ASML Stock Forecast: Strong Top-line Results

This ASML Stock Forecast article was written by Yu Yao – Financial Analyst at I Know First.

Summary

- Q2 2022 earnings did not meet analysts’ expectations but the stock rebounded

- The demand is expected to be strong according to Peter Wennink, CEO of ASML

- Valuation model indicates that ASML is currently undervalued with a 16% upside potential

Company Overview

Founded in 1984 and headquartered in the Netherlands, ASML Holding N.V. (ASML) develops, produces, promotes, sells, and services sophisticated semiconductor equipment solutions, including photolithography, metrology, and inspection-related systems, for memory and logic chip manufacturers. ASML is the leader in photolithography. Photolithography or lithography is the process in microchip manufacturing that uses light to pattern parts on a silicon wafer. As shown in the figure below, ASML’s customers include Intel, Samsung, and TSMC, the world’s largest contract chipmaker.

Is ASML a Good Business?

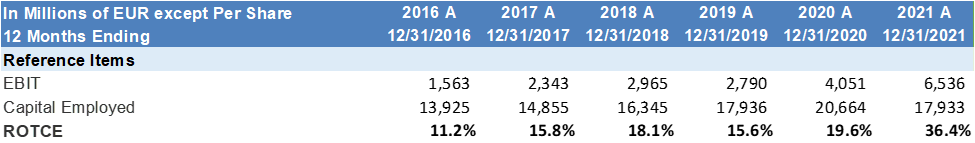

Based on the “Good Business” framework, ASML meets all the criteria as shown in the figure below. As the largest semiconductor machinery manufacturing company in the world, ASML holds about 8.2% market share, followed by Tokyo Electron (7.0%) and Applied Materials (5.2%) according to IBIS World.

According to IBIS Semiconductor Machinery Manufacturing Industry Report, the industry grew at a CAGR of 2.1% from 2016 to 2021 and is expected to have a CAGR of 4.2% from 2021 to 2026, meeting the stable growth threshold. As shown in the figure above, ASML grew at a CAGR of 20% for the last five years, much faster than the industry growth rate. However, the competition in the industry is high and increasing, and ASML is managed to maintain market shares. ASML has average cyclical risks and strong positive free cash flow that can be used for strategic acquisition and research and development investments.

As shown in the figure above, the returns on capital employed of ASML have been improving. According to Gurufocus, the ROCE of ASML in the most recent quarter was 38.24%.

Overall, ASML is good business with strong barrier to entry and high revenue growth rates.

ASML Delivered Good but Not as Expected Quarterly Results

On July 20, 2022, ASML published its quarterly results. Revenue for Q2 2022 was €5.4 billion, representing 54% growth quarter-over-quarter and 35% increase year-over-year. The revenue guidance for the next quarter is between €5.1 billion and €5.4 billion with a gross margin between 49% and 50%. The full-year revenue growth is expected to be about 10%.

The gross margin improved by just 10 bps from last quarter due to inflation. The quarterly net income reported was €1.4 billion, indicating a 103% increase quarter-over-quarter and 36% growth year-over-year. EPS grew from €1.73 to €3.54, representing a 105% increase quarter-over-quarter and 40% increase year-over-year.

Even though ASML delivered great top-line results, it still missed analysts’ expectations on EPS by 1% as shown in the figure above. However, the stock shoots up 9.3% since the earnings release.

The Demand for ASML Products Is Still Strong

ASML, as the market leader in semiconductor machinery manufacturing, has been doing well since the start of the pandemic due to the global chip shortage. According to Peter Wennink, the president and CEO of ASML, the demand for ASML products is still strong and the company does not see any demand reduction in the future. In fact, the production capacity of ASML is lower than the demand. ASML reported record high net bookings in Q2 2022. Net bookings soared over 21% to €8.5 billion from €7 billion last quarter.

Valuation Model Indicates ASML is Undervalued

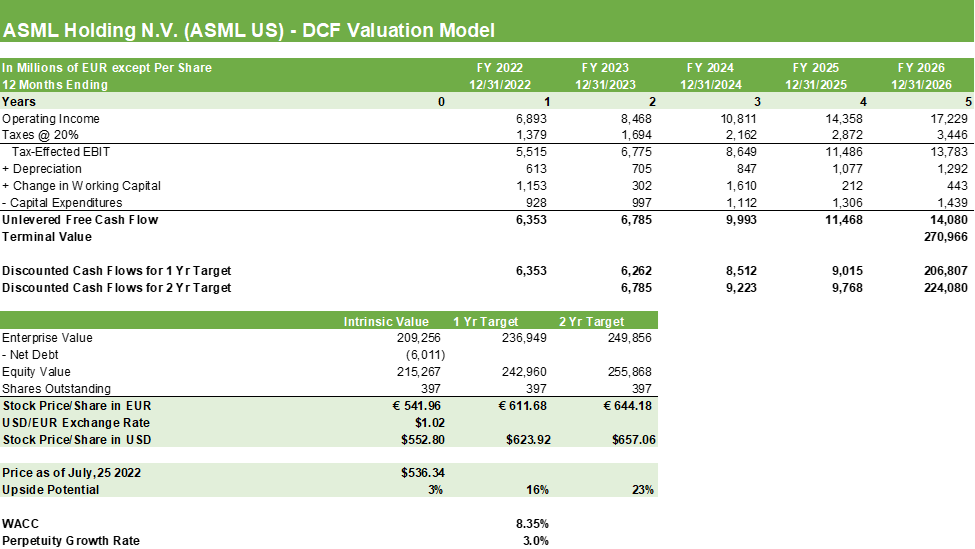

Based on a five-year DCF model shown in the Figure below, the one-year target price of ASML stock is $623.92, inferring a 16% upside from the current price of $536.34 as of July 25, 2022. When comparing the current market price to the intrinsic value, ASML is slightly undervalued as shown in the Figure above.

The main assumptions made are revenue growth rates and margins based on historical data and macroeconomic expectations. The revenue growth rate assumption for 2022E is 10% and the gross margin is 50% based on company guidance. The tax rate is assumed to be 20%. Beta used to calculate the cost of equity by using CAPM is 1.1 according to Yahoo Finance. WACC is 8.35. The perpetuity growth rate assumption is 3%, which is slightly lower than the US GDP growth rate average.

As shown in the figure above, ASML has higher than average multiples, making it more expensive than its peers. But ASML has much better margins than its competitors’ average. Additionally, its ROE and ROCE are all higher than the average. ROA is slightly lower than the average.

Based on Yahoo Finance coverage for ASML as shown in the figure below, out of 7 analysts: 5 take Strong Buy and Buy positions, 2 take the Hold position, and none take the Underperform or Sell position. The analysts’ community puts the average target price for the stock at $735 while it is currently traded at $534 as of July 25, 2022.

Conclusion

Based on all the analysis above, I take a BUY side on ASML stock. Both the DCF valuation model and Yahoo Finance coverage supports my recommendation that the stock is currently undervalued. The one-year target price of $623.92 calculated by the DCF model represents over 16% upside from its current price of $536.34 as of July 25, 2022.

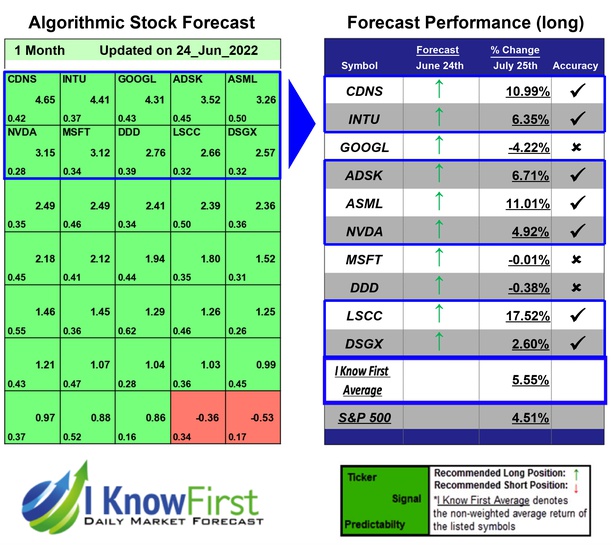

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the ASML stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast. Also, it is interesting that Bridgewater takes the opposite position in ASML.

Past Success with ASML Stock Forecast

I Know First has been bullish on the ASML stock forecast in the past. On June 24, 2022, the I Know First algorithm issued a forecast for ASML stock price and recommended ASML as one of the best stocks to buy. The AI-driven ASML stock prediction was successful on a 1-month time horizon resulting in more than 11.01%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.