AMD Stock Outlook: Brilliant Move For AMD To Sell The Radeon RX 480 For Just $199

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

AMD Stock Outlook

Summary

- Unlike the obtuse analysis of Mark Hibben, I think the 14-nm $199 Radeon 480X Polaris video card will intensify AMD’s campaign against Nvidia.

- I suspect that AMD’s management wanted to spoil the debut of Nvidia’s $380 GTX 1070 GPU card.

- Bringing the high-end video cards at sub-$200 level is disruptive.

- The $199 Radeon RX 480 is usable for Virtual Reality. Even Chinese PC gamers will be able to afford this card.

- I Know First is currently bullish on AMD stock for the long term

I am long Nvidia (NVDA). Unlike the flawed thesis of Mark Hibben, I immediately understood the danger presented by Advanced Micro Devices’ (AMD) new $199 Radeon RX 480 Polaris video card. Hibben’s argument that unveiling a $199 Polaris card (against the high-end Nvidia GTX 1080 and GTX 1070) makes AMD uncompetitive badly reeks of myopic thinking.

Selling affordable14-nm video cards that are Virtual Reality-ready will only accelerate AMD’s growing market share in discreet GPUs. Getting a bigger market share means more revenue for AMD. More revenue for AMD means more money to budget allocation for Research & development. Selling an affordable $199 virtual reality-ready Radeon might just help AMD become profitable.

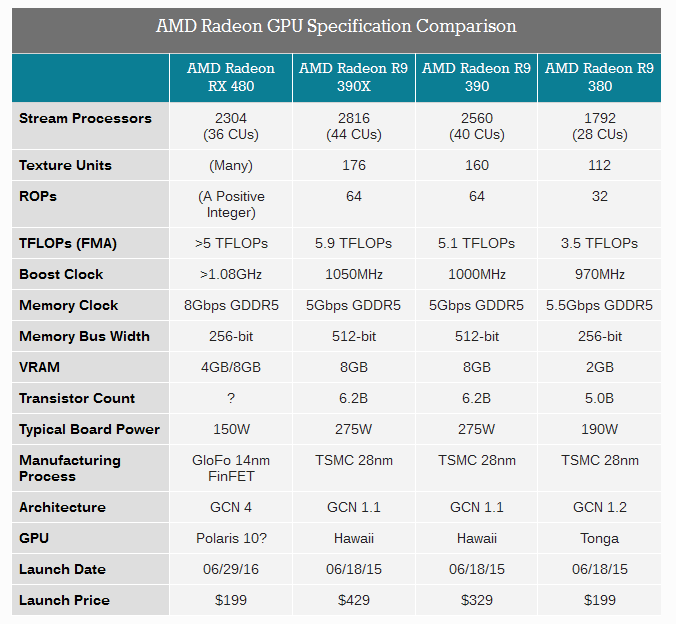

(Source: AMD)

Gamers who were not able to afford the $400 Radeon R9 390X should be pleased to know that the $199 Radeon RX 480 is nearly as good. The comparative chart from AnandTech clearly reveals the Radeon RX 480 is the best value-for money product to get.

AMD’s Priority Is Stronger Revenue Not Profit Margins

I am an avid random chess player. I’m used to thinking future consequences of critical moves. Hibben failed to see the brilliant logic behind AMD’s decision to release the $199 Radeon 480X. Selling a cheaper alternative to Nvidia’s latest video cards could boost sales of AMD GPUs. A surge in Radeon-related sales could finance research in making AMD GPUs become compatible with deep-learning computers.

Unlike debt-laden AMD, Nvidia was able to invest enough money to post a big lead in GPU-accelerated artificial intelligence computing. AMD’s future is closely tied to Radeon. The GPU market for artificial intelligence is much bigger than in video games. GPU-accelerated deep learning computers are key to the $125 billion/year Big Data and analytics market.

Radeon’s potential therefore as revenue/profit generator for AMD is limited if it allow Nvidia to monopolize GPU-accelerated artificial intelligence. AMD’s best chance to do this is to improve its GPU sales by any means necessary. Selling high-end Polaris 10 GPUs at a small margin is a legitimate tactic to steal customers away from Nvidia.

Cheaper Products Is Effective In Defeating Competitors

Hibben’s argument that selling lower-margin $199 Polaris GPUs is non-competitive for AMD is wrong. Since time immemorial, products that sell at lower price tags have a greater total addressable market than their more expensive counterparts. The potential higher sales volume from selling $199 video cards could possibly erase the margin advantage of selling $380 video cards.

The Radeon RX 480 could to 5 teraflops, slightly lower than the 6 teraflops of the Nvidia GTX 1070. Any real PC gamer will tell you that this slightly performance disadvantage of the $199 RX 480 is negligible. I suspect that the Radeon RX 480 will force Nvidia to lower the price of the GTX 1070 once AMD’s card starts outselling it.

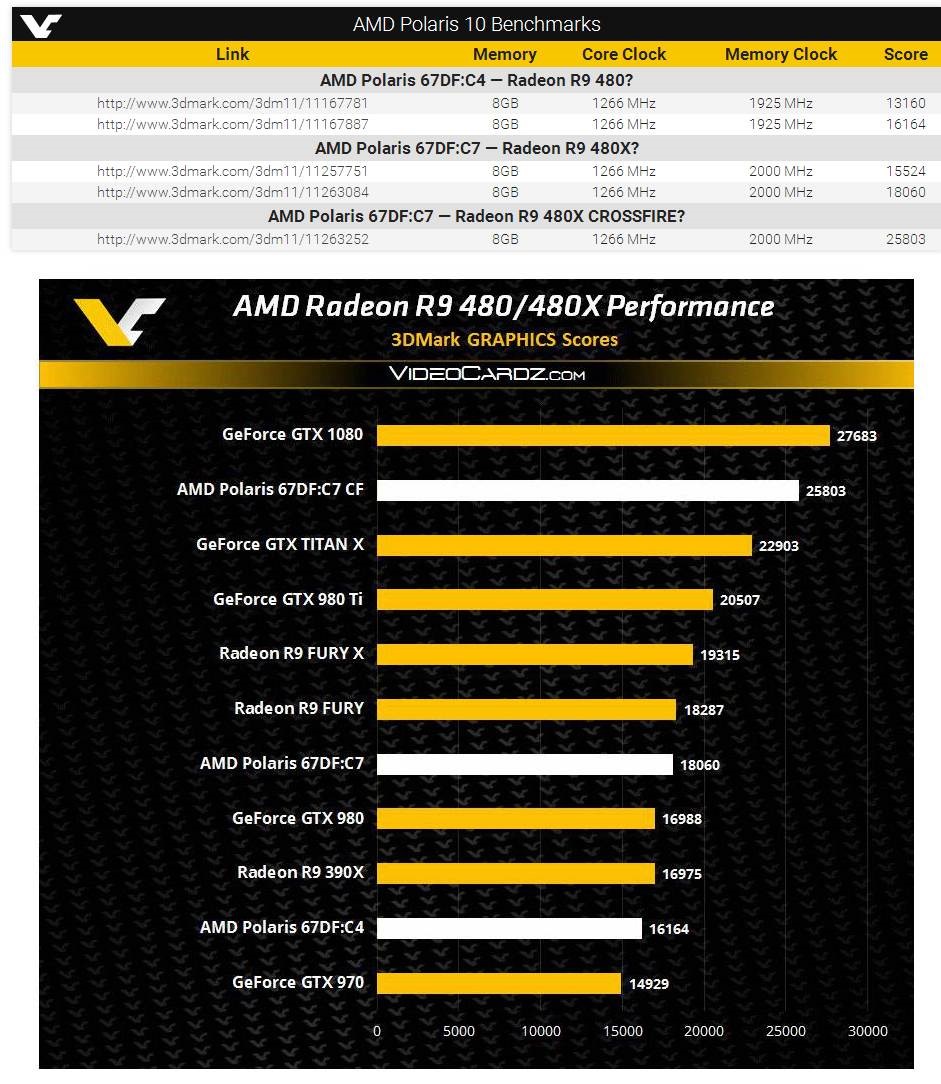

AMD also has a high-end Polaris GPU that could again affect the sales of the Nvidia GTX 1080. Leaked benchmark report already revealed there are three models of Polaris 10 video cards. Hibben should really check out the chart below. The $199 Radeon 480X is not AMD’s sole response to Nvidia’s Pascal GPUs. AMD has a rival to the GTX 1080 and Lisa Su is just waiting for the right time to unveil it.

(Source: Videocardz.com)

Conclusion

We should not question the wisdom of AMD’s management. There are underlying reasons why AMD only revealed a $199 Polaris GPU at Computex 2016 event. The business of selling GPU cards is like playing chess. AMD made a pawn push that exposed Nvidia to a pricing war. AMD revealing a much cheaper rival to the GTX 1070 is definitely going to make Nvidia rethink its pricing strategy for Pascal GPUs.

In the end, it is the consumer that benefits from AMD and Nvidia selling more affordable high-end video cards. Again, making the new GPUs more affordable increases their total addressable market. The more people there are that could afford a RX 480 or GTX 1070, the better it is for the GPU industry.

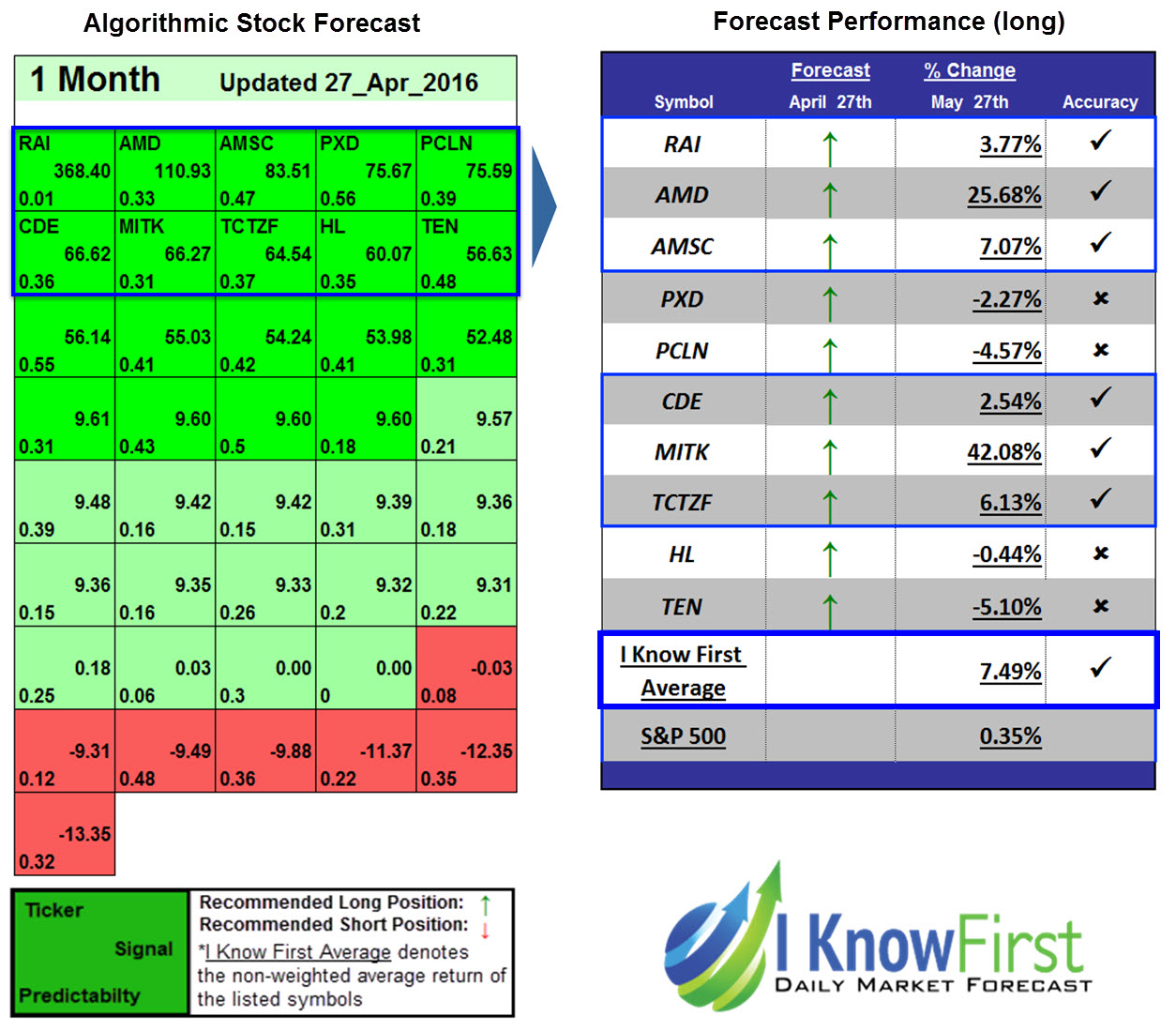

My buy recommendation for AMD is again supported by the positive algorithmic forecasts from I Know First’s deep-learning supercomputer. AMD still has positive trend forecast scores. Negative articles like those made by Hibben are just annoying part of investing. AMD, being a small company with a lot of debt and in the red is exposed to online propaganda.

A month ago I Know First Algorithm predicted the bullish movement on AMD stock.

In the forecast below we see a bullish signal of 110.93 on AMD stock with a predictability of 0.33 managing to bring return of 25.68% in 1 month.