Stock Market Forecast: Chaos Theory Revealing How the Market Works

I Know First Research | May 8th 2014

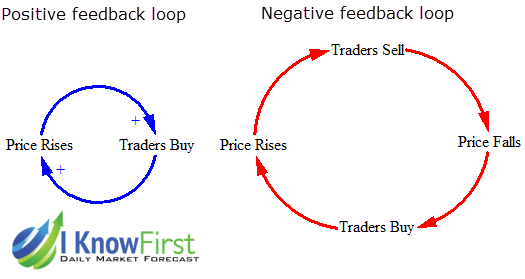

How Can We Predict the Financial Markets by Using Algorithms? Common fallacies about markets claim markets are unpredictable. However, chaos theory together with powerful algorithms proves such statements are wrong. Markets are chaotic systems with complex dynamics, yet to a certain extent we can make valid stock market forecasts. Using these forecasts generated by cutting-edge predictive algorithms together with a careful risk management strategy may give a trader a significant competitive advantage.

Co-Founder & CTO of I Know First Ltd. With over 35 years of research in AI and machine learning. Dr. Roitman earned a Ph.D from the Weizmann Institute of Science

Co-Founder & CTO of I Know First Ltd. With over 35 years of research in AI and machine learning. Dr. Roitman earned a Ph.D from the Weizmann Institute of Science