AMZN Stock Prediction: Amazon’s First Bookstore Is Likely An Acid Test Toward Becoming A Traditional Retailer

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

AMZN Stock Prediction

- Amazon has opened its first brick & mortar book store.

- This is just a decisive expansion move beyond its core online marketplace.

- Wal-Mart and other traditional retailers are expanding their online stores. It’s only proper that Amazon also expands to physical retailing.

- Amazon’s stock price is likely to go higher this year considering the holiday shopping season is coming soon.

I believe Amazon (AMZN) is just testing the waters if it could also become a major traditional retailer by opening its first brick & mortar book store. Amazon Books will open in Seattle today and it’s a physical extension of Amazon’s online book marketplace. This back to the future move toward operating a traditional brick & mortar store for online e-commerce pioneer Amazon is easy to comprehend.

Wal-Mart (WMT) and other top U.S. traditional retailers are aggressively expanding their business toward the online commerce space. It’s only proper therefore that Amazon also tries to answer the threat from Wal-Mart by also going after the walk-in retail customers of old-fashioned brick & mortar stores.

Going forward, I expect Amazon to eventually expand Amazon Books to sell more than just books. As per the report of Reuters, Amazon Books will also let customers test out Amazon’s branded electronic products like the Kindle Echo, Kindle Fire Tablet, and the Fire TV. I see Amazon-branded retail stores serving as selling points for every portable product available currently on the company’s online marketplace.

Amazon Books therefore serves as a “hands-on product evaluation unit” for Amazon’s electronic products. It is not a mere store for bookworms to visit. I see this first physical store of Amazon to serve as an acid test if a major expansion toward traditional retailing is viable.

Shopping at Traditional Brick & Mortar Stores Is Still Very Popular

Bezos’ original idea for Amazon was to create a low-cost online store as an alternative to traditional brick & mortar shopping. However, in spite of the massive success of Amazon in making online e-commerce a daily habit, some shoppers still prefer buying their desired/needed products from traditional retailers like Wal-Mart.

It might be beneficial for Amazon investors if Bezos will expand the company’s market reach by seriously going after those old-fashion shoppers who still want to touch or physically examine the things they want to buy. There are billions of purchasing power found among people who still do not shop online but instead at brick & mortar stores.

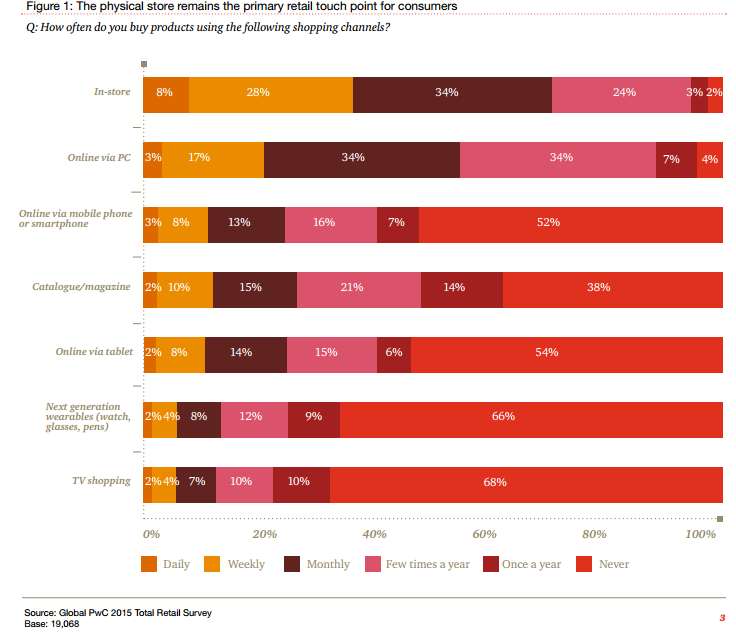

As per the Total Retail 2015 report of PwC, physical retail stores remain the popular shopping destination for weekly and monthly shoppers. In fact, daily shopaholics are more prone to buy products from a brick & mortar shop rather than from an online store like Amazon. As per PwC’s findings below, 8% of daily shoppers buy from physical stores which is way higher than the 3% of daily shoppers who buy online via computers.

In spite of the often cheaper deals available from online stores, there are hundreds of millions of shoppers that still like buying products from the nearest mall or corner street store. Some people still feel the need to touch, see, test, and try on the products they want to buy. Only physical stores can satisfy these peculiarities of offline shoppers.

The chart below list some of the reasons why traditional retailing is still a booming industry.

(Source: PwC)

The findings of PwC is also in line with the study results of Zebra Technologies. Zebra’s 2015 Global Shopper Study again emphasizes the undying need for physical retail stores. The human habit of physically touching the products before they buy is deeply ingrained among a huge population of shoppers. Browsing or experiencing the product is the number one reason why many people still shop at brick & mortar stores.

My point now is that Amazon Books is a great move toward perhaps becoming a full-pledged physical store retailer. There is too much shopping money that Amazon is leaving at the table by its current online-only business model. The future growth prospect of this company will definitely be better if it starts going after the walk-in customers of Wal-Mart.

My Takeaway

The total global retail business was worth $22 trillion last year. The total global online retail e-commerce was only worth $1.3 trillion in 2014. Amazon definitely has a huge opportunity if it builds a global wide network of physical retail stores in addition to its current online marketplace. There is obviously more money to be made by going after the traditional shoppers/customers that still flock to Wal-Mart’s stores and ignore the convenience and cost-effectiveness of buying cheaper products from Amazon’s online store.

I expect Bezos to eventually expand Amazon’s first bookstore to other specialty shops for different product types. Amazon has the cash flow to buy/rent store acreage and build a country-wide chain of brick & mortar stores in America, China, and Europe.

The next physical store of Amazon might be a pharmacy. The privacy issue of purchasing medicines is partly why people still flock to traditional drug stores. There is a big potential in creating a chain of brick & mortar pharmacies that tout Amazon’s razor-thin-margin business strategy.

After the Successful buy signal From I Know First Self-learning Algorithm, I am endorsing a Hold for Amazon. The near-term forecasts of I Know First is slightly negative for AMZN. However, I expect the holiday shopping season and the upcoming Black Friday sale event to push sales for Q4 2015 to new record breaking numbers.

I Know First is warning us that for the near-term, Amazon’s might drop a little from its current price $628. On the other hand, going forward in earnings report in early 2016, I expect bulls to again rally behind AMZN once Bezos’ reports record revenue for Q4 2015.

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First has had success predicting the movement of Amazon’s stock price in the past. In this one-year forecast from October 26, Amazon had a strong bullish signal strength of 189 and a predictability indicator of 0.41. In accordance with the algorithm’s prediction, the stock price increased 112% during that time.

Amazon’s stock price doubled this year already but I still expect Amazon to hit above $650 in early 2016. Wal-Mart’s stock, on the other hand, posted a -32% YTD performance this year. I expect WMT to suffer some more losses once Amazon makes a major push toward becoming a major traditional retailer.

(Source: Google Finance)