Apple Stock Predictions For Q2: An Algorithmic Analysis

Apple Stock Predictions

Apple announced the date for its 2015 second quarter earnings report, and will release its most latest quarterly figures and host a live conference call on Monday, April 27th. The stock price has skyrocketed over the last year, boosted by strong sales of its newest smartphones, the iPhone 6 and 6 Plus. After selling over 74 million such phones during the last quarter, it would be understandable to think that Apple could not live up to the lofty expectations set for it this quarter. But Apple is set once again to blow past expectations and surge even higher in coming months, as I Know First correctly predicted it would in an article after the last earnings report. Continued rapid sales of the new iPhones, deeper expansion into the enterprise segment, and an increase in the capital expenditure program mean Apple is still bullish looking ahead to the end of the month, and should continue trending higher afterwards.

iPhone Will Continue To Post Strong Sales Numbers

As I mentioned, the Apple sold over 74 million iPhones last quarter, a record number for any quarter. While the tech giant will not post that high of sales again this quarter, the sales numbers will continue to beat expectations, based off a number of factors. During the last quarter, Apple got a large percentage of its sales from customers that switched from other mobile platforms, namely Android. That means a great number of iPhone users are yet to upgrade their phones, which should drive sales during this quarter.

Apple is also hoping to continue to switch users from other mobile platforms during the current quarter. The company recently introduced an expanded trade-in program, now letting customers trade in non-Apple smartphones to get credit towards a new iPhone. Before, customers could only trade in older models of the iPhone to get credit, but several models including Samsung, HTC, LG, Sony, BlackBerry, and Nokia can all be traded in as part of the expanded program.

This coincides with the upcoming release of the Samsung Galaxy S6 and S6 Edge, Samsung’s new flagship programs. The models are set to be released around the world on April 10th. Apple is trying to convince potential customers to upgrade to an iPhone 6 or 6 Plus before they upgrade to the new Samsung Galaxy device. They can do so either online or in an Apple retail store.

Sales will also be helped as customers in general are upgrading their phones more often. Mobile carriers like AT&T, Verizon, T-Mobile, and Sprint have been very competitive with each other over the past couple of years, and have been offering incentives to keep customers and to try to attract rivals’ customers to switch carriers. One such incentive is offering faster smartphone upgrades, including the iPhone. The quicker upgrades will help sales. Gross margins will also be benefitted, as costumers are opting for models with larger quality to account for higher-quality cameras and increased app usage.

Get Daily Algorithmic Forecast For AAPL

Get the Top 10 Stock Picks For July 2015 Based On Algorithms

Expanding Deeper Into Enterprise Segment

Apple’s iPad sales have been slipping in the last few years, as the life span of the device is greater than that of the iPhone. Customers do not feel the need to upgrade devices as often, and the larger iPhone 6 Plus has been cannibalizing some of the sales of the iPad Mini. To address the concerns of waning sales, Apple entered into a partnership with IBM last July, in which the two companies target enterprise customers in the hope that businesses will buy iPads for their employees.

The partners released their first ten apps in December, and have been sporadically releasing new apps since then. Now, the companies have released eight more apps, adding three more industries in the process. The apps now address nine different industries in all, including banking, utilities, government, healthcare, manufacturing, insurance, retail, telecommunications, and transport.

The most interesting of the apps just released are the healthcare ones, such as the Hospital RN app for the iPhone. It works to reduce the operational costs associated with managing patient information by connecting with a hospital’s own systems. Other hospital apps that were released focus on organizing and prioritizing task assignments, both for the iPhone and the iPad.

The two companies continue to be on track to deliver 100 apps by the end of the year, as Apple CEO Tim Cook promised it would when revealing the partnership. Should the partnership work out as the companies hope, it could be a big threat to Microsoft’s dominance in the enterprise. Cook has not revealed much information about how many enterprises are buying these custom apps to run on new iPhones and iPads, and the earnings report at the end of the month could be the first time results are shared.

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

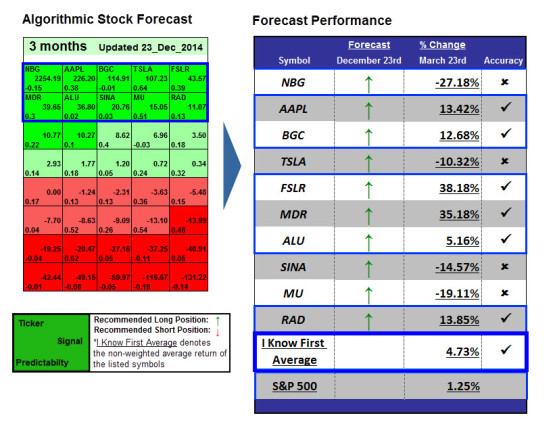

The self-learning algorithm uses artificial inelegance, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

The forecast included above is a three-month algorithmic prediction including Apple. In this forecast, the company had a signal strength of 226.20 and a predictability indicator of 0.38. The stock price increased as the algorithm predicted, rising 13.42%. A 1-year forecast is included below, also including Apple. Once again, the stock price for the company rose as the algorithm predicted, soaring 70.42% in just one year.

Having illustrated how I Know First’s algorithm has accurately predicted the stock price of Apple in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. Figure 2 includes the one-month and three-month forecasts for Apple from April 2nd, 2015. In both forecasts, the company has a positive signal, indicating the algorithm is bullish for the stock.

The bullish forecast before the earnings report makes sense, as the stock price is set to move higher in the next few months. Besides the strong expected iPhone sales and expansion into enterprise apps, Apple is also expected to increase its capital return program, with a predicted increase in the share repurchase program from $90 billion to $120 billion. The dividend is also predicted to increase 10%. Besides the return of capital to investors, Apple also has a very reasonable valuation, with a forward P/E ratio of only 14, below that of the S&P 500 even though the company is experiencing revenue growth because of strong iPhone sales. Along with the first information surrounding the Apple Watch, the earnings report on April 27th is sure to be filled with promising information, and the stock price is set to soar as a result.