Apple’s leading Innovation Breakthrough Followed By Outstanding Q2 Fiscal Financial Results Of 2018

“If you’re going to make connections which are innovative… you have to not have the same bag of experiences as everyone else does.” – Steve Jobs

Highlights:

- Apple on the way to a breakthrough – carbon-free aluminum smelting

- Financial Results for fiscal Q2 of 2018

- Q3 Financial Guidance

- Industrial comparison

Apple on the way to a breakthrough – carbon-free aluminum smelting method

Aluminum is a key material in many of Apple’s most popular products, and for more than 130 years, it’s been produced the same way. Aluminum giants Alcoa Corporation and Rio Tinto Aluminum announced a joint project to commercialize original technology that eliminates direct greenhouse gas emissions from the traditional smelting process. This is a key step in aluminum production that if fully developed and implemented, will strengthen the closely integrated Canada-United States aluminum and manufacturing industries.

As part of Apple’s commitment to reducing the environmental impact of its products through innovation, the company helped accelerate the development of this technology. Apple has partnered with both aluminum companies, and the Governments of Canada and Quebec, to collectively invest a combined $144 million to future R&D. “Apple is committed to advancing technologies that are good for the planet and help protect it for generations to come,” said Tim Cook, Apple’s CEO.

This follows Apple’s announcement last month that all of its facilities are now powered with 100 percent clean energy and 23 of its suppliers have committed to do the same.

[Image Source: GlobalMediaIT]Q2 Financial Results of 2018

On May 1st, 2018, Apple announces its financial Q2 results of 2018. Apple achieved a quarterly revenue of $61.1 billion, 16% increase from Q2 of 2017, quarterly earnings per diluted share of $2.73, up 30%, and generated over $15 billion in operating cash flow. International sales accounted for 65% of the quarter’s revenue. In Q2, iPhone X was sold more than any other iPhone each week and the company’s revenue in all geographic segments grew, with over 20% growth in Greater China and Japan. As for this financial Q2 report, Apple’s board has approved a new $100 billion share repurchase authorization and a 16% increase in their quarterly dividend. Reflecting the approved increase, the board has also declared a cash dividend of $0.73 per share of Apple’s common stock.

Apple is expected to continue to net-share-settle vesting restricted stock units. From the inception of its capital return program in August 2012 through March 2018, Apple has returned $275 billion to shareholders, including $200 billion in share repurchases.

The Company will complete the execution of the previous $210 billion share repurchase authorization during Q3.

Q3 of 2018 Financial Guidance

- Revenue between $51.5 billion and $53.5 billion

- Gross Margin between 38% and 38.5%

- Operating Expenses between $7.7 billion and $7.8 billion

- Other Income/(Expense) of $400 million

- Tax Rate of approximately 14.5%

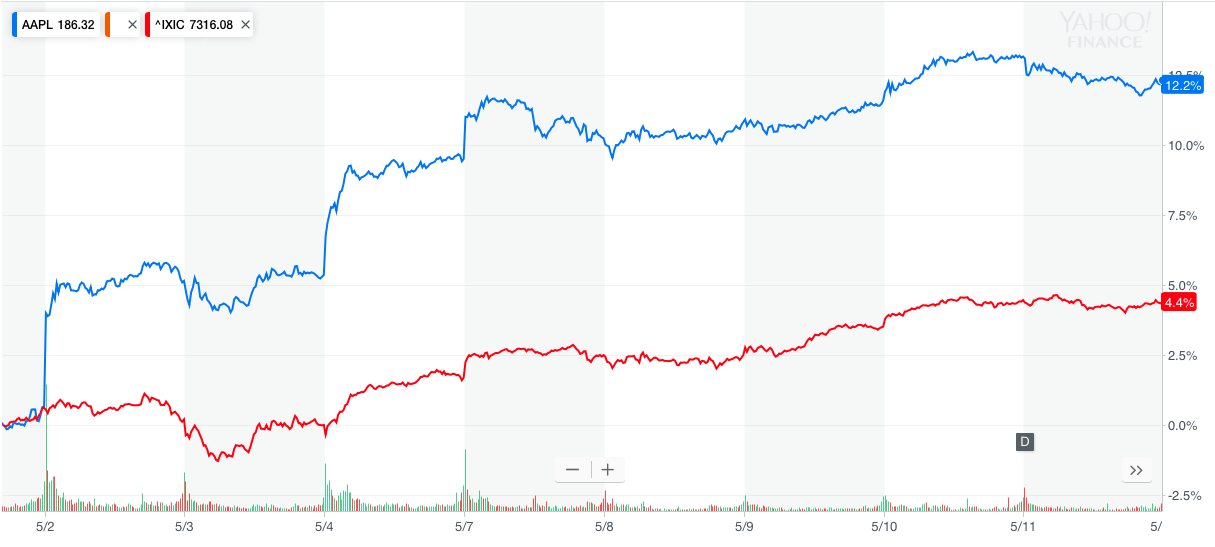

Following the above AAPL stock increased by 12% and my assumption is that it will continue to grow given the high revenues and increasing sales with each quarter of 2018.

Industrial Comparison

| Apple Q2 of 2018 | Electronics Industry Q1 of 2018 | |

| Revenue Quarterly Growth | 16% | 11.2% |

| Gross margin | 13.75% | 58.12% |

| Operating Income | 12.75% | 22.59% |

| Net income | 25.33% | -45.77% |

Presented above is the industrial average growth comparison with Apple’s Q2 growth results of 2018. As shown, one can see that Apple is above the industry average growth in Revenue quarterly growth by about 5% and in Net income Apple is up 71% compared to the industry average.

Today, in my point of view, Apple leads the world in innovation with iPhone, iPad, Mac, Apple Watch and Apple TV. Apple’s four software platforms — iOS, macOS, watchOS and tvOS — provide all-in-one experiences with all Apple devices and inspire people with advanced services such as App Store, Apple Music, iCloud etc. Therefore, based on Apple’s advancing technology techniques and growing results I believe AAPL stock will go up in the long term and increase a “buy”, priority over its competitors.

[Image Source: truonghocdautu.com]My long-term estimation for AAPL is supported by an optimistic one-year forecast from I Know First. The 1-year forecast illustrates a signal of 52.89 and a predictability of 0.7. The 0.7 predictability score for AAPL is saying I Know First’s self-learning Artificial Intelligence has a long history of correctly predicting the one-year market performance of AAPL.

Past I Know First forecast success with Apple

I Know First has made accurate prediction on Apple on August 3, 2017. AAPL is with 21.5% gain since this bullish forecast. This bullish forecast for AAPL sent to the current I Know First subscribers on August 3, 2017

I Know First Algorithm Heat-map Explanation

This indicator represents the predicted movement direction/trend. The signal strength indicates how much the current price deviates from what the system considers a balance or “fair” price.

The signal strength is the absolute value of the current prediction of the system. The signal can have a positive (increase), or negative (drop) sign. The heat map is arranged according to the signal strength with strongest up signals at the top. The table colors are indicative of the signal. Green indicates to the positive signal and red indicates a negative signal. A deeper color means a stronger signal and a lighter color equals a weaker signal. The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability measures the importance of the signal. The predictability is the historical relationship between the prediction and the actual market movement for that particular market. For each asset this indicator is recalculated daily. Theoretically the predictability ranges from minus one to plus one. The higher this number is the more predictable the particular asset is. In comparison to different time ranges, predictability will be higher for longer time. This means that longer-range signals are more accurate.

Predictability is a unique indicator of the I Know First algorithm which allows users to focus on the most predictable assets according to the algorithm. One should focus on predictability levels significantly above 0 in order to trust the signal, when ranging between -1 and 1.