Algorithmic Trading: The New I Know First Interactive User Interface

If you are a monthly subscriber and want to receive these features simply contact our analysts HERE. They will help you with the upgrade and assist you with any remaining questions. Existing annual subscribers can add the new features free of charge, please also contact our analysts for assistance with it.

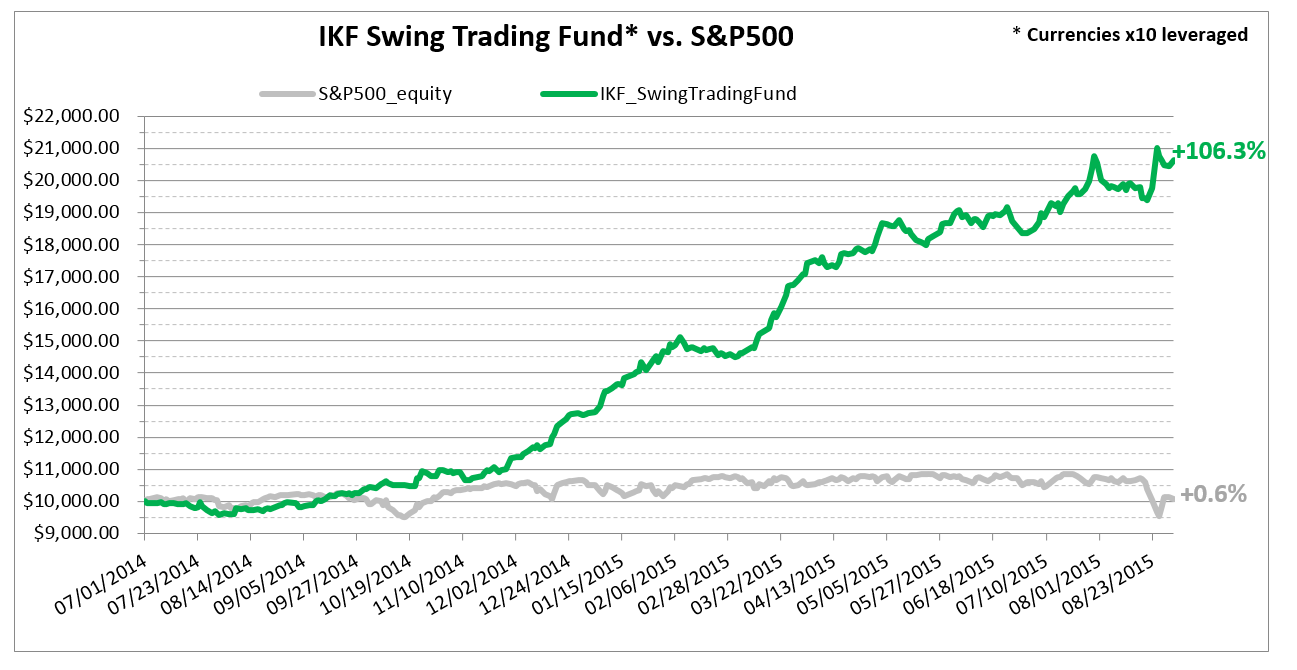

Algorithmic Trading: Hedge Fund Model- Daily Re-Adjustment Swing Trading

Following the development of Dr. Lipa Roitman’s understanding of relying on the 5 day simple moving average as a secondary trigger for entry and exit, the I Know First R&D team has developed a complementary model to support his thesis. The results were positive, and incorporating the 5 day SMA trigger allows us to design day trading strategies which further enhance returns and reduce risks. The overall return in the one year period from July 1st, 2014 to August 30th, 2015 is 106.3% while the S&P500 rose by 0.6% during the same period.

Stock Picking Based On Self-Learning Algorithm: Up To 20.40% Return In 3 Days

Package Name: Top 10 Stocks

Forecast Length: 3 Days (9/30/2015 – 10/2/2015)

I Know First Average: 9.83%

Forecast Length: 3 Days (9/30/2015 – 10/2/2015)

I Know First Average: 9.83%

Read The Full Forecast

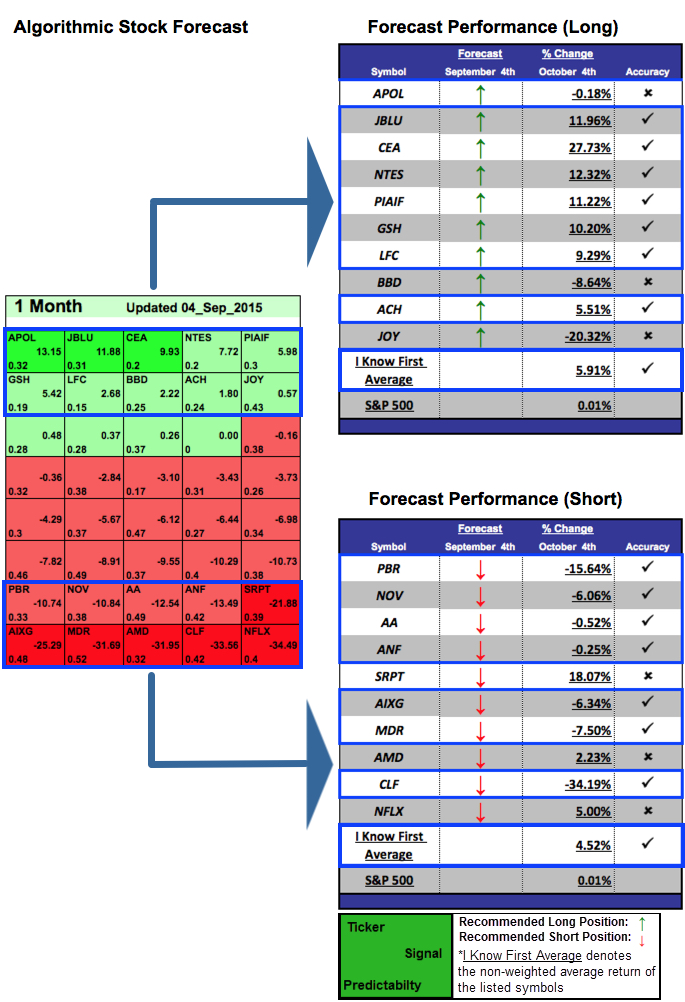

Quantitative Trading: Up To 34.19% Return In 30 Days

Package Name: Risk-Conscious

Forecast Length: 1 Month (9/4/2015 - 10/4/2015)

I Know First Average: 5.91% (long) & 4.52% (short)

Forecast Length: 1 Month (9/4/2015 - 10/4/2015)

I Know First Average: 5.91% (long) & 4.52% (short)

See The Full Forecast

Systematic Trading: Up To 104.45% Return In 1 Month

Package Name: Stocks Under 10 Dollars

Forecast Length: 1 Month (8/26/2015 - 9/26/2015)

I Know First Average: 16.29% Long; 5.18% Short

Forecast Length: 1 Month (8/26/2015 - 9/26/2015)

I Know First Average: 16.29% Long; 5.18% Short

Read The Full Forecast

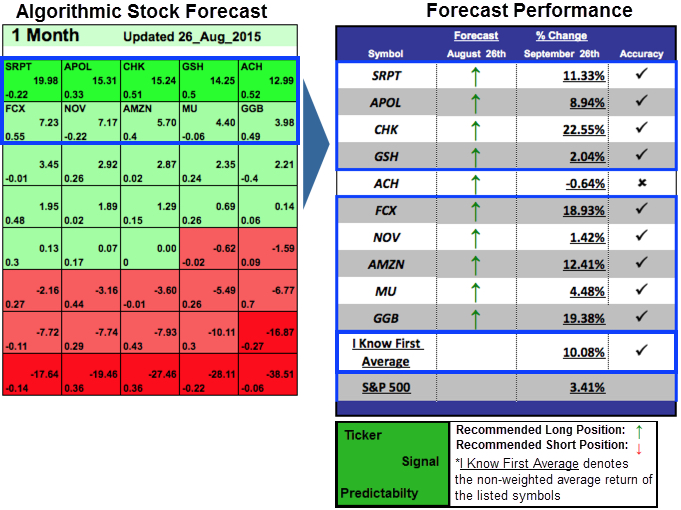

Stock Market Algorithm: Up To 22.55% Return In 1 Month

Package Name: Risk-Conscious

Forecast Length: 1 Month (8/26/2015 - 9/26/2015)

I Know First Average: 10.08%

Forecast Length: 1 Month (8/26/2015 - 9/26/2015)

I Know First Average: 10.08%

See The Full Forecast