AMZN Stock Forecast: The Company That Seemingly Grows Without End

This AMZN stock forecast was written by Jessica Kremer – Analyst at I Know First.

This AMZN stock forecast was written by Jessica Kremer – Analyst at I Know First.

Summary

- The acquisition of Zoox allows Amazon to break into a relatively untapped market space

- I am endsoring a $3,400 price target for AMZN before the end of the year

- Amazon has a $1.3 trillion dollar market cap and multiple revenue streams from industries that have immense growth potential, resulting in my buy verdict for this AMZN stock forecast.

Amazon stock keeps climbing, seemingly with no end. On Tuesdays’s trading session, the stock reached its all-time high of $3,063.78. This represents a total gain of more than 65% since the beginning of the year. Amazon is a modern day necessity for most people, and due to its unique position and strong valuation, I recommend the stock as a buy. Our last AMZN stock forecast issued a $3,000 price target for the stock. Since, the stock has beat this price target, prompting me to raise it further, to $3,400.

Amazon’s Healthy Financials

On April 30, Amazon released their first quarter results, which exhibited growth despite the pandemic. Amazon reported that their operating cash flow increased 16%, to $39.7 billion for the trailing twelve months, compared to the $34.4 billion in the prior year. They also reported an increase in free cash flow, to $24.3 billion. This growth, amidst the pandemic, reflects the profitability and stability of the company, further rendering AMZN stock a buy.

Amazon is a continuously profitable company. In relation to its industry, Amazon holds a high gross profit margin, demonstrating their ability to make a large revenue. The company also holds the largest cash from operations. This further reflects their ability to generate profit and sustain their business. In addition, the healthy return on equity further strengthens my buy verdict for AMZN stock.

The graphic above demonstrates the healthy financial position of Amazon. In both the short and long term, the company has enough assets to cover their liabilities. In addition to a healthy financial position, part of the company’s expenses come from their hefty research and development costs. R&D expenses indicate a company that is constantly trying to innovate, and Amazon’s R&D for the twelve months ending March 31, 2020 was $37.329 billion, almost a 25% increase from the prior year. Amazon is consistently spending more on innovation, with Forbes stating that in 2017 the “technology retailer was the largest investor, spending $22.6 billion globally for research and development.” This was more than other top companies, with Alphabet spending $16.2 billion, Microsoft $12.3 billion, and Apple $11.6 billion in the same year. Since then, Amazon has only increased its R&D expense, demonstrating the company’s dedication to innovation.

Amazon Prime’s Potential Competition

Amazon Prime has been one of the company’s most lucrative innovations, with the company generating $19 billion from subscription services in 2019. Walmart is now following this move, with the company announcing plans to launch its own membership program, Walmart+. However, based on what has been reported so far, investors don’t believe this will pose any serious competition for Amazon Prime. Instead, Walmart+ seems to be an extension of its existing grocery delivery services. As reported by Recode, this $98 subscription will include “same-day delivery of groceries and general merchandise, discounts on fuel at Walmart gas stations, and early access to product deals.” In other words, Amazon investors should not allow this move by Walmart to sway their confidence in Amazon.

Immense Growth Potential

Amazon, one of the world’s leading retail e-commerce companies, clearly has room to grow. Regarding the graphic above, the e-commerce industry is projected to grow by billions in the upcoming years. With a $1.3 trillion market cap, in conjunction with a pandemic leaving millions working from home, investors can be sure Amazon will reap the benefits of this growth.

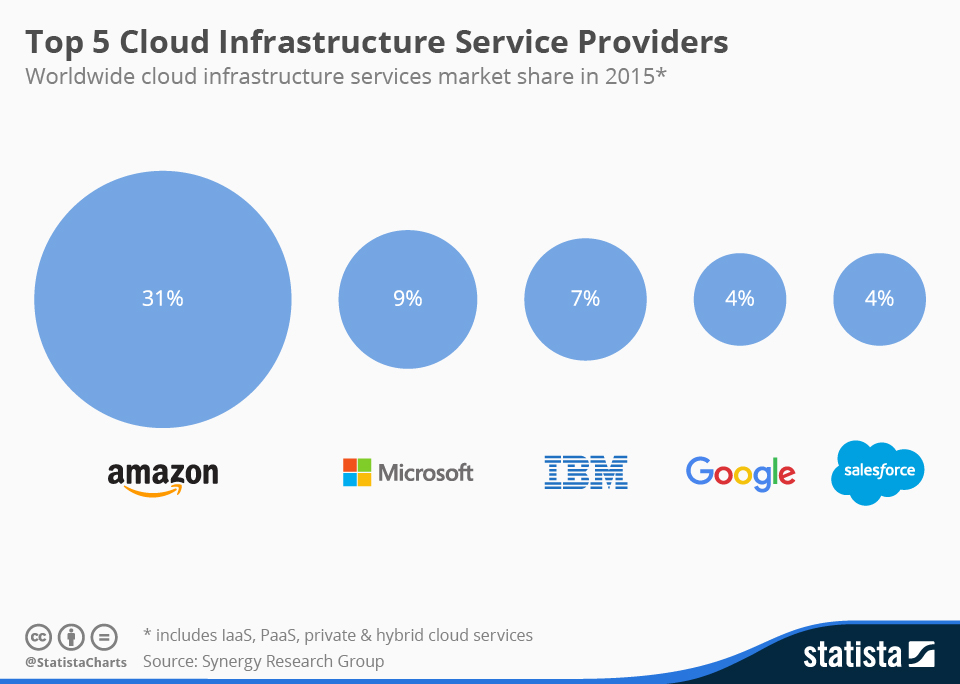

Not only will retail e-commerce see growth, but the cloud service market will also experience this growth. Regarding the graphic above, cloud application and system infrastructure is projected to grow from 266.4 billion in 2020, to 354.6 billion by 2022. As can be seen below, Amazon accounts for more than 30% of this industry. In this sense, investors can be sure that Amazon investors will surely benefit from the growth of this industry.

Amazon Breaking Into a New Industry

Amazon also recently acquired Zoox, an autonomous vehicle company, for an estimated $1.2 billion. Although many believed this acquisition was intended for autonomous package delivery, autonomous ride sharing (ARS) services are instead Amazon’s intentions. By acquiring Zoox, Amazon can now become a major competitor in what many believe is an enormous new market.

Zoox holds a unique business model in the sense that they have skipped first-generation autonomous vehicles and instead began developing vehicles purpose-built for autonomous ride services. Typically, an ARS company would retrofit existing vehicles first, but not Zoox. Instead, their latest vehicle, the VH5, has seats that face each other, no steering wheel or pedals, and is bidirectional. Although the company is technically ahead of its competitors in this sense, Amazon will need to finance another couple billion before a car is ready. With that being said, Amazon does have a clear path to grow Zoox to more than $35 billion in revenue in the next 5-6 years.

This acquisition could be compared to Amazon’s expansion with Amazon Web Services, or AWS. Initially launched in 2012, by 2017 AWS had $17.46 billion in annual revenue, and last year, AWS had a revenue of $35 billion, accounting for 80% of Amazon’s total profit. According to Seeking Alpha, some analysts believe that AWS could account for $400-500 billion. In this sense, Amazon will have multiple revenue streams, prompting its valuation to increase.

Conclusion

Amazon stock is a very stable stock to purchase. The company has multiple revenue streams, all that have and will continue to produce profits during the pandemic. In addition to the company’s strong position in multiple industries with strong growth, the company recently acquired Zoox. This acquisition propels Amazon to be a leader in a fairly new market space. Finally, my bullish prediction for Amazon is strongly influenced by our algorithmic forecast. As can be seen below, AMZN has a one-year forecast score of 817.98. More importantly, I Know First’s one-year AMZN stock forecast for UNH has a high predictability score of 0.57.

Past I Know First AMZN Stock Forecast Success

I Know First has been successful on AMZN stock forecasts in the past. On June 7, 2020, I Know First has made a bullish Amazon stock forecast. In this month time frame, the prediction has proven to be successful since AMZN’s price rose by more than $50. This equates to a more than 23% increase, as can be seen by the chart below. Our algorithm correctly predicting amazon stock price is just one of our successful stock market forecasts.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.