Apple Stock Forecast for 2021: Take Your Profits On Apple

The Apple stock forecast for 2021 was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The Apple stock forecast for 2021 was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Apple’s stock has risen +46% since my June 21 buy recommendation. We should now reap our gains.

- AAPL’s TTM P/E of over 39 makes it vulnerable to market emotions. A slow-down in its Services segment could compel investors to turn bearish.

- The robust revenue from iOS games has a headwind from the cloud gaming platform’s new ability to bypass the iOS app store. Publishers can make PWA versions to bypass Apple’s app store commission.

- Apple’s tactic of blocking apps that do not process payments through its 30%/15% commission rule on its iOS app store has a headwind from browser-only cloud gaming.

- Google Stadia is now available to iOS device owners via Google Chrome or Apple’s Safari browsers.

Congratulations to those who heeded my June 21 buy recommendation for Apple stock forecast For 2021 (AAPL). The pandemic no doubt is still a bonanza for Apple. AAPL’s 6-month price return of 45% should compel you to cash out your profits. Selling 40% of your current AAPL exposure at $128 is the right move. This is better than holding on to AAPL hoping it would go beyond $150.

The historically-high TTM P/E ratio of 39.5 exposes AAPL to the capricious emotions of the stock market. The ongoing euphoria over Apple’s impressive Services’ segment can evaporate without warning. Facebook (FB), Microsoft, and others are assisting Epic Games’ legal battle against Apple’s 30% tax on iOS app purchases/in-app purchases.

The increasing hostility from other mega-cap companies can slow down Apple’s Services segment’s growth. Apple’s condescending offer of a lower 15% commission is only for developers/app publishes who have an annual gross of less than $1 million on the iOS app store. This won’t satisfy its enemies. An app store that gets hammered with legal suits means Apple will again have to depend more on iPhone sales for growth.

The obvious risk is that investors will dump their AAPL if Apple again makes more than 45% of its revenue from iPhone sales. The high 39.5x TTM P/E could dip to below 30x.

Apple’s antagonistic move against advertising giants like Facebook (FB) and Google also permanently killed its chance of becoming an ad platform vendor. Exposing Facebook and other advertising vendors’ data-gathering activities via iOS app descriptions is odious to ad sellers (e.g., Facebook, Google) and ad placement buyers. Apple is being a hypocrite Google has been paying Apple $8-12 billion per year so it can have a default search engine on the iOS version of Safari. Apple does not really care about the privacy of its users.

Many analysts are still endorsing AAPL as a buy but at current prices. However, Google’s (GOOGL) release of its cloud gaming Stadia as a web app for iOS devices convinced me that Apple’s Services segment’s impressive growth will slow down. Nvidia (NVDA) also did this last month. Nvidia made a Progressive Web App (PWA) version of the banned Fortnite app so that iOS device-using gamers can play.

Progressive Web Apps Allow Publishers To Bypass The iOS App Store

The rise of Progressive Web Apps is a headwind for Apple’s video games-boosted app store business. It is no secret that AAPL’s big run-up this year (+75% YTD) is largely thanks to its games-fueled Services segment. Apple’s estimated gross sales from its iOS app store in 2019 was $54.2 billion. As per App Annie’s latest report, Apple took 65% of this year’s $112 billion (71% of which are on games) spending on mobile apps. Apple’s app store gross sales for 2020 therefore is around $72.8 billion. The current 30% app store commission of Apple is therefore almost $22 billion.

The app store business is the biggest contributor to the Services’ segment’s quarterly revenue of around $13 billion. Apple Music, Apple TV+, Apple Arcade, and software sales are also expensive to operate. The easy 30% cut on app store sales is still the most important piece of Apple’s Services segment.

As more people get access to 5G devices and internet connectivity, PWA apps and games will eventually taper the strong revenue stream from the iOS app store. Apple’s current easy $3 to $5 billion quarterly commission from iOS app sales will likely erode after 3 years. Apple cannot block its iOS device customers from accessing PWA subscription apps and games.

Publishers of top-grossing iOS apps like Tencent (TCEHY) are now building their own cloud gaming platforms. It will hurt Apple if games like Genshin Impact, Honor of Kings, PUBG Mobile, Clash of Clans, and Candy Crush Saga gets PWA versions for iOS devices. Those games generate more than $1 billion in annual sales. Tencent and its peers know that Apple has been delaying full support for PWAs. However, iOS 14 brings more PWA compliance.

Conclusion

The big rally of AAPL this year is thanks to the pandemic boost for its app store and other subscription services. We should now take our profits before market sentiment starts reversing. Apple’s gold mine from app store purchases is clearly threatened by PWA apps. Unless Apple starts developing, publishing and hosting its own paid streaming platforms for apps and games, the Services segment will have to make do with the low-margin ventures of Apple TV, Apple Music, and Fitness+. A busted tailwind from its Services segment can force investors to devalue AAPL.

Christmas Eve is here. We should cash out our profitable investments of 2020. Being cash-rich is a good way to celebrate the Yuletide season.

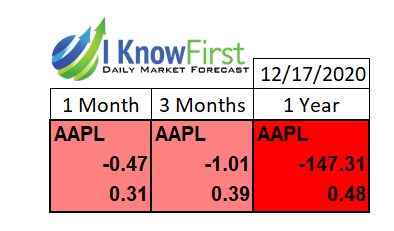

My profit-taking sell recommendation for Apple stock forecast For 2021 is in line with its bearish one-year forecast from I Know First. The AI algorithm of I Know First has decided that AAPL is vulnerable to downside trends within the next 12 months.

How to interpret this diagram.

Past Success With AAPL Stock Price Forecast

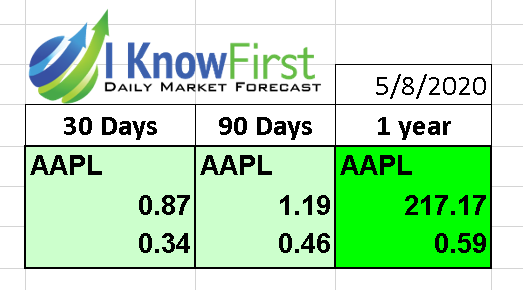

I Know First has been bullish on AAPL’s shares in past forecasts. On May 8, 2020, the I Know First algorithm issued a bullish forecast for Apple. The algorithm successfully forecasted the movement of Apple’s shares on the 3 month time horizon. AAPL’s shares rose by 63.80% in line with the I Know First algorithm’s forecast. See the chart below.

Here at I Know First, our AI-based stock predictions algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. The database used is 100% historical data free from human-derived assumptions. The database is constantly evolving with newly added data and adapting to changing market situations. Today, we are producing daily forecasts for over 10,500 assets such as stocks under 10, as well as gold price forecast and currency predictions, while also providing the latest AAPL stock news. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast