Apple Stock Predictions: Apple’s iPhone Sales Growth Is Sustainable

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- Institutional and retail investors should add more AAPL shares into their 2016 portfolio.

- Apple again dominated smartphone sales during the peak holiday shopping period last December.

- I, therefore, expect the next earnings report to deliver better-than-estimated quarterly iPhone sales.

- Apple could keep on selling a record number of iPhone units this year if it continues marking down its phones.

- The mid-range 4-inch iPhone 6C could help Apple battle Xiaomi in Asia and Latin America.

The continuing drop in Apple’s (AAPL) stock price is likely due to the rumor that the company is downscaling its new iPhone 6S-related orders from suppliers by 30% this first quarter of 2016. This speculation was allegedly due to lower-than-expected sales of the latest iPhone models. On the other hand, the pessimism over iPhone 6s and iPhone 6s Plus sales might be overblown.

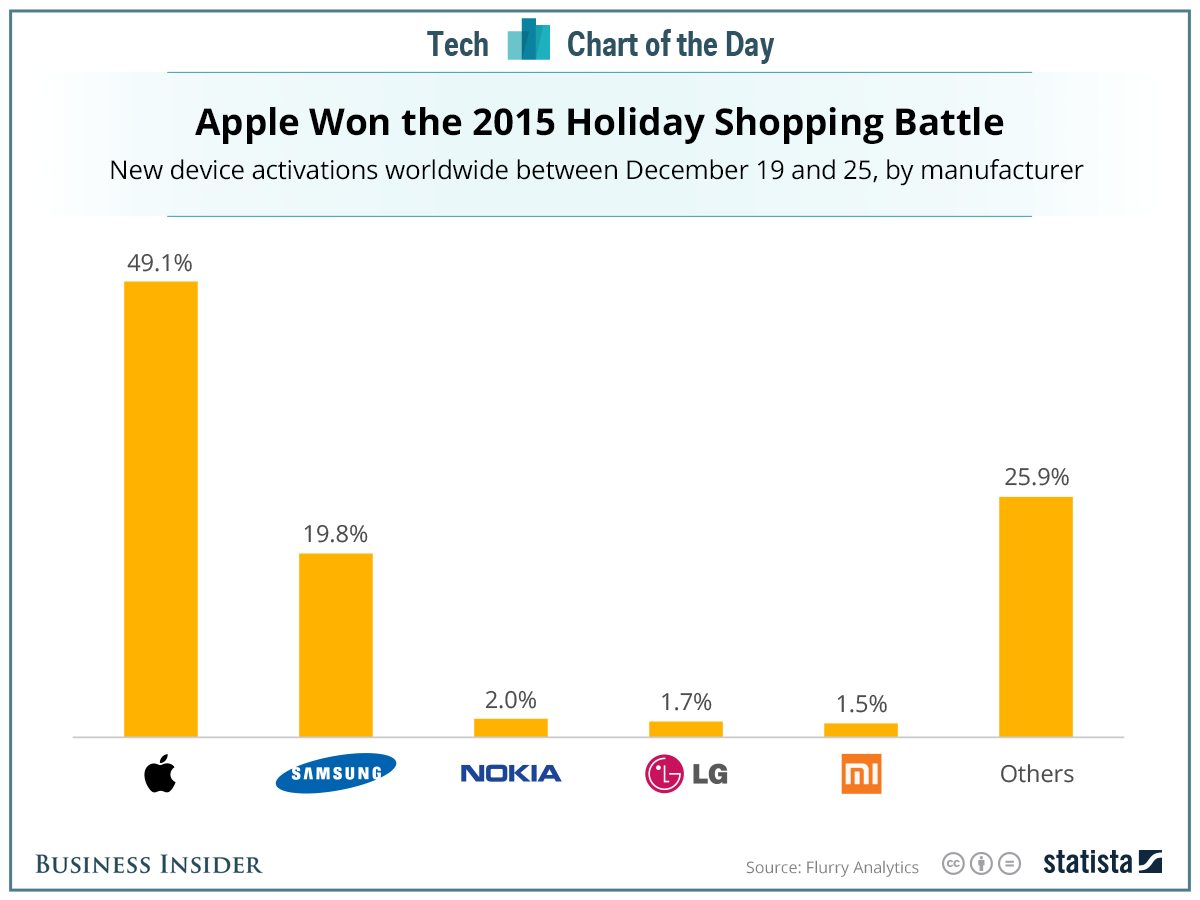

The alleged upcoming 30% cut in iPhone 6s-related supply orders is hard to believe. According to the latest commissioned survey of Business Insider, the iPhone brand again dominated the holiday shopping during the peak December 19-25 week shopping period last year.

It is obvious that Apple continues to enjoy a big lead in higher-margins phones over its rivals. As per the chart from Flurry Insights, iPhones accounted for 49% of new global smartphone activations during the period between December 19 and 25. This is more than double that of its nearest rival, Samsung (SSNLF).

(Source: Business Insider)

While the chart above did not state the specific models of new iPhones that got activated, it still offers a clue that sales the iPhone 6s did great last month. Christmas shopping, more often than not, encourages people to spend their 13th-month pay and Christmas bonuses on pricey gifts for their loved ones (and even to themselves).

I opine that many holiday cravings for the iPhone 6s were fulfilled last month. A social media survey put the iPhone the third most-wished-for Christmas gift, next only to cash and gift cards.

Why Investors Should Raise Their Bets on AAPL

I put my trust in this December global-wide report from Flurry Insights. The iPhone-dependent Apple will likely announce a record sales figure for its smartphones for the last quarter period of 2015. Consequently, investors should consider adding more AAPL shares while it trades below $103.

This stock could rally back to above $110 once Apple declares 50 million or more iPhone sales during the next earnings report. As long as iPhones top the sales charts in developed markets like the UK, Apple will continue to rake in almost all of the operating profits from the global smartphone industry.

Going forward, I really do not expect Apple to substantially reduce the production of its latest iPhones this quarter. Contrary to Nikkei Asia’s report, I estimate that Apple will only reduce its production order of iPhone 6s by 10-15%.

Yes, Apple ordered 75-80 million units of the iPhone 6s for its initial release last September. Apple further ordered 65-70 million units of it for the last quarter of 2015.

However, the majority of these units were likely already sold before December 31. The holiday season probably helped Apple sell 90-100 million units of the iPhone 6s and 6s Plus in 2015. Apple will still, therefore, need to order 55-65 million units for this quarter. This is to make sure it has enough of the new phones to distribute among its global sales channels.

Let us not forget that the new iPhone 7 will only come the last quarter of 2016. It makes sense for Apple to have a constant supply of the now more-affordable iPhone 6s for the next 8-9 months.

Apple Is Willing To Sell Cheaper iPhones

Apple has a compelling reason to keep a constant production for the iPhone 6s. Apple substantially reduced the price tags of its latest iPhones in India. The 20% price reduction of the iPhone 6s models in India could substantial help Apple increase its 2% market share in India. This cheaper-phone-strategy could also be applied in China, USA, and other important markets.

This year could see Apple further increase its market share in high-end phones once the latest iPhones become notably more affordable. Logic dictates that an $800 phone that suddenly is discounted to $650 obviously opens up a bigger total addressable market.

Apple’s willingness to reduce prices could also probably generate better-than-expected demand for the new iPhones. A price reduction strategy is still best implemented when there is an uninterrupted available supply of the product being offered.

The price reduction for the iPhone 6s is a smart move. It is helping Apple persuade many iPhone 6 and iPhone 6 Plus owners to upgrade their units to the latest hardware. A cheaper iPhone 6s also helps wireless carriers reduce their initial cash outlay for new iPhones intended for bundling with their postpaid plans.

The more carriers that support the iPhone 6s, the better it is for Apple. What I would like to see is for Apple to keep reducing the price tag of the iPhone 6s models while also finally releasing the mid-range iPhone 6C this year. This two-pronged attack could help Apple sustain its growth in phone sales.

Sad but true, Apple’s previous focus on selling only the most-expensive phones did not help its stock perform better last year. Perception is always important for any publicly traded company. In spite of Apple cornering most of the operating profits from global sales of smartphones, AAPL’s YTD performance for 2015 was -7.66%.

Conclusion

AAPL’s exemplary fundamentals are insufficient reasons to attract the bulls. It might be good for Apple to change tactic and try to sell more affordable iPhones. I believe that only an upward trend for iPhone unit sales will help the stock market treat AAPL better. The fact is investors do not appreciate enough Apple’s outstanding high-margin approach.

The market observers and stock market players give weigh more on Apple keeping its iPhone sales growth momentum. Last month’s speculation from Morgan Stanley that Apple will finally see a drop in annual iPhone unit sales was and still is a source of anxiety for AAPL. However, I again reiterate my belief that Apple will sell more iPhones this year than in 2015. This year will see the launch of the iPhone 7 and the budget-friendly 4-inch iPhone 6C.

A $400 iPhone 6C could greatly hurt sales of the high-end Android phones of Xiaomi and OnePlus. The iPhone 6s’ cheaper price tags will also help Apple continue its expansion in emerging markets.

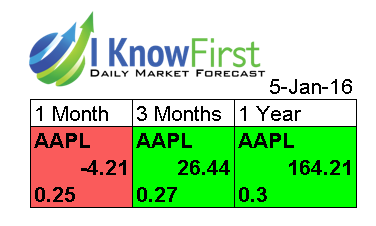

My buy recommendation for AAPL is echoed by the very bullish 3-month and 1-year algorithmic forecasts from I Know First.

I Know First utilizes an advanced algorithm based on artificial intelligence and machine learning to predict market performance for over 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The system follows the flow of money from one market into another.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

As you can see from the chart below, the bright green +164.21 one-year forecast for AAPL from I Know First hints that the below $103 stock price of Apple is an opportunity. Retail investors should try and buy AAPL while it is undervalued.