ATI Stock Forecast: 9.09% Gain In 7 Days

ATI Stock Forecast

ATI Stock Forecast

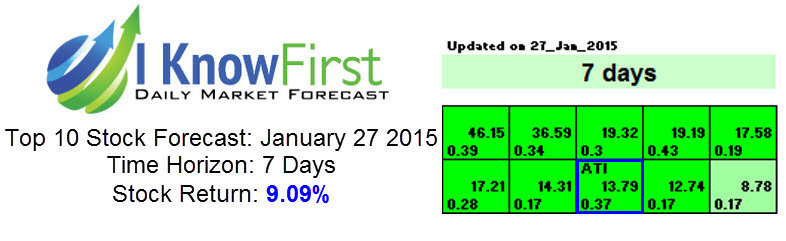

Allegheny Technologies Incorporated (ATI) was a top stock pick based on predictive algorithm recommended to I Know First subscribers on January 27th for the 7-day time horizon. ATI had a signal of 13.79 and a predictability of 0.37. In accordance with the algorithm, the company reported short-term capital gains of 9.09%.

ATI was part of the stock forecast that can be found in the “Top Tech Stocks” Package.

The full Top 10 Small Cap Stocks forecast includes a daily prediction for a total of 20 stocks with bullish and bearish signals:

- Top ten stocks picks to long

- Top ten stocks picks to short

Allegheny Technologies Incorporated (ATI) is an American specialty metals company headquartered in Pittsburgh, Pennsylvania, in the United States. ATI is one of the largest and most diversified specialty metals producers in the world and it’s key markets are aerospace and defense, oil & gas, chemical process industry, electrical energy, and medical.

Allegheny Technologies (NYSE:ATI) last issued its quarterly earnings data on Tuesday, January 20th. The company reported $0.18 earnings per share for the quarter, beating the analysts’ consensus estimate of ($0.01) by $0.19. The company had revenue of $1.05 billion for the quarter, compared to the consensus estimate of $1.09 billion. During the same quarter last year, the company posted ($0.08) earnings per share. On average, analysts predict that Allegheny Technologies will post $1.32 earnings per share for the current fiscal year.

Allegheny Technologies (NYSE:ATI) has been given a consensus recommendation of “Hold” by the thirteen analysts that are presently covering the stock. Two equities research analysts have rated the stock with a sell recommendation, five have assigned a hold recommendation and five have given a buy recommendation to the company. The average 1-year price target among brokers that have issued a report on the stock in the last year is $41.40.

ATI Stock Forecast

ATI Stock Forecast