Apple Stock Predictions: What To Expect From Apple After Excellent 2Q

Apple Stock Predictions

Apple Inc. (AAPL) had another incredibly strong quarter following its record breaking first quarter, when the company had profits of $18 billion. Profits this quarter weren’t nearly as high, as the first quarter includes holiday sales causes it to always be the best performing quarter. But profits did increase 33% when compared year-over-year, an astonishing amount, as the company had its best ever March quarter results. Revenue was up 27% and earnings per share were up 40%, which indicate that the company’s margins improved while it repurchased shares. Taken altogether, CEO Tim Cook put it best when he declared that it was hard to find anything not to like in the numbers.

Algorithmic Predictions For 2Q Compared To Results

I Know First has written numerous bullish articles during the second quarter, arguing that the company would continue to perform well and the stock price would climb even higher. The first article was written after the first quarter earnings report. In it, I argued that the stock price had more room to increase, especially because of the success Apple was having in China. Another article, written on February 25th, focused on how demand for the iPhone would remain high even though Apple sold a record 74.5 million units in the first quarter. A third article was a preview for the earnings report, and reiterated that iPhone sales would perform better in the second quarter compared to previous years because most of the sales so far had been converting users of other devices, and that Apple would continue this trend in the coming quarter. The stock price has continuously climbed during the previous quarter as the articles predicted, increasing over 15%.

The results from the second quarter coincide well with the previously written articles, and they point to more prosperous times in the future. Strong sales of the iPhone, especially in emerging markets like China, solid performance in other fields such as MacBooks and the App Store, and the massive amounts of cash the company has on its hands set the company up well to continue thriving during the next quarter.

iPhone Sales Continue To Impress

The larger screen iPhones that Apple released last fall continue to be extremely popular, especially in emerging markets and China. The company sold 61.2 million iPhones in the three months that ended on March 28th, which is a 40% increased compared to the year-before period. Remarkably, Apple was able to increase its market share while simultaneously increasing prices, as the average selling price of the iPhone during the last quarter was $659, and $60 increase compared to a year earlier.

The iPhone was especially successful in emerging markets, including a 72% increase in sales in China. The second quarter is the biggest quarter in this market due to the Chinese New Year, a peak shopping period for the country. Cook attributed much of this growth to more people moving into the middle class in China and an increase of physical retail stores and online presence. The gains in revenue in international markets like China is made even more extraordinary by the fact that Apple, like all other American companies during this earnings season, is facing currency headwinds, as sales in other countries are worth less in US dollars.

The iPhone should continue to have more success moving into the future, as roughly only 20% of the iPhone sales have been a result of upgrades. Instead, most of the sales have been a result of consumers switching over from other mobile devices, such as Android, or first time consumers in emerging markets. This means that there is plenty of room for further sales in the next two quarters, which in the past have lagged off quite drastically as iPhones have aged. The newest iPhones have so far resisted this trend, and very well could continue to for the rest of the year.

Mac Sales And Other Products Also Positive

iPhones did not have the only strong performance in China during the previous quarter, as Mac sales were also outstanding. They were up 31% in this market, while the overall PC market in the country declined 5%. Once again, this includes currency headwinds, making these results rather amazing. Overall, revenue from China rose 71% to $16.82 billion, overtaking Europe as the second largest market for Apple. Cook has previously stated that it will eventually become the largest. The strong performance of Mac sales in China helped Apple increase sales of its notebook by 10% overall, compared to a 7% decline in the overall PC market worldwide.

The App Store also had its best quarter ever, as a record number of customers made purchases. This led to a new record for revenue and growth of 29% year-over-year. Apple Pay also continues to be successful, as the company announced a couple of big partnerships that will help the service become more widely adopted. Best Buy, a large electronics consumer store, announced that it would be introducing Apple Pay in its stores later this year. This comes after Apple announced that the number of locations accepting Apple Pay had tripled last month. A leading healthcare payment network also announced acceptance of the mobile wallet, showing that merchants aren’t the only ones accepting the service.

Source: Statista

The only worrying trend the company is facing besides currency headwinds, which is out of its control, is falling sales of the iPad. Sales of the tablet fell year-over-year for the second straight quarter. This is partially because the larger screen iPhones and lighter Macs have cannibalized sales of the product, something that was acknowledged by Cook in the earnings recap. The product also does not need to be upgraded as often as the iPhone, as it does not take as much of a beating daily as smartphones do. The future for this product is still bright, however, as Apple has partnered with IBM to create enterprise solutions using the tablet with the goal of getting more businesses to buy iPads for their employees. Cook was upbeat about the product, claiming it is a good business over the long term.

Apple Has An Abundance Of Cash

Apple ended the quarter with $193.5 billion in cash and cash equivalents, up from $178 billion at the end of December. That amount is greater than the market capitalization of all but 15 companies in the S&P 500. The staggering amount of cash has enabled the company to make 27 acquisitions in the last six quarters. It also has increased its spending on R&D, as the company continues to look for new products and technologies to further drive revenue growth.

One such possible market could be the Apple TV, which the company is rumored to be updating currently before releasing a cable streaming service that will include roughly 40 channels. Apple announced its partnership with HBO Now during the last quarter, which has been extremely well received by costumers so far. This could lay the groundwork for Apple to revolutionize the television market and the home in general, as it plans to have a whole ecosystem that can be controlled through Apple. Siri will be included in the next Apple TV, allowing customers to use voice commands to change the channel, turn off the lights, and a whole range of activities controlling the home.

The cash will also be used to upgrade the capital-return program, returning additional money to investors. Since it began in 2012, the program has returned $112 billion to shareholders through share repurchases and dividend increases. During that same time, it has managed to increase its cash holdings by $76 billion. While former CEO Steve Jobs was reluctant to return value to shareholders, instead focusing on innovation, Cook has no such reservations, as he increased the capital-return program by $88 billion, bringing it to $200 billion in total. Most of this will be in the form of share buybacks, but Apple is also increasing its dividend by 11%.

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

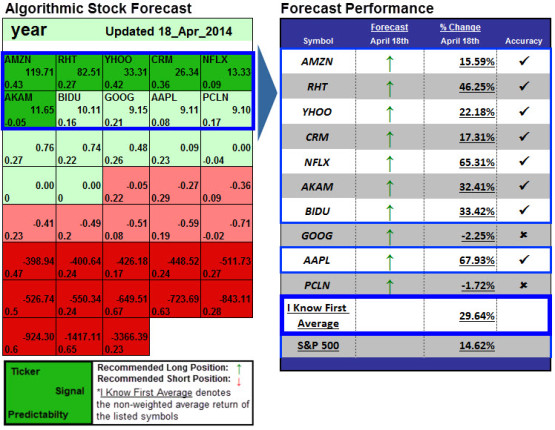

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

The above forecast includes a one-year prediction from April 18th, 2014. Apple had a signal strength of 9.11 and a predictability indicator of 0.08. In accordance with the algorithm’s prediction, the stock price increased 67.98% in the predicted time horizon. Having demonstrated an example of when I Know First’s algorithm was able to correctly predict the behavior of Apple’s stock price in the past, looking at the current forecast can add meaning to the fundamental analysis above.

The algorithmic analysis for both the one-month and three-month forecasts for Apple is weak, as can be seen in the figure above. The three-month forecast is especially weak, with a signal strength of 2.57. This indicates that the algorithm believes that the stock price is in equilibrium for now. This makes sense considering how much the stock price has increased over the past few months. However, there is a good chance that the stock price could continue to climb considering the increased capital-return program and the fact that the current iPhone model has done a better job of converting users of other mobile devices, meaning it should continue to perform better than previous models. While the current stock price might be fair, look for developments over the next quarter to send the stock price even higher.