AMD Stock Prediction: AMD’s Rally Is Just Getting Started

![]() Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

AMD Stock Prediction: AMD’s Rally Is Just Getting Started

Summary

- AMD’s new GPUs have paved the way for the company’s turnaround.

- Lower price points and high efficiency have contributed to the success of the Polaris architecture-based GPUs.

- AMD can benefit further if it launches a successful product for the high-end market.

- The stock still has more upside potential.

- I Know First Algo is still Bullish on AMD

Shares of Advanced Micro Devices (AMD) have rallied strongly over the last few months. The stock has jumped almost 300% since hitting the year to date lows earlier in February. There are several reasons to believe why AMD’s rally will likely continue in the coming months, which is why I think the stock is a buy despite the recent run.

A Great Quarter

AMD’s focus on diversifying its business model and delivering great and efficient products has been a tailwind for the company. In the most recent quarter, robust semi-custom demand along with better than expected graphics sales drove a 23 percent successive top-line surge and the company’s return to non-GAAP operating viability.

Furthermore, the company also recorded its first full quarter licensing improvement from its China server JV. AMD also enhanced its balance sheet with cash profits from the creation of its ATMP joint venture with NFME.

Moving on to computing and graphics division, AMD’s revenues dropped 5 percent as sturdier graphics unit sales were counterbalanced by a drop in desktop processor sales. As compared to the year-ago period, GPU sales in the first half of this year witnessed double-digit growth.

AMD’s launch of low-priced Radeon RX 480 is the primary reason behind the company’s success, as it resulted in highest desktop channel graphics unit shipments since the fourth quarter of 2014. However, the true benefits of the new GPUs will be evident in the next quarter, which is why I think the stock has room to run higher.

RX 480’s Over Power Draw Issue is Nothing to Worry About

AMD has underperformed previous year, and lost considerable market share to NVIDIA and Intel in the GPU and CPU market, respectively. However, recently, the company launched its new architecture, called Polaris, which has turned the game in AMD’s favor.

The company’s new architecture comprises many major upgrades including the switch to 14 nanometer FinFET technology. Moreover, the company also launched new graphics card, Radeon RX 480, based on its new architecture.

But, after some days of the launch of RX 480, it was found that the card draws more power than the rated power from PCIe slots. As a result, it could potentially fry the PCIe slot. However, the company is now well aware of this issue, and has already started working on it.

This will surely have some slight impact, but the pricing power and improved performance will help the company overcome these issues. AMD’s Radeon RX 480 is available for just $199, as it is priced to target the mainstream market. AMD’s decision to target this market was shrewd, and it will certainly help the company gain back some market share from NVIDIA.

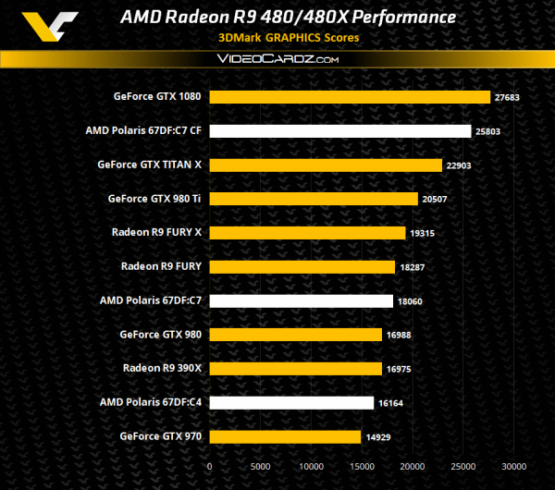

(Source: videocardz)

A Threat to NVIDIA

It is well known that NVIDIA and AMD both are the only two major players in the graphics card industry. NVIDIA also launched its new architecture called Pascal to challenge AMD’s Polaris.

NVIDIA’s Pascal architecture also comprises of major hardware enhancements that result in improved performance as well as efficiency. Recently, NVIDIA launched its new graphics cards GTX 1080 and GTX 1070 based on Pascal architecture, specifically for the high-end market.

Therefore, by placing its emphasis on the high-end market first, NVIDIA left the door open for AMD to grasp a sound position in the mainstream market. And, AMD saw the opportunity and grabbed it with both hands, which is evident by the soaring sales of the company’s RX 480 sales.

NVIDIA did, however, introduce its third graphics card, GTX 1060, based on Pascal architecture. NVIDIA claimed that GTX 1060 is designed to deliver strong performance, and will specifically focus on mainstream users. GTX 1060 is priced higher than AMD’s RX 480, which can possibly act as a potential headwind for NVIDIA going forward.

When it comes to the high-end market, NVIDIA already has a firm lead over AMD. Therefore, it is mandatory for AMD to launch a new high-end graphics card soon along with huge improvement in performance and efficiency. If AMD is successful in delivering a strong performing and efficient graphics card along with the competitive pricing, the company will gain a huge boost in its sales, and that will surely help it regain considerable market share going forward.

Hence, I think AMD can still offer more significantly upside if the company manages to deliver another great product challenging NVIDIA’s dominance in the high-end market.

Conclusion

After struggling for years against NVIDIA, it finally looks like AMD has found the winning formula. AMD made the right decision by taking on the mainstream market early, and the lower price point further helped its cause.

NVIDIA will find it difficult to compete against AMD in the mainstream market, and if AMD launches another card for the high-end market which is as successful as its RX480, the stock could move higher considerably in the near future. Thus, I think AMD still has more upside to offer and is a buy despite the recent run-up.

My bullish stance on AMD is resonated by I Know First’s algorithmic signals. In the past, I Know First has also been bullish on AMD as exemplified by their 90-day forecast from April 27 where AMD returned an impressive 87%.

On April 22th 2016, A senior analyst for I Know First stated that AMD’s stock still has upside potential. He argued the joint venture with Tianjin Haiguang Advanced Technology Investment Company will help AMD compete in China’s chip industry. While at the same time, AMD will also supply the CPU/GPU inside the Nintendo NX console. I Know First published a bullish signal for AMD predicting its recent movement. Since then, AMD rose 160%.

I Know First uses an advanced state of the art algorithm based on artificial intelligence and machine learning to foresee market performance for more than 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The algorithm generates a forecast with a signal and a predictability indicator. The signal is the number at the center of the box. The predictability is the figure at the bottom of the box. At the top, a particular asset is identified. This format is standardized across all forecasts. The middle number indicates strength and direction, not a price target or percentage gain/loss. The bottom figure, the predictability, signifies a confidence level.