AMZN Stock Prediction For 2015 Based On A Predictive Algorithm

AMZN Stock Prediction: Still King of the Internet Retail Jungle – An Algorithmic Perspective

Company Profile

Amazon.com, Inc. (NASDAQ: AMZN) is an American company that, in recent years, has become a household name: founded just nineteen years ago, the company is nevertheless the United States’ largest Internet-based retailer, selling everything from books, CDs, and MP3 downloads to food, toys, and furniture. Bringing in a sizeable $88.98B in revenue in 2014, Amazon isn’t just a grand operation – it’s also a geographically and commercially

diverse one, with the company’s websites spanning across fourteen countries (including the UK, France, Canada, Germany, Italy, Australia, China, and India), and its own products ranging from its famous online shopping, hosting, and content distribution interface to consumer electronics (e.g., the relatively well-known Kindle).

Recent News: Stock Skyrockets When Profits Beat Expectations

As is customary, late January and early February mean press releases churning out Q4 2014 results. And those, of course, often mean shifts in investors’ and analysts’ perspectives. Amazon was just one company that made waves recently. The multinational retailer posted its Q4 2014 earnings last Thursday, January 29th, and its stocks soared, up 14% after-hours, and more than 12% as of Friday, January 30th.

As much as Amazon is, as its profile indicates, a remarkable company, its reputation isn’t news to anyone, and isn’t, as such, singly sufficient to have generated such a dramatic share price elevation overnight.

Why, precisely, have investors grown so confident in Amazon in the past week?

In short, as The Motley Fool’s Steve Symington puts it, Amazon “just significantly exceeded even its own guidance for Q4”.

To begin, we have the company’s earnings per share. Amazon reported a Q4 EPS of $0.45, beating many analysts’ expectations and Q3’s $0.95 loss. Further, Amazon reported $214 million in net income (45 cents per share, in other words): that is 2.5-times more than the per-share net income of 17 cents that Wall Street analysts consensually predicted. That wasn’t all, however – on a full-year basis, Amazon also reported a loss per share of only approximately 52 cents – less than 2013’s per-share loss of 59 cents. Included as part of the notable Q4 earnings, as mentioned, Amazon’s revenues increased by $14.5 billion, when compared to last year’s value.

Figure 1. Steadily historic revenues have encountered a steeper slope ahead.

These numbers, though were probably integral to Amazon’s stock jump, may not be the only factors at play – Amazon’s Prime-related announcement may also have boosted investor interest, given that it seemed to suggest worldwide customer growth despite increasing prices. While some analysts have pointed out that this declaration wasn’t particularly well-backed where anything quantitative is concerned (i.e., though CEO Jeff Bezos reported percent growth, he hasn’t ever quite told us how many customers Amazon Prime actually has), others suggest that a big reveal is in the works, and that it’ll be far from disappointing; this kind of notion could well have compelled investors to put faith in Amazon last week.

At present, whether because of these or other factors, Amazon sits at a healthy $353.53 – on the higher end, then, of its 52-week range of $284.00 – $383.11. This is reflected in Yahoo! Finance analysts’ recommendations, which currently average out to about 2.2 – a relatively strong buy, considering that 1.0 is the strongest possible buy, and 5.0 is a sell (Figure 1). Where specific brokerages are concerned, many – including Benchmark, Baird, Citigroup, Bank of America, and Credit Suisse – have significantly raised their price targets, with Citi’s Mark May citing “solid topline results, better than expect bottom-line results, better-than-feared Q1 guidance, plans to expand segment disclosures starting in Q1, and management commentary about prioritizing expense efficiency in 2015” as reasons he’s bullish on the company.

Figure 2. Yahoo! Finance analysts’ recommendations place Amazon on the strong buy end of things.

The Positive Attributes

While analyst and investor sentiments are not always the best indicators of a stock’s potential for success, fundamental analysis suggests that Amazon may not be overhyped, in this case.

To begin with, the company’s Q4 2014 numbers indicate upwards movement across a range of factors. In the fourth quarter of last year, net sales increased 15% year-over-year ($29.33 billion in Q4 2014, up from $25.59 billion in Q4 2013); if we ignore the impact of foreign exchange rates, further, net sales presumably increased even more – up 18% compared to Q4 2013. Operating cash flow also increased sizably, climbing 25% to $6.84 billion compared with $5.47 billion for the trailing twelve months ending December 31st, 2013. Net sales, too, were up 20%, increasing to $88.99 billion from $74.45 billion in 2013.

Several Amazon business moves have also seemed to pan out as planned, indicating that the company knows how to move forward in at least some senses. Last year, for one, as mentioned above, Amazon decided to raise the price of Amazon Prime – a premium service that provides members with faster shipping, unlimited photo storage, and exclusive access to a range of Amazon movies, music, and Kindle books; the company firmly held that customers would continue to purchase Prime membership, regardless of the price hike. This turned out to be completely true: as Founder & CEO Jeff Bezos says in Amazon.com’s latest press release, “worldwide paid membership grew 53% – 50% in the U.S. and even a bit faster outside the U.S.”. Bezos has stated that Amazon will, in light of this growth, fight to further Prime – pushing the premium service forward has already been the company’s focus for two years, and Prime has, as can be seen from the above new-subscriber count, grown significantly. If Prime continues to be innovated upon, and continues to contribute similar percentages of novel customers to Amazon, the company could experience significant growth in part as a result of this service (especially given that Prime customers appear to spend more than double what nonmembers do on the site). Macquarie Securities’ Ben Schachter apparently feels similarly, stating “This growth in Prime is perhaps the most bullish indicator we’ve seen for AMZN in years.”

In fact, things may already be so good for the service, says Recode.net’s Jason Del Ray, that Bezos – who typically hates revealing information about product sales and subscriber counts – seems to be dropping hints about (and may eventually even choose to disclose) Amazon Prime’s member count. A reveal would in itself be another Amazon-related positive: if Bezos discloses Prime’s member count, says Del Ray, competitors will near-immediately show signs of caving, and analysts will stand in support of the company, creating potential for stock prices to rise to a whole new level.

Another investor-appeasing move that may well be responsible for renewed Amazon-related confidence? Amazon’s decision to disclose the financials of its cloud-computing business, Amazon Web Services, as early as next quarter. The notion that Bezos could reveal more information about AWS may well excite investors, given that AWS is used by such prominent companies as Netflix (NASDAQ: NFLX), is expected to be Amazon’s biggest business in the long run, has been said to have more than one million active customers, and apparently grew 90% year-over-year.

Amazon’s original content has also made recent news: while the company is predominantly a retailer, it has also created its own series called Transparent, available exclusively via Prime. Shortly after the show won two Golden Globe awards, Amazon announced that Woody Allen will be creating another original series for the company. With this news, Amazon breaches yet another market; though Netflix still dominates where original content creation is concerned, as we wrote here last year, and while I personally see this as a bit of a far cry, Amazon now has a chance at becoming a worthy opponent to its own customer in the long run, say some analysts.

Other potential positives include Amazon’s expansion into voice recognition devices, its commitment to creating twelve original, prestige films for Prime customers every year, its expansions into the Netherlands and China, and AWS-related partnerships and service innovations, all of which are discussed in more detail in Amazon’s fourth-quarter report, and on Business Wire.

To be certain, of course, some are more enthused with Amazon than others. Several analysts, among them Forbes’s Samantha Sharf, point out that Amazon “is notorious for being profitable one quarter, and reporting a loss the next” – the turnaround, in other words, is nothing new, and the “latest”, January-29th surge is just another one that may well die down with time. If we take a look at Amazon’s one-year charts, we’ll see that this sentiment isn’t so far-removed from the truth: initially sitting at a near-52-week high of $378.77 on March 18th, 2014, share prices dropped to a much lower $288.32 – almost the 52-week low – less than two months later, on May 8th: that’s quite the change, and similar – though less drastic – fluctuations are evident across the year (Figure 2). While this may well indicate that Amazon will experience drops over the course of the long term, it doesn’t negate the fact that those interested in a short-term investment may well profit in the immediate future.

Figure 3. Amazon’s stock does indeed fluctuate dramatically, but that’s not necessarily problematic in the short term.

A Growing Industry & Customer-Oriented Business

Aside from their very sound financials, Amazon.com’s business principles illustrate their very own goals in pursuing growth. Its clear focus on long-term productivity and profitability is led by the company’s lust for future success. The e-commerce behemoth has great potential for longstanding success. Specifically, the online-shopping industry has become a multi-billion dollar stream. In a day and age where time efficiency is so valuable to the masses, many don’t even debate the matter of shopping online – as long as it’s user-friendly and functions well. It is clear that, as shopping online gains traction and momentum in a society demanding efficiency, the e-commerce giant will apprehend long-term growth. Combined with a growing and prominent customer satisfaction index, the growing online shopping industry will prove to benefit Amazon in its future profitable endeavors.

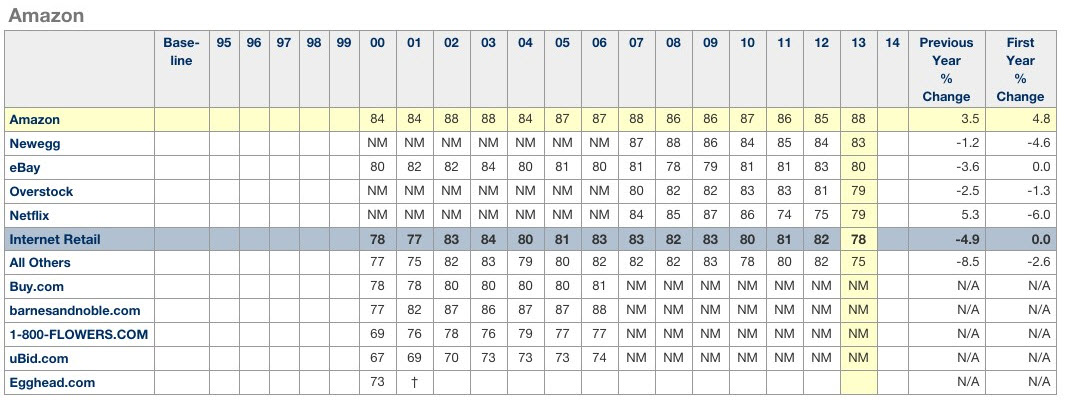

To begin, let’s look at the excellent customer satisfaction a customer is expected to receive at Amazon. According to the ACSI Federal Government Report 2014 Amazon holds the number one position in the private sector, with a score of 88. Compared to the 2013 report, which yielded 85 on the index, Amazon appears to be expanding the enjoyment and fulfillment shoppers wish to experience online. In addition to the ACSI report, customer experience analytics company: Foresee, concurs on its exceptional customer service. It sees the company at the top, in that regard, with a score of 90. Interesting excerpts from the Foresee report gratify Amazon as the perfect example of displaying customer service, along with their ability to advance in a pace that exceeds their rising competitors.

Figure 4. Amazon’s growing satisfaction level indirectly relates to increasing sales.

A prime reason for this optimal and growing satisfaction rate the retail company has accomplished is due to its CEO and leader: Jeff Bezos. The 2012 businessperson of the year is known for his leadership and innovative mindset, which, some argue; put him in the same league as Apple’s late Steve Jobs, and Microsoft’s Bill Gates. With hundreds of millions of customers, it would seem improbable for any CEO to land such exceptional satisfaction ratings – especially in the retail industry. Contrary to the norm, Bezos has found a way, and, with his simple philosophy of: “customer comes first,” has taken the industry by storm.

Revolving around his customer-centric ideals is the very base of Amazon’s business model. A clear distinction between physical and online retailers that Bezos has realized, ultimately in order to expand this customer-centric service, is that the Internet is an entire social network in itself:

“If you make customers unhappy in the physical world, they might each tell six friends. If you make customers unhappy on the Internet, they can each tell 6,000.”

This important realization has guided Bezos to even provide first-hand apologies to users of his website, in order to maintain its high level of satisfactory service. The site’s 99% goal of delivery in 2011 was reached, in which a proud Jeff Bezos responded by stating how improvement is still achievable. This 1% area of improvement is only made significant since Bezos realizes the dangers of the Internet: more specifically the spread and significant speed of social news, as his quote reads. Bezos’ exceptional entrepreneurial mindset is one that many are privy of, but few ultimately activate: the demand-driven flow. A supply chain that heeds the demands of customers is becoming progressively important in present. Bezos’ competence of this significant factor is easily portrayed when asked how much the company was willing to spend on the Kindle project, to which he replies: “How much do we have?” In hindsight, the Kindle is now a defining factor for Amazon, brining in an estimated $3.9 billion in revenue for the sale of the device alone in 2013.

Furthermore, the sales of the customer-oriented product, which launched in 2007, are set to ascend in upcoming years as more readers are exposed to the e-book market. The global e-book market accounts for 12.6% of the global book publishing market, as of 2014, and, as forecasted by analysts, is supposed to increase to over 27% of the entire book market. This ascension in market share is yet another long-term advantage that gives Amazon its potential. In fact, Amazon holds a great majority in the e-book market with 67% (see Figure Y). As a result, profitability in that sector suggests prosperity.

Figure 5. With a majority share in the e-book market, the advancement of the e-book market suggests more Kindle and e-books sales for Amazon.com.

As for the industry itself, Amazon finds itself in a perpetually growing one. One statistic projects U.S. retail e-commerce sales increasing from $304.1 billion in 2014, to $491.5 billion in 2017 (see Figure Z). Additionally, according to the U.S. Census Bureau, the number of online shoppers is forecasted to increase by 5% from 2011 to the end of this year. Without much doubt, people value their time. When a regular shopper has the option to instantly order something rather that travel to a retail store, hence wasting time, the shopper will, naturally, choose the online option. Although the time of delivery must be accounted for, innovation and technology will further decrease that interval, as can already be observed with Amazon’s Prime.

Figure 6. Historical growth in the e-commerce industry shows no signs in the drawback of further constant growth in coming years.

The Risks Involved

Despite recent financial news that resulted in the rapid steep hike in Amazon’s share price, like with any investment, risks are certainly incorporated. Specifically, an increasing amount of competition from several angles has resulted in some speculative bearish outlooks for the company.

Specifically, a report from The Motley Fool dethrones the king of under-cutting. Although named the “Wal-Mart of the Internet”, Amazon has faced competitive threats in regards to its prices. It is worth noting that Wal-Mart and Target had defeated the king in its online pricing game late last year. Essentially, Wal-Mart and Target both seemed to have established bots that would under-cut Amazon’s prices. More recently, Staples and BestBuy have joined the price war. In fact, Staples has aggressively incorporated a, basically, free delivery program to take a more significant role in the battle. In lieu of Amazon’s Prime service, Google has answered with Google Express, which offers one-day delivery from retail stores such as: Costco, Target, and Whole Foods. Additionally, ShopRunner has teamed up with hundreds of stores to offer a competing free 2-day shipping service.

The most recent, and perhaps most dangerous, adversary Amazon faces is the lucrative Alibaba Group (NYSE:BABA). The companies are currently viewed as the two giants in the worldwide e-commerce market, but who has the upper-edge? With little exposure to the Chinese market, Amazon is outdone there. Similarly, Alibaba’s insignificant exposure to the U.S. market gives Amazon the Western victory. Essentially, a carefully planned, innovative expansion into the competitors’ home markets will decide the true victory. Baba’s extremely successful IPO has caused a great disruption in the online shopping industry. Although Amazon has historically bested Baba in terms of revenue -$74.5 billion compared to $8.6 billion in 2013- Baba is projected to grow its sales at a faster rate, according to data compiled by Bloomberg. The data projects this growth in effect to the growing consumer tendency in China to shop online. In fact, by 2017, China anticipates a takeover of the U.S. in online spending. Evidently, Alibaba poses a threat to Amazon’s current dominance in the e-commerce market. That being said, if Amazon can successful plan an aggressive expansion into the lucrative Chinese market, it can maintain its supremacy.

Amazon’s continuous focus towards future growth, as well as bold investment decisions, grants the company sizeable potential, but when considering this investment, it would be unwise to discount the advancing competitors Amazon faces.

Discounted Cash Flow Valuation

Finally, to emphasize the company’s strong financials, and long-term outlook, a discounted cash flow (DCF) model yields an interesting valuation. Essentially, a DCF model suggests a current value of the company by projecting future cash flows within it. The sum of a company’s cash flows earned in the future, discounted back into the present, is one way we can foresee a possible Amazon outcome in the future. Historic data, combined with an annual outlook, provide a benchmark used to evaluate foresights. However, it must be not be relaxed –historic data does not fully suggest futuristic data. It should also be stressed that projections are discretionary and estimations, ultimately implying the risk of inaccurate inputs used in the process. That being said, carefully performed DCF can aid the investor in further considering the potential Amazon has to offer.

Looking at Amazon’s focus in the long-term, it was stated in their 10-K that they have been pursuing sustainable growth in free cash flow per share, which, apart from their lack-luster 2012 performance, seems to be realized. This will be primarily done through operating income growth, along with the management of working capital and CapEx. More specifically, the increase in sales will result in an increased operating income. In accordance to that, along with the momentum Amazon has achieved, our projections have included more opportunistic viewpoints of their future earnings.

Although very difficult to estimate, projections of future revenues are based on historic performances, and are subject to uncertainty. Amazon’s revenue growth has been impressive, and we believe it won’t falter in the upcoming years. In fact, we believe the next two years will unveil 25% growth to its revenue, followed by a steady 20% the following 3 years.

Amazon’s fundamentals, combined with their substantial financial growth, gives precedence to a baseline terminal FCF growth rate of 1.5%.

The discount rate was calculated using the weight average cost of capital (WACC) model. The average cost of raising the primary methods of financing a company – debt and equity – is given as a value when multiplying the cost of each source by its corresponding weight. By inputting estimates of the cost of debt and equity into the WACC formula, we achieve a discount rate of 6.9%

In the analysis, we use an unlevered FCF method in which we take Net Operating Profit After Tax (NOPAT) + Non-Cash Adjustments + Changes in Working Capital –CapEX = Unlevered FCF. Combining this with the WACC, we arrive at an enterprise value for the company.

Conclusively, our DCF projection implies a current share price of 427.54, which indicates a 14.3% discount for the current price of the stock.

Algorithmic Analysis

While fundamentals are very important, it can be quite advantageous to also consider stocks like Amazon from an algorithmic perspective. Though algorithms, like any other methods of analysis, are not definitive, they often contribute important information about a company, especially when viewed in combination with historical trends and fundamentals. In addition, certain algorithms can effectively predict short- and long-term trends for stocks that are otherwise difficult to analyze: given its history of rapidly fluctuating prices, Amazon, it could be argued, is such a stock.

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm predicts the flow of money in almost 2000 markets across a range of time frames (e.g., 3-day, 1-month, 1-year). The algorithm’s predictability becomes stronger in the 1-month, 3-month, and 1-year horizons, so it is particularly useful as a long investment tool, albeit that it can also be used for intraday trading.

I Know First has successfully predicted Amazon’s outcomes in the past (Figure 3). For example, in a three-month forecast running from October 26th, 2014 to January 36th, 2015, I Know First predicted that Amazon would be one of the ten best stocks of the forecast; the stock held true to this prediction for a return of +7.88%.

Figure 7. Three-month forecast last updated on October 26th, 2014. Amazon is shown to be strongly bullish, and is boxed in purple for emphasis. Prediction is on the left, stock performance is on the right – note that Amazon performance coincided with forecasted behaviour.

The new 3-month forecast for Amazon, generated by the I Know First algorithm and updated on January 28th, is shown below (Figure 4). Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, though not as negative. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and its predictability (found in the bottom left corner, this is the approximate level of confidence our service has in the forecast).

Figure 8. Updated forecast for Amazon.com, Inc.. Amazon’s ticker symbol – “AMZN” – is boxed in blue; its position indicates that it is strongly bullish.

This algorithmic assessment coincides well with the previously described developments, and parallels analyst sentiment, to a degree.

Conclusion

Amazon.com, Inc., a worldwide Internet retailer, appears to be worthy of investors’ consideration at present. In addition to better-than-expected profit, less-devastating-than-anticipated losses, and decent guidance, Amazon is expanding its AWS services, branching into original content creation, and perpetually furthering Prime – the service that already appears to be aiding it along quite significantly. Its long-term growth is enhanced with the continuous high satisfaction ratings, along with a stable and constantly growing e-commerce industry. Although there are doubts regarding the sustainability of its profits, these fundamentals, alongside analyst opinion, a positive DCF valuation, and I Know First’s forecast, appear to indicate that Amazon – though it is a company known for its ups and downs – may well be bullish in the future, and in both the short-term and the long-term horizons.