ANET Stock Forecast: Surge In Internet Traffic During Pandemic Makes Arista Networks A Buy

This ANET Stock Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This ANET Stock Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- If you have above average IQ, you know that Arista Networks is one of those companies that are truly benefiting from the COVID-19 pandemic.

- Billions of people are still forcibly stuck-at-home or imprisoned. Fascist quarantine orders are causing a huge surge in internet usage.

- Internet service providers and data center operators are being forced to buy more routers and ethernet switches.

- The COVID-19 pandemic further fortifies Arista’s leadership in 100G ethernet switches.

- The more customers for its 100G switches, the faster Arista can focus on growing its 400G products.

The stock of Arista Networks (ANET) is already trading well above its pandemic-punished price of $157.04. However, I highly recommend that you still buy more ANET shares. This stock obviously has further upside. My fearless forecast is that ANET could rebound back to $250 before 2020 ends.

The massive surge (+70%) in internet traffic during this pandemic will greatly boost the current and forward revenue/net income of Arista. The reason why many investors previously dumped ANET is because most of them got disappointed by 4Q2019’s -7.7% year-over-year drop in revenue. No thanks to COVID-19, I expect the first two quarters of 2020 to be lucrative for Arista.

My takeaway is that Q1 revenue would likely be around $520 million, and EPS would be $1.88. This is almost in-inline with earnings whispers’ guesstimates. Arista will report its earnings on May 5. No thanks to COVID 19, better-than-expected first quarter numbers are now believable.

Pandemics Are Terrible, But It Also Has Economic Benefits

The new normal of work-from-home for many companies is boosting the sales of internet routers and Ethernet switches. The upsurge in video streaming during this pandemic is also boosting sales of routers and switches. You should buy more ANET because Arista’s bread & butter is Ethernet switches. Arista is the leader in 100G Ethernet switch ports. Ergo! ANET is a strong buy!

Going forward, better sales for Arista’s 100G Ethernet switches can help it accelerate development and commercial launch of 400G products. As you can see from the chart above, switches with equal to or greater than 400 Gbps speed will become the most lucrative segment. You should buy more ANET because this company has a comprehensive list of 400G products. In other words, Arista is well-prepared to supply 400G products to data centers, cloud computing companies, telcos, and AI platforms.

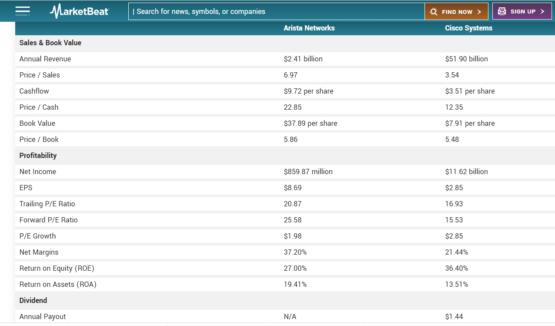

Arista’s obvious early-bird zeal for the 400G shift is partly why its stock touts higher valuation ratios than Cisco (CSCO). Yes, Cisco is old and reliable. However, Arista is the new sexy star when it comes to networking hardware. Most investors are very attracted to companies with obvious growth potential. Cisco is already too big and old, I don’t think it can find new growth drivers for the next five years.

The huge disparity between the Price/Sales rations between ANET and CSCO is very telling. Investors give higher priority/importance to every dollar that ANET earns. I like going against the flow but often times it is more profitable to follow the emotion of majority. Following where most of the herd is going is boring but safe. As long as there is no panic-inducing events like COVID-19, following where the herd is going is the best thing to do. You follow the herd because it will likely lead you to a waterhole or a pot of gold.

Growth At A Reasonable Price

The best way to evaluate ANET’s future valuation is to compare it with cloud computing leaders like Microsoft (MSFT) and Amazon (AMZN). We should buy more ANET because it boasts higher 5-year and 3-year CAGR than cloud computing leaders AMZN and MSFT. Arista is small and nimble. It will therefore continue to outpace the growth rates of Amazon and Microsoft.

Sad but true, majority investors still prefer growth over safety. We should heed the biased emotion of the general public that puts ANET on the high-growth pedestal. Following the herd on ANET is still affordable. ANET is more affordable to own than MSFT and AMZN. Based on the chart above, ANET’S trailing and forward P/E ratios are still lower than that of MSFT and AMZN’s.

Conclusion

There is little risk in going long on ANET right now. It is fairly-priced. The continuing failure to find a true cure to COVID-19 will keep internet usage high. This pandemic is actually a long-term tailwind for Arista. The SARS-CoV-2 virus is mutating, a vaccine for it will not be forthcoming within the next 18 months. Buy more ANET shares now. I am therefore highly confident that this stock will again breach the $250 barrier.

To further fortify the hypothesis of this article, I suggest you heed the clear buy signal from I Know First. The stock-picking AI of I Know First gave ANET a super-bullish one-year forecast score of 340.13. I Know First is therefore extremely confident that ANET will trade at higher price levels within the next twelve months.

Past ANET Stock Forecast Success

I Know First has been bullish on ANET stock forecast. On January 10th 2019, Know First issued a bullish 3-month forecast for Arista Networks (NASDAQ: ANET). The forecast illustrated a signal of 6.39 and a predictability of 0.69. In accordance with the forecast, ANET stock returned 48.54% over this period, highlighting the accuracy of the prediction produced by the I Know First algorithm. See chart below.

This bullish forecast for ANET was sent to the current I Know First subscribers on January 10th 2019.

Here at I Know First, our AI-based algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock market outlook, as well as a gold forecast, forex forecast, and, in particular, Apple stock news. Today, we are producing daily forecasts for over 10,500 assets. These stock valuation ideas generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.