Apple Stock Forecast: 2020 Remains A Prosperous Year for AAPL Stock

This Apple stock forecast article was written by Habiba Mohamed – Junior Analyst at I Know First.

This Apple stock forecast article was written by Habiba Mohamed – Junior Analyst at I Know First.

Summary:

- Apple showed robust returns in the Q3 financial statement showing an increase of 11% from the year-ago quarter

- A stock split in AAPL stocks is helping in boosting the desire of buying Apple shares

- 5G initiation is the biggest innovation in phones’ history, that will increase the AAPL stock price

Booming Q2 and Q3 Earnings Despite COVID-19 Leading to a Successful AAPL Stock Forecast

Despite the market volatility in the past year, Apple maintained strong performance during Q2 and Q3 financial reports. According to Apple’s press release, the Q2 report showed an increase in the quarterly revenue by 1% compared to last year. This allowed the revenue to reach $58.3 billion. Also, the company experienced an increase in quarterly earnings per diluted share by 4%, reaching $2.55. The major contributors to Apple’s Q2 revenue were international sales that accounted for 62% of its revenue.

Apple’s Q3 earnings have even grown better than Q2. As reported by Apple’s Q3 press release, the total revenue increased by 11% in comparison to the year-ago quarter. This attained revenue of $59.7 billion, alongside an 18% increase in the diluted share price to reach $2.58.

I believe that Q3 earnings will continue to grow even more in Q4. As expected, there might be a second wave of COVID-19 which means people will be forced to stay at homes. Therefore, technology will continue to be people’s main focus, so the sales will continue to boost. Also, the holiday season is approaching which will lead to higher sales and more demand for Apple’s services.

I predict that due to these opportunities Apple has, Q4 results will be surprisingly high. In my opinion, I believe that revenue will increase by at least 16% in comparison to the year-ago quarter. Also, an increase in diluted share price will occur to reach $2.62.

4-1 Split Expands the Base of Investors

According to Apple Investor Relations’, a stock split of 4-1 basis occurred on August 28, 2020. This split encouraged investors to have more interest in the AAPL stock, leading to an increase in its price. The general idea of the split is to increase the number of outstanding shares while maintaining a lower stock price. This leads to a larger number of investors. According to the Financial Post, the stock split helps with Apple’s prestige in the stock market.

In my opinion, the split will absolutely expand the number of investors leading to a higher demand for the shares. This will eventually lead to a higher stock price. Also, the timing is perfect for a stock split, as a lot of people have more time to invest. Therefore, such a split can be an incentive to buy more Apple shares. I believe that the share price will increase by at least 75% in the next 12 months reaching about $203 per share. This prediction may seem too high; however, with the 5G phones coming up, COVID-19 is making technology the main focus, the holiday season coming up during lockdown, and finally, the stock split initiation that Apple recently announced will make the AAPL so attractive in the eyes of investors. Therefore, I strongly endorse AAPL stock as a buy.

5G iPhones Initiation Influence on the AAPL Stock Price

According to CNBC, WSJ estimates that Apple will approximately sell about 190 million 5G devices in 2021, while McNealy predicts that Apple will sell 208 million devices by then. The 5G initiation is the biggest innovation that has been ever discovered in the phone’s history. This initiation is going to contribute to Apple’s sales leading to great returns, which will eventually cause a higher stock price. The article continues to explain how McNealy disagrees with WSJ’s conservative predictions.

Besides, McNealy believes that the 5G phone will have the most advanced technology which will lead to an increase in demand. Also, according to a more recent CNBC article, the new 5G iPhone will help with remote learning and allow people to stay at home, which in result will help boost the stock price, especially during the pandemic.

I support McNealy’s belief as I think the introduction of the 5G iPhones is one of the company’s top strengths. It is almost 100% that the demand for these new phones and services will be way higher than any other past iPhones demands, especially that people’s number one priority is the technology and the ability to conduct virtual meetings, learning, work, etc. in the most efficient way possible. The 5G introduction wouldn’t have been as beneficial for Apple as during these times because people are forced and willing to spend a bit more money to get better access to more efficient and faster services.

Apple Transforming to 100% Carbon-neutral By 2030

CNBC reported that Apple is planning to go 100% carbon-neutral by 2030. This change will not just have a positive externality on the environment, but will also have a great influence on the AAPL stock price. This change will initially cost the company a lot of money, but in the long-run, it will help decrease the costs as it will eliminate many obstacles caused by climate change.

I expect this change to have a huge impact on the AAPL stock price, as relying on carbon was considered one of Apple’s main weaknesses and threats according to my SWOT analysis. Therefore, by working towards this change, Apple is transforming these challenges into strengths and opportunities leading to a wider customer base and a higher stock price.

Apple Stock Forecast and MA

The AAPL stock has been performing above MA50 and MA200 which shows its robust performance despite any fluctuations in the market. This performance indicates that the AAPL stock is a good buy.

Conclusion:

The AAPL will continue to grow dramatically in the long term. AAPL’s continuous growth brings assurance to the investors as, during these unprecedented times, Apple is successfully implementing new technologies and methods to deal with the pandemic. Also, the initiative of going 100% carbon-neutral will not just eliminate any climate change obstacles, but will also help attract more investors who are concerned about climate change.

As a result, according to my assessment, I believe that the AAPL stock is a very appealing buy. My 90-day target for this stock is $145, and my 12 months price target is $203. In addition, the MA200 analysis shows a strong positive trend.

What’s important is that the above forecast comes within the context of I Know First’s recent AI predictive algorithm performance. The below chart shows the hit ratio of the algorithm’s predictions generated over the period from June 1, 2019, through September 13, 2020:

As could be seen, we were able to provide our clients with accurate forecasts for this time period, which allowed them to choose the right investments. Our algorithm, using AI, helped us hone our predictions increasing the safety for our clients. Our Apple stock forecast was accurate enough despite all the fluctuations that have been happening in the market in the last few months. This high accuracy shows how robust our forecast is, and gives our clients more confidence in our predictions in a similar fashion that our AI-driven Tesla stock predictions analyzed recently. Being able to have a hit ratio of no less than 62% for the past year is a great sign of how precise our algorithm is, even during times of doubt.

Past I Know First Success With Apple Stock Forecast

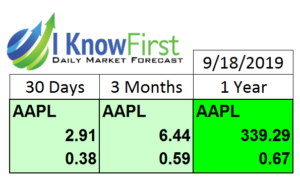

The Apple stock forecast generated on September 18, 20219 is a good example of the successful long-term I Know First AI algorithmic prediction that was bullish. This forecast showed that the AAPL stock was a strong buy – the prediction had a 1-year signal of 339.29 and a predictability indicator of 0.67 resulting in roughly 92% gain over a 1-year horizon.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.