal year 2020 second quarter, Autodesk predicts its revenue between $782 and $792 million. Non-GAAP earnings are forecasted to be 59 to 63 cents per share while the consensus EPS prediction is $0.62 dollars.

Conclusion for Autodesk Stock Forecast

Although Autodesk missed the consensus EPS prediction last quarter, it still has a great potential to reach the following quarter prediction. Autodesk also published its financial forecast for full year fiscal 2020, which shows that revenue is anticipated to increase by 26%-28% and non-GAAP EPS is predicted to be $2.71 – $2.90. This forecast accorded with the report Autodesk published in February 2019, which indicates that Autodesk still have a positive outlook for the company’s future performance.

Besides, the company’s strategy is proven useful since the acquisition of PlanGrid as part of cloud-based collaboration service saw an outstanding outcome up to now. Based on these facts, I personally give Autodesk a bullish outlook.

According to Yahoo Finance, the average analyst price of Autodesk is $187.33, slightly more than current price ($173.71). The majority, about 83% of analysts give a “Buy” or “Strong Buy” for Autodesk stock forecast.

Current I Know First Autodesk Stock Forecast

The I Know First machine learning algorithm has already made a forecast on 17 July 2019 with a positive outlook for ADSK stock over all time horizons. I Know First forecast is the most bullish for the 1-year period with a strong signal of 204.37 and predictability indicator of 0.74.

Past I Know First Success With Autodesk Stock Forecast

On May 13 2018, I Know First published a bullish 1-year Autodesk stock forecast. Since then, ADSK stock price had seen a increase of 24.78%, from $136.99 to $174.33, highlighting another success of I Know First’s algorithm.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.