Apple SWOT Analysis: Apple Price Target for 2016

Ever Haggiag is a Financial Analyst Intern at I Know First.

Ever Haggiag is a Financial Analyst Intern at I Know First.

Apple SWOT Analysis

New Management Changes (New COO was announced, potentially great news for apple’s management as he brings along a lot of prior experience)

New Management Changes (New COO was announced, potentially great news for apple’s management as he brings along a lot of prior experience)- SWOT Analysis

- Price Target: $145 (I Know First)

Apple recently announced management changes that in our opinion will increase focus on operations management, semiconductor design, and the App Store. All of the following changes will impact Apple in a positive way.

Apple named Jeff Williams as its new COO. Mr. Williams currently is the Senior Vice President of Operations, and, according to Apple, he has overseen Apple’s entire supply chain, service and support, and the social responsibility initiatives since 2010. Apple said that Jeff played a key role in the company’s entry into the mobile phone market with the launch of iPhone, and he continues to supervise the development of Apple’s first wearable product, the Apple Watch. It is strongly believed that these changes will have a positive effect on apple.

Phil Schiller takes over the App Store: Phil Schiller, Senior Vice President of Worldwide marketing, is expanding his role to App Stores across all platforms. Apple said that Phil now leads nearly all developer-related functions at Apple, in addition to his other marketing responsibilities, including Worldwide Product Marketing, international marketing, education and business marketing

SWOT Analysis

Strengths:

- Apple has a very strong brand image. Everyone knows Apple because of its timeless and simple design as well as their user-friendly multifunctional interfaces. Most millennial’s love owning all kinds of Apple products if they don’t do so already.

- Apple’s customer loyalty is extremely high, meaning that most customers who buy Apple products will stay with Apple and upgrade to their newest products very often. For example, the iPhone has an 89% Retention rate.

- Over the years, Apple has been always reluctant to take on debt, because of this Apple is extremely strong financially and has close to zero debt. The fact that Apple has very little debt is extremely good because it gives them the option to issue debt and raise capital if needed, as well as their high level of liquidity.

- Apple has incredible marketing and advertising capabilities, in 2015 alone; Apple’s marketing budget equaled $1.8 billion. If we look at peer competitor’s budgets, Apple’s budget is not huge; they are definitely the ones who use it most effectively.

- Apple has extremely good distribution channels in the US, the second largest smartphone market in the world after China. Also to be noted is that the US is the largest high-end tech device market. About 35% of Apple’s total sales are in the US alone. In the US Apple sells its products through various distribution channels, including the Apple stores, Best Buy, Target and many other retailers. Online it has a huge presence on Amazon and EBay. Another big distribution channel for Apple are all the US telecoms such AT&T and Verizon, which promotes Apple’s product in stores and online as well.

Weaknesses:

- The main weakness, Apple has extremely high prices, often higher than the competition, rendering it a luxury good. Because of this Apple risks losing many potential customers, which will opt for cheaper options, even if they were inclined to purchase Apple products.

- Also, as we have seen with the iPhone 6s this year, Apple is offering new products with very little upgrades. Because of this, customers are less willing to pay luxury prices to upgrade their existing devices. IPhone 6s sales this year, for example, were much worse than the original iPhone 6 sales last year.

- Apple’s hardware and software are only compatible with Apple devices. On the one hand, this is good for Apple because it obliges customers who can afford it to buy their whole product range. On the other hand, it disincentives customers to buy any Apple products because they will only be able to access all of Apple’s advantages with more than 1 device.

Opportunities:

We believe that Apple has many growth drivers, which can propel earnings ahead of 2016 consensus estimates:

- The release of the new iPad Pro is inserting Apple in the market of tablets becoming computers, or at least very close, we believe if Apple starts offering IOS software for all its devices, iPhones included this could potentially bring enormous upside.

- In our opinion, the new Apple TV with an app store could provide Apple with an entrance into the lucrative console gaming market as well as additional app revenues.

- Apple Watch also still could drive material upside to consensus expectations.

With all of this potential for growth and improving dividend yield driven by buybacks, we see AAPL as materially undervalued.

Threats:

- Macroeconomic risk: Should macroeconomic weakness hurt end-market smartphone, computers and tablet demand by more than expected, Apple’s revenues would be at risk therefore potentially altering an overweight view on Apple.

- FX exposure: Apple is a global company operating in many currencies. Recent USD strength has been a headwind to otherwise strong growth. Should these headwinds intensify, Apple could be at risk.

- Competitive dynamics: We assume that Apple will continue to be a major participant in smartphones and tablets while taking market share in PCs. Should competitive responses in these three segments disrupt Apple’s business, then the latter would be at risk.

- Gross margin: Our view assumes that Apple’s gross margin profile remains stable as component pricing eases and manufacturing yields of newer products improve to offset entry into lower-priced products and categories. If these dynamics do not take place, Apple will be facing some trouble.

- The rate of new product cycles: We expect Apple to sustain its rigid cycle of new product refreshes. Should the company begin to slow in its technology improvements and frequency of refreshes, the company’s competitiveness could diminish. In such a case, we fear that investors could begin to lose interest in the story. Apple needs to keep being as innovative as it was these last years.

Our year-end 2016 price target of $145 is based on 13.7x CY16E P/E. At 11.7x CY16 PE ex-cash, Apple would be largely in line with large-cap tech peers trading on an average of 11.4x multiple. We believe our view on Apple to be pretty conservative considering its peers do not have all the upside we believe Apple can offer.

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The Algorithm: The system

Based on our SWOT analysis, and our estimates for Apple’s 2016 year-end price targets we consider the stock to be fundamentally overweight. Our view is supported by our algorithm, which just released a very strong buy signal for Apple over the next year.

I Know First’s Bullish Signal for Apple

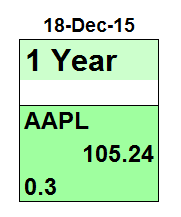

I Know First published a bullish forecast on Apple. The one-year forecasts for Apple are included.

In our previous Apple article, Apple Stock Predictions for 2016: Why Apple won’t hit the $150 Price Target of Many Analysts, we had a pretty bearish view on Apple on the short term with a signal of -0.65 and predictability of 0.2 for the 3 month horizon and a signal of -0.84 and predictability of 0.2 for the 1 month horizon, as our algorithm correctly predicted Apple shares decreasing on a 1-month and 3-month Period.

Over the past 3 months, Apple did decline by -4.99% as of 18th of December 2015, as the algorithm forecasted it. On the other hand, we were bullish on the longer term as our algorithm predicted an overall increase in Apple’s share prices over the year. This supports our thesis based on our SWOT analysis that Apple is to be considered an Overweight stock getting into 2016. This analysis also supports the fact that Apple will not hit $150 by year-end as we have calculated a price target of $145.

Over the past 3 months, Apple did decline by -4.99% as of 18th of December 2015, as the algorithm forecasted it. On the other hand, we were bullish on the longer term as our algorithm predicted an overall increase in Apple’s share prices over the year. This supports our thesis based on our SWOT analysis that Apple is to be considered an Overweight stock getting into 2016. This analysis also supports the fact that Apple will not hit $150 by year-end as we have calculated a price target of $145.

A previous forecast predicting Apple’s performance during a 1 Year period from the 21st of October 2014 to the 21st of October 2015. the signal of apple was very bullish with 202.84 and had a predictability of 0.72 which is very strong and very accurate. In effect, we saw the asset go up and bring returns of 15.98% during a year period as the algorithm correctly predicted. The overall Tech Package in the long position managed to return on average 27.11% and in the short position 24.21%. A fantastic performance of the predictive algorithm and the results speak for themselves.

Conclusion:

. The Algorithm has previously predicted Apple’s Stock and will do also in the future. The Algorithm gives a hit map with the ticker name, signal and predictability for six different time periods. There are different trading strategies which each trader adopts and will be able to use the forecast hit map for its own purposes.

For more articles on Apple: subscribe

New Management Changes (New COO was announced, potentially great news for apple’s management as he brings along a lot of prior experience)

New Management Changes (New COO was announced, potentially great news for apple’s management as he brings along a lot of prior experience)